United States – world’s second largest ferrous scrap exporter after EU-28 has marked successive growth in annual ferrous scrap exports volumes since last three years. But will the same momentum continue taking its EAF ramp up plans into consideration?

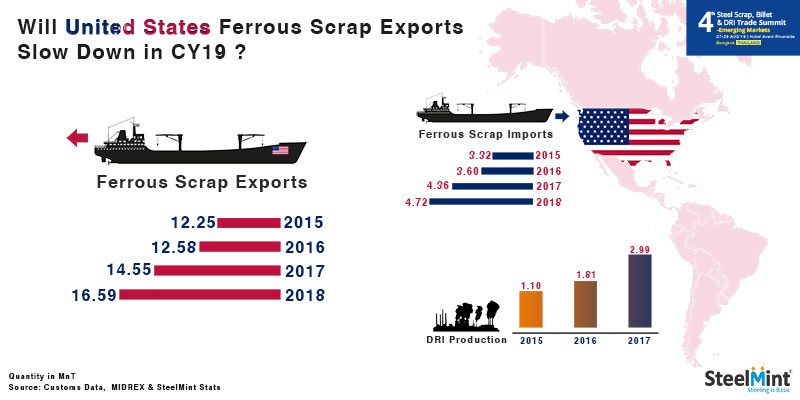

US exported 16.59 MnT ferrous scrap in CY18. Trade participants have already pointed out that CY19 could be the year of significant importance for the global economy considering impact of Trade war and sanctions.

US scrap consumption to increase in coming years?

1. Ramping up of EAF capacities and investments in the US – In Jan’19, Nucor Corp. announced a new EAF mill of USD 1.4 billion in the Midwest to produce 1.2 million tons steel per annum. Steel Dynamics, a producer based in Fort Wayne, Ind., plans to build a USD 1.8 billion mill with an EAF in the southwestern U.S. with an annual capacity of 3 million tons. GFG Alliance, a British conglomerate, announced plans in January to expand its U.S. steel production by 800,000 tons a year and restart a second electric arc furnace at a South Carolina plant. In Feb’19, U.S. Steel Company said it would begin construction on an EAF at its Fairfield plant near Birmingham, Ala.

2. Rise in DRI production – As per Midrex reports, total DRI production in North America (USA & Canada) recorded at 4.60 MnT in CY17 up 44% Y-o-Y against 3.20 MnT in CY16. While that in Latin America recorded at 10.51 MnT in CY17, up 14% Y-o-Y against 9.19 MnT in CY16. These numbers are expected to have increased in CY18 with US turned as a supply merchant with the first HBI plant in the United States, located outside Texas ramped up production in 2017. Also, Cleveland-Cliffs, Inc. had announced in June of 2017, plans to build a 1.6 MnT pa HBI Plant in Toledo, Ohio, USA.

3. Increasing ferrous scrap imports – US ferrous scrap imports recorded at 4.72 MnT in CY18, up 8% Y-o-Y against 4.36 MnT in CY17. The US exports a lot of low-quality scrap, but imports high-quality raw material. That means there is a shortage of prime grade scrap there.

4. Rising crude steel production on increasing EAF output – According to world steel association, US crude steel production recorded at 86.60 MnT in CY18, up 6% Y-o-Y as against 81.61 MnT in CY17. US total crude steel production was recorded at 78.47 MnT in CY16 comprising of 67% share of EAF route while 33% share of blast furnace production. Reports suggest that country’s EAF steel output has been constantly increasing since past couple of years resulting in rising domestic scrap demand apart from rising scrap imports which may lead to limit exports in CY19.

The imposition of tariffs has provided the much-needed protection to American steel producers who have long struggled to cope with a tide of cheap foreign imports. The punitive tariffs appear to be bearing fruit as reflected by a decline in U.S. steel imports in CY18.

Scrap oversupply situation in Turkey, Brexit dynamics in Europe, Iran driven suffocation, changing dynamics of recycling in India, will keep global scrap demand volatile in CY19. Thus, it seems scrap consumption in US will increase in near term and emerging scrap markets like Vietnam, South Korea, Bangladesh, Pakistan and Indonesia could have to pay high for US scrap in CY19.

The imposition of tariffs has provided the much-needed protection to American steel producers who have long struggled to cope with a tide of cheap foreign imports. The punitive tariffs appear to be bearing fruit as reflected by a decline in U.S. steel imports in CY18.

Scrap oversupply situation in Turkey, Brexit dynamics in Europe, Iran driven suffocation, changing dynamics of recycling in India, will keep global scrap demand volatile in CY19. Thus, it seems scrap consumption in US will increase in near term and emerging scrap markets like Vietnam, South Korea, Bangladesh, Pakistan and Indonesia could have to pay high for US scrap in CY19.

4th Steel Scrap, Billet & DRI Trade Summit

Don’t miss the opportunity of meeting global buyers and sellers at the 4th Steel Scrap, Billet & DRI Trade Summit in Bangkok, Thailand, to be held from 27-29th August 2019.