Steel mills across the globe are staring down a desert land of dried-up demand, as the Russia-fuelled war rages on in Ukraine. Prices of gas, which power households and factories across the European Union, have surged 700% till date, as per reports, putting the entire Continent and other parts of the world in an uncomfortable inflationary grip which has also decimated steel demand.

Rebar demand weaker than flats

While global demand for long steel is weak, especially in China, which cracked down on its real estate market post-the Evergrande collapse, the EU is seeing some light at the end of the tunnel for flats. As per some reports, prices of domestic hot rolled coils inched up on 12 July as buyers are slowly eyeing restocking amid widespread output cuts by mills. Demand is not exactly hunky-dory but Northern Europe buyers are expected to resume restocking for September from end-July.

But rebar is not so lucky. Buyers are holding back, waiting for prices to drop further. The market is characterized by wide gaps in bids and offers and muted trade.

In China, rebar dropped below RMB 4,000/t in a long time, on the Shanghai Futures Exchange.

Traditionally, July and August are challenging months from the demand standpoint, putting mills globally on the backfoot all the more in terms of raising prices.

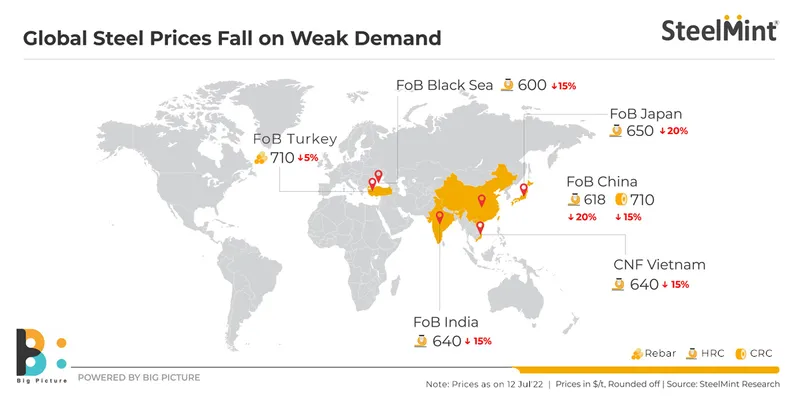

In fact, data maintained with SteelMint reveals that in just a single month, HRC prices globally have fallen by 15-20%. As on 12 July, 2022, China’s HRC FoB prices have lost 20% m-o-m to $618/t and CRCs by 15% to $710/t. Black Sea HRC FoB prices declined 15% to as low as $600/t, while in Japan, these dropped 20% to $650/t FoB. Vietnam imports and India exports both lost ground 15% to $640/t. In rebar, Turkey’s prices on 12 July were down 5% to $710/t.

Factors influencing current global steel scenario

Inflationary pressures in the EU: There is a high risk of recession, especially in the West and governments there are keen to reign in the same through measures such as capping of monetary supply and raising interest rates. But, in a vicious cycle, this will definitely have a fallout on demand, globally.

The euro’s value has been eroding for months and at the time of writing this story, it was equal to the US currency. A year back, it was at 1.20 to the dollar against 1.13 more recently.

Two factors are weakening the euro. Rising EU inflation and the US’ comparative insulation from the war. Inflation in the EU has averaged 8.6% in June on the back of spiralling energy prices. On the other hand, with the US somewhat immune to the volatility in oil and gas markets given its own oil reserves and alternate energy sources, the dollar has fared better. The US Federal Reserve has also been raising interest rates for months, making dollar denominated investments safer at present, allowing it to appreciate.

Meanwhile, the European Central Bank is in a catch-22 situation. The soaring inflation merits increase in interest rates but may just dry up demand in an already beleaguered economy. Being a major consuming region, if demand from the Continent falls, there will be far-reaching ramifications. Possibly, after Ukraine, the EU has been hit the most, economically, by the war.

Energy crisis looming in Q4? There are fears of a probable energy crisis in Q4. In fact, as per reports, demand has rebounded in Europe in the face of such fears. Among the goods that cannot be imported from Russia into the EU include crude oil and refined petro goods, coal and other solid fossil fuels, iron and steel, amongst others. It may be noted that trade in some commodities like coal will come to a standstill from 10 August, 2022 while Russia’s Gazprom has cut off 60% of gas supply from its Nord Stream pipeline. Obviously, Europe is heavily dependent on Russian supplies and the actual impact will be felt from Q4 onwards although the region is already suffering from energy shortage and power plants are running helter-skelter to revive coal-fired utilities.

The China factor: China, the largest producer and consumer of steel, is labouring under its own challenges. Covid, falling demand and prices and squeezed margins have the mills fighting with their back to the wall. The off-season is also not supportive of demand or prices. However, the silver lining is the policy measures that can kickstart an infrastructure boom in the second half which can translate into demand revival.

Outlook

Most mills globally are sitting on limited inventory because of the widespread production cuts on the back of the spiralling energy crisis and lack of demand.

However, by end-August or first week of September, the inventory could get depleted, a scenario that will give elbow room for prices to head up globally.

In addition, Russian mills are heard to have reduced their export volumes due to their very strong local currency. This could offer solace to steel exporting countries.

So, have prices bottomed out as of now?

What factors will drive steel prices in H2 2022?

SteelMint Events is organising India Steel Conference with SUFI at Bombay Stock Exchange (BSE) Mumbai, on 25th Aug’22.