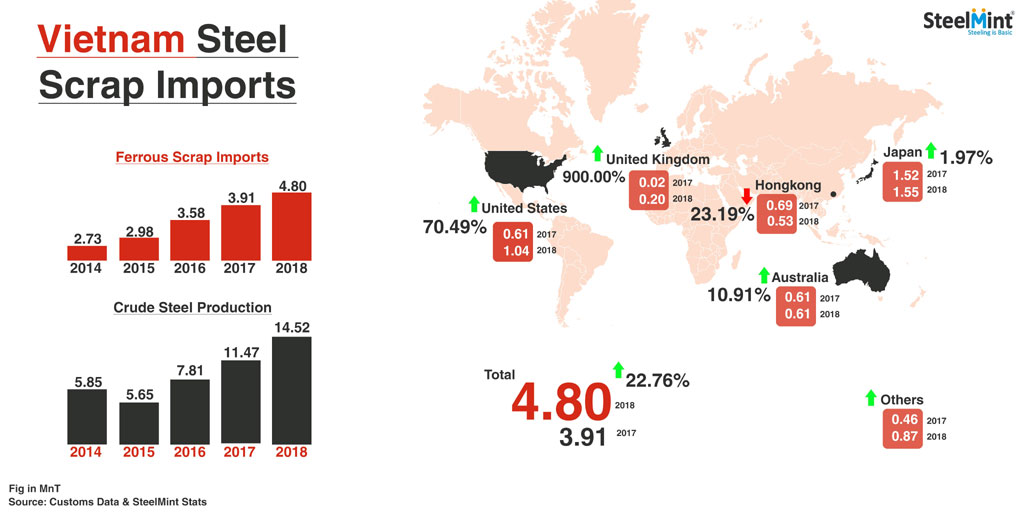

Vietnam – one of the fastest growing steel markets in South East Asia has continued uptrend in crude steel production and ferrous scrap imports in 2018. As per released customs data, Vietnam imported 4,800,891 MT ferrous scrap in 2018 up 23% Y-o-Y against 2017.

What makes Vietnam a sweet spot in steel industry?

Vietnam’s government is optimistic with its projection of growth in construction sector and is expected to expand in long run with upcoming infrastructure projects of the government. Vietnam’s steel demand is learned to be around 21-22 MnT. Vietnam exported around 6.26 MnT steel in 2018 and steel imports recorded at 13.5 MnT.

Japan remained the largest scrap supplier to Vietnam

Japan supplied 1.55 MnT ferrous scrap occupying almost 32% share in total imports in Vietnam. Japanese scrap exports climbed marginally by 2% Y-o-Y against 1.52 MnT in 2017. USA scrap exports surged 70% Y-o-Y crossing 1 MnT mark the first time while that from UK jumped 900% to 0.20 MnT in 2018 to Vietnam against 0.02 MnT in 2017.

Amid rising EAF crude steel production, Vietnam witnessed a fifth successive rise in yearly ferrous scrap imports in 2018.

According to World Steel Association, Vietnam produced 14.52 MnT crude steel in CY18, up 27% Y-o-Y as against 11.47 MnT crude steel production recorded in CY17. Rising EAF steel output which comprises of almost 65-70% of total production in Vietnam has led the country to become fourth largest scrap importer surpassing USA in 2018.

Concerns looming on Vietnam ferrous scrap imports

In Aug’18, Vietnamese government tightened control over scrap imports and said that going forward it will only issue import licenses if the importers can prove that their shipments meet the environmental standards.

However later in Aug’18, the Vietnam Steel Association (VSA) proposed to extend licenses of existing importers if they meet the environmental standards. Furthermore, as the domestic supply of metal scrap only meets 40% of the industry demand, imports are a major source for steel producers.

Upcoming steel capacities in pipeline

A series of steel plants are expected to ramp up capacities in two years down the line including Hoa Phat Steel, Hoa Sen Steel, the Vietnam Steel Corporation, the SMC Steel Company, and the VSC – Posco Steel Corporation (VPS). Surging EAF capacities are likely to push more scrap imports.

To know more on steel scrap scenario of world’s emerging markets, be a part of 4th Scrap, Billet and DRI Summit during 27-29th Aug’19 in Bangkok, Thailand.