-

Strong emphasis being given to solar energy

-

Setting up of fresh coal-fired plants banned

-

More hydropower imports from Nepal planned

As per Climate Watch data, Bangladesh’s greenhouse gas emissions nearly doubled in 2018 from a decade ago although it remains a small emitter at a global level.

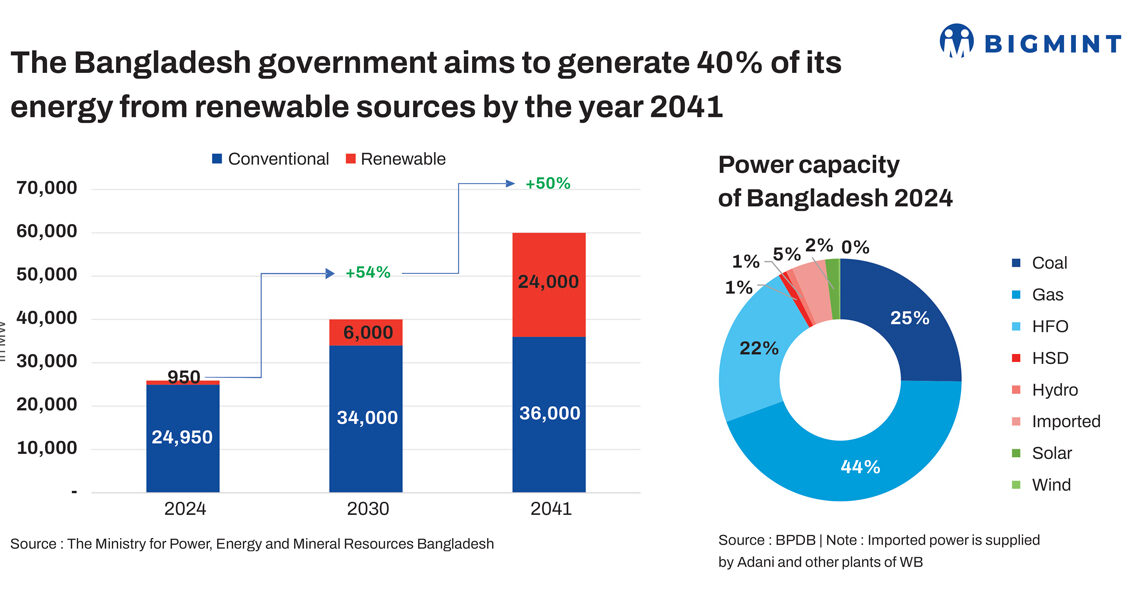

Its Ministry of Power, Energy, and Mineral Resources announced a few years back that Bangladesh aims to generate 40% of its electricity from clean energy sources by 2041, a key component of the country’s long-term strategy for the power sector.

State Minister for Power, Energy, and Mineral Resources, Nasrul Hamid, outlined that this plan involves importing about 9,000 MW through regional cooperation with neighboring countries.

Additionally, the government has set a target to derive 10% of the total power generation from renewable sources by 2041. Currently, Bangladesh’s power generation capacity stands at 25,826 MW, with 1,160 MW being imported, mostly through hydropower from Nepal and Bhutan.

The installed capacity of renewable energy in Bangladesh has risen to 950.72 MW.The government is confident in achieving a power generation capacity of 40,000 MW by 2030 and 60,000 MW by 2041, with a significant focus on renewable energy and regional energy cooperation.

While the bulk is contributed by gas, the share of coal-fired generation has been increasing steadily since 2019.

According to Bangladesh Power Development Board (BPDB) official statistics, new power plants that are either already connected to the grid or are in the process of being linked will contribute significantly to the energy supply. The additions include:

- 1,600 MW from Adani Group’s coal-fired power plant

- 620 MW from the Rampal Power Plant

- 1,224 MW from S Alam Group’s coal-fired power plant in Bashkhali, Chittagong

- 718 MW from Reliance Power’s LNG-based plant in Meghnaghat

- 590 MW from GE-Summit Meghnaghat-2’s LNG-based power plant

- 584 MW from Unique Group’s LNG-based power plant, also in Meghnaghat.

These new power sources represent a diverse mix of energy, with coal-fired plants providing a significant portion, alongside growing contributions from LNG-based facilities.

Imports of greener source of power to increase: The government is in talks with Nepal for increasing imports of hydropower to broaden the green energy basket and help it reach closer to its emission goals. At present, Bangladesh is importing around 40 MW of hydropower from Nepal and the rest from India (700 MW from Adani Power and around 100 MW from the eastern part of India).

Emphasis on HSFO-based generation is likely to wane because of the higher tariffs.

4th Bangladesh International Trade Summit

Bangladesh, a strategically significant country for Asia-Pacific, is emerging as a hotspot of growth through sustainable practices. The economic expansion is expected to encourage the participation of more global companies and attract forex for the country.

BigMint Events will be hosting the 4th Bangladesh International Trade Summit on 14-15 May 2024, at Hotel Pan Pacific Sonargaon, Dhaka, Bangladesh. The two-day conference shall bring together key stakeholders from the steel, cement, and power industries, including industry stalwarts, policymakers, traders, and investors. It shall provide a network for collaboration and an ideal platform for discussion of prevailing industry trends and challenges.