- Iron ore and pellet export shipments fall 90% in June,hits 7-month low

- With export duties in place, shipments to remain low

- Iron ore and pellet production to get impacted

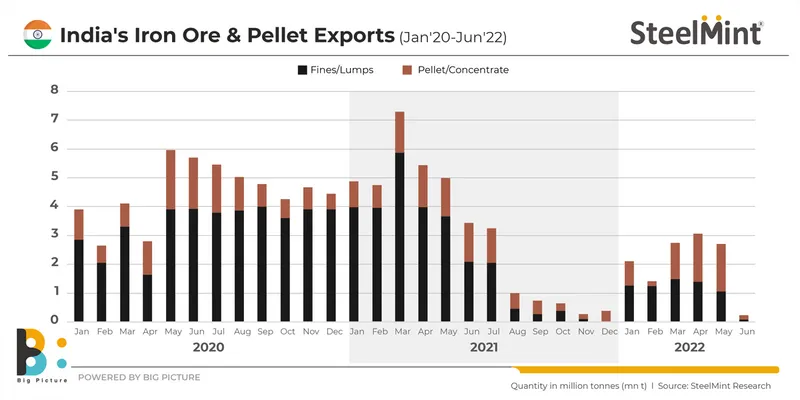

India’s exports of iron ore and pellets have plummeted to the lowest level in seven months, SteelMint data reveals. Export shipments dropped to just a little over 230,000 tonnes (t) in June 2022 – a new low since November last year when total exports stood at around 250,000 t.

While China’s steel production curbs in the second half of 2021 had cast a shadow over India’s export prospects, the government’s overnight imposition of stringent export duties on steel, iron ore and pellets towards the end of May 2022 adversely impacted export volumes, SteelMint notes.

Out of total exports in June, about 146,000 t comprised iron ore, while around 84,000 t of pellets were shipped out by Indian mills during the month. Strikingly, iron ore exports declined by over 91%, month-on-month, in June from around 1.64 million tonnes (mnt) in May, while pellets exports fell sharply by 92% on the month from 1.05 mnt in the preceding month.

Reckoned on a year-on-year basis, India’s combined exports of iron ore and pellets fell by over 93% in June from over 3.4 mnt in June 2021.

While Indian suppliers shipped around 53,000 t iron ore fines to China in June, volumes fell sharply from over 1.5 mnt in both May and April. Total exports to China fell over 97% m-o-m, data shows. Indonesia was the leading recipient of India ore in June at over 56,000 t even as Malaysia bought around 36,000 t.

Oman and Malaysia were the only importers of pellets from India in June at around 51,000 t and 33,000 t, respectively.

State-owned KIOCL and eastern India-based steel producer BRPL were the sole exporters of pellets in June at 51,000 t and 33,000 t, respectively, with the other leading suppliers such as AM/NS India, Godawari Power & Ispat and Rashmi Metaliks all recording zero shipments.

Why exports dropped so drastically?

- Govt imposes export duty: In the third week of May, the government imposed a 50% export duty on iron ore of all grades from the previous 30% levied only on ore of grade Fe58% and above. At the same time, it fixed a steep 45% duty on exports of pellets from the country. These trade policy measures directly hit export volumes. Steep duties are meant to discourage exports and ensure enough raw material availability for the domestic producers of iron and steel.

- Decline in global prices: Iron ore prices globally have slumped rapidly over the last 15 days or so due to the lingering COVID-19 disruption and lockdowns in China and low steel demand. By some estimates, China may cut steel production in 2022 from 2021 levels; demand for steel from the downstream sectors remains weak, while producers’ margins continue to shrink. Property investments and home sales are down y-o-y, while steel inventories are piling. Benchmark Fe62% Australian iron ore has dropped to $110/t CNF China, as per SteelMint assessment on 5 July – down 25% from around $147/the month back. Declining prices are naturally discouraging exports.

- Karnataka producers await clarity: The Supreme Court on 20 May lifted curbs on exports of iron ore from Karnataka and eased all restrictions on sales from the districts of Bellary, Chitradurga and Tumkur where mining activity had been prohibited in 2011. Despite the court order, and prior to the issuance of the interim guidelines by the state government, market participants were unsure of the modalities of iron ore evacuation and dispatch, which resulted in a deadlock situation where the mineral for which confirmed orders had been received and advance payments made was not allowed to be lifted for want of requisite permission from the state government. Lack of clarity on the operational part of the court order affected production and sales. Karnataka miners, as per the state government’s interim guidelines, can now both sell iron ore through direct contracts/spot sales as well as e-commerce platforms such as MSTC. However, due to cap on production and with iron ore consumption being almost equal to production (of around 40 mnt) in the state, prospects for exports from Karnataka are slim.

Outlook

India exported over 15 mnt of iron ore and more than 11 mnt of pellets in FY’22 – over 26 mnt combined. SteelMint expects exports to fall this year, although industry insiders believe that the export duties are a temporary phenomenon and will be subsequently waived once inflation subsides.

Although domestic mills are seeking to diversify supply destinations, at current tariff rates, and given subdued global prices, exports are plainly unviable.

Indian Iron ore and Pellet Summit, 3-4 Aug’22, New Delhi

Join us in our event, to know more about Indian iron ore production & demand outlook

SteelMint Events will be hosting the 5th Indian Iron Ore & Pellet Summit on 3-4 August, 2022 at The Lalit, New Delhi. The conference will discuss key issues being faced by the iron ore and pellets industry in India. The focus will be on market dynamics, policy-related changes, growth challenges and enablers, sustainability and decarbonisation goals, the way forward and many more talk points.