South Korea – world’s 2nd largest ferrous scrap importer after Turkey has witnessed sharp rise in ferrous scrap imports from US in Q1’2019. South Korean ferrous scrap imports hit a record volume of more than 4 years high in the first quarter of 2019, the customs data maintained with SteelMint showed.

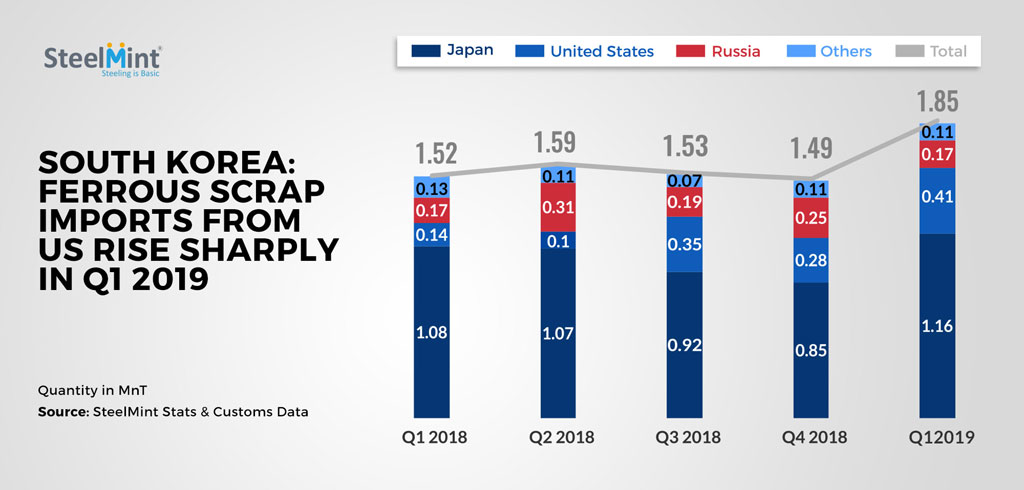

South Korean ferrous scrap imports stood at 1.85 MnT ferrous scrap in Q1’2019, up 24% Q-o-Q against 1.49 MnT in Q4’2018 while jumped 22% against 1.52 MnT ferrous scrap in Q1’2018 on yearly premises. Scrap imports recorded in Feb’19 hit 53-month high against earlier highest was at 671,974 MT in Sept’14.

Notably, US has supplied 0.41 MnT ferrous scrap to South Korea in Q1-2019, up 46% Q-o-Q against Q4’2018 while exports multiplied almost three folds against just 0.14 MnT recorded in the same quarter last year.

Why was a shift in preference towards US scrap?

Japanese domestic scrap prices remained on higher side in March ahead beginning of Golden Week holidays. Amid expectation of hike in prices, South Korean steel mills had booked bulk cargoes in previous months from US and Russia.

Hyundai’s bidding for Japanese scrap is considered to be the benchmark for East Asian scrap market. The steelmaker has resumed open bidding in Mar’19 after a gap of two months. It had discontinued bidding amid high inventories and comparatively higher Japanese prices during Jan-Feb’19.

Also Hyundai Steel had planned maintenance activities at its factories including Incheon steel mill during 3rd-19th February. Company officials had plans to reduce local scrap prices ahead of facility repair.

Japan continues to remain the largest scrap supplier in Q1 2019

Despite observing marginal fall in total scrap exports in Q1 2019, Japan exported 1.16 MnT ferrous scrap to South Korea, observing a rise of 36% Q-o-Q against 0.85 MnT ferrous scrap in Q4’2018 and a rise of 7% Y-o-Y against 1.08 MnT in Q1’2018. Japan occupied the highest 63% share in total scrap imports in Q1’2019 followed by US and Russia occupying 22% and 9% share.

US stepped up as second largest supplier position surpassing Russia amid less clarity on scrap export ban from the Russian government. Russia supplied 0.17 MnT ferrous scrap to South Korea down 32% Q-o-Q against 0.25 MnT in Q4’2018. Russian scrap yards continued attracting higher prices domestically resulting in remaining on the higher side in Q1’2019 in comparison with Japan & US.

Hyundai Steel aims at 3.5 MnT ferrous scrap imports in CY19

The largest ferrous scrap consumer in South Korea- Hyundai Steel aims to bolster its ferrous scrap consumption to around 10 MnT in CY19. Out of total around 3.5 MnT scrap is anticipated to be imported in 2019. The company is likely to bolster its overseas ferrous scrap procurement lineup by strengthening the long term relationship with supplying scrap yards globally in 2019.

According to World Steel Association, the country’s crude steel output stood at 18.10 MnT during Q1’2019 marginally up 2% against 17.81 MnT produced during same quarter last year. South Korean finish steel prices are driven by imported scrap prices. Country’s finish long exports remained stable at around 0.6 MnT in Q1’2019 while finish flat exports jumped 12% Q-o-Q to 6.14 MnT in Q1’2019 against that of Q4’2018.

To know more on Japanese scrap supply-demand, book your seat at SteelMint’s 4th Steel Scrap, Billet & DRI Summit and get a chance to hear views of Mr Arshdeep Singh, Director Vital Solutions. The conference is being organized during 27-29’th Aug’19 in Bangkok, Thailand.