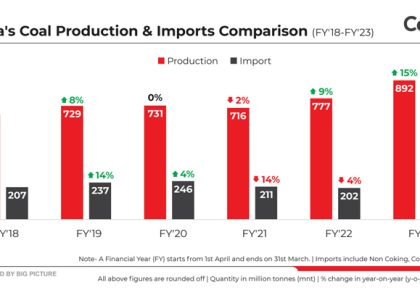

Despite the slump in world crude steel production in 2022, global seaborne trade in coking coal remained strong with imports of Coking coal and PCI increasing by 8% y-o-y to around 319 million tonnes (mnt) from 295 mnt in 2021, as per provisional data maintained with CoalMint.

Leading importers

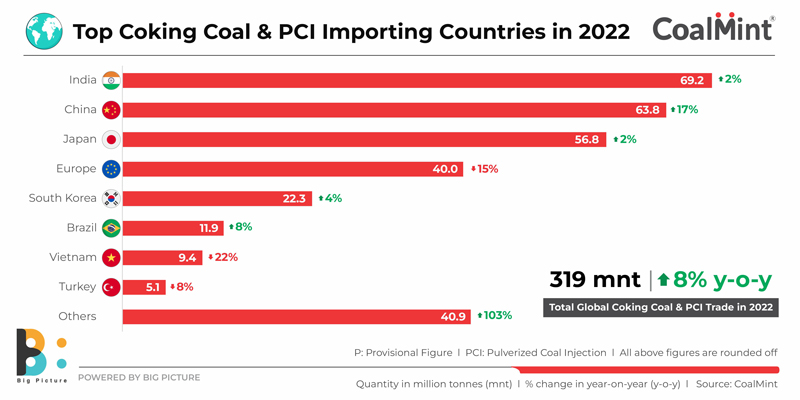

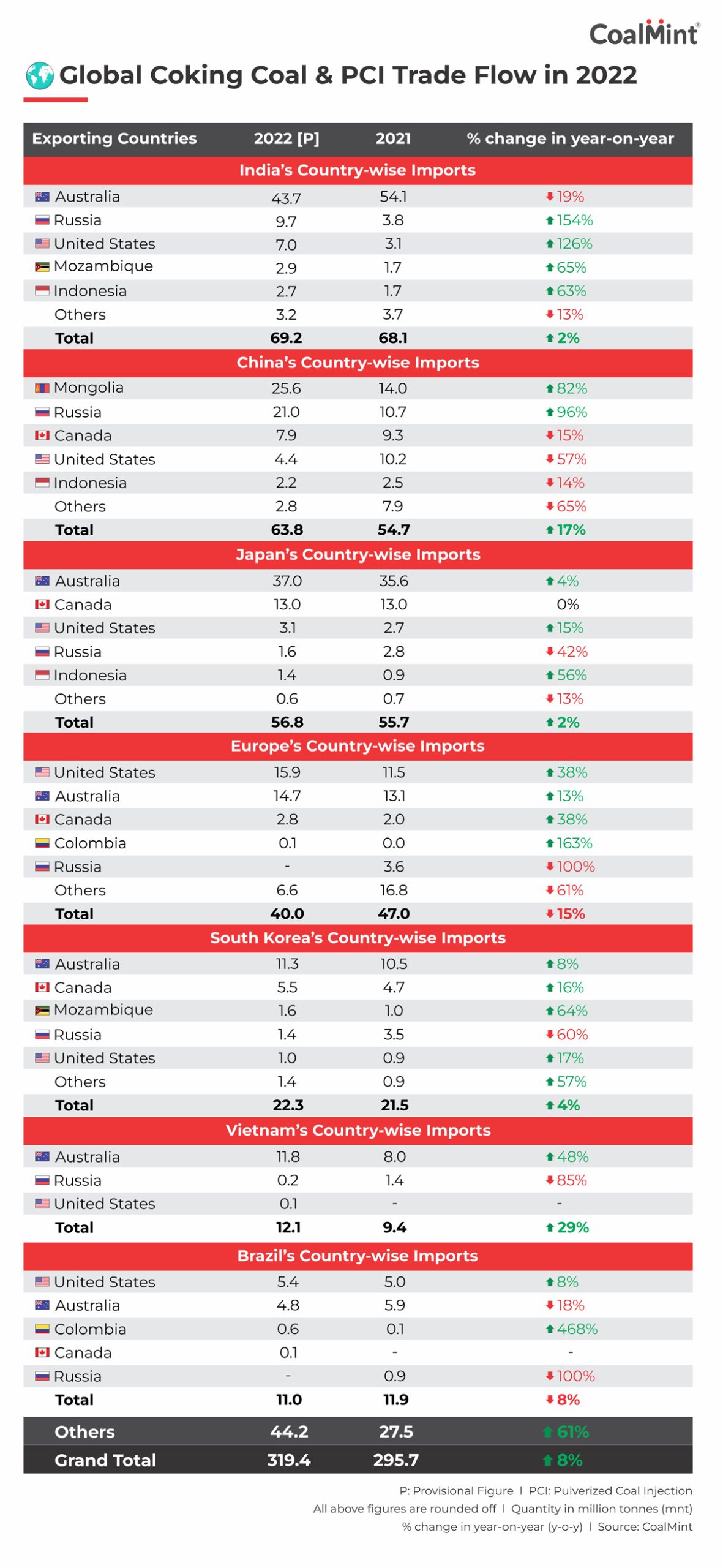

India was the leading coking coal importer at 69 mnt in 2022, accounting for 22% of total global imports. India’s imports were almost stable y-o-y compared to 2021 China was the second-largest importer at 63 mnt. Imports by China rose 17% y-o-y, although crude steel production fell around 2%. Imports by Japan and South Korea remained largely stable y-o-y at 57 mnt and 22 mnt, respectively. Sentiments remained bearish on a gloomy global steel export outlook amid high inflation, supply chain problems in the auto industry and natural disasters. Europe’s coking coal imports fell by 15% y-o-y due to high energy inflation affecting steel production and demand following the outbreak of the Russia-Ukraine conflict. After Europe imposed a complete ban on Russian coal imports from 10 August global trade flows altered. The EU traditionally sourced 55-60% of its coking coal requirement from Russia and Australian and US coking coal made their way into the continent.

Top exporters

Australia was the largest coking coal exporter in CY22, although its share in global exports fell by 8% compared to 2021 due to bad weather. The La Nina event in the country led to heavy rains in the mining regions which affected operations, leading to supply disruptions. In addition, strikes by mine workers and unavailability of labour weighed on production. The US and Canada emerged as an alternative to Australian coal due to supply disruptions. Russia emerged as the second largest exporter with 47 mnt, an increase of 48% y-o-y. The war between Russia and Ukraine affected seaborne trade dynamics of coking coal. As more Russian coal found its way into China and India, Japan and South Korea reduced sourcing of Russian coal in response to Western sanctions.

Why trade volumes increased?

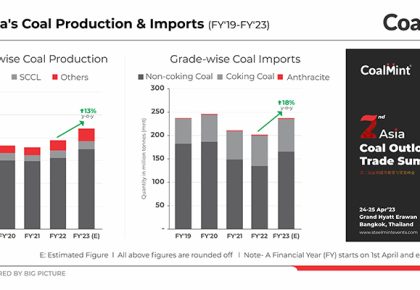

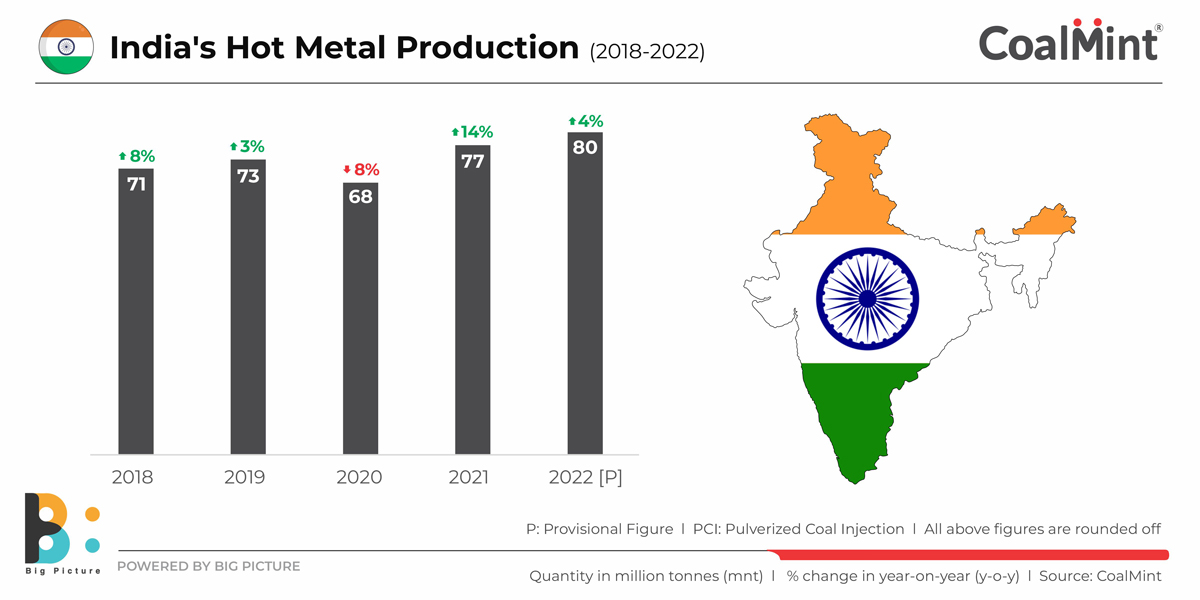

1. India’s crude steel production increased by around 6% y-o-y to over 124 mnt. Similarly, hot metal production also increased by 4% to 80 mnt from 77 mnt in 2021. For Indian importers of coking coal there was no major change in the demand scenario. Demand did not fluctuate much since the steel export duty fiasco but remained generally steady.

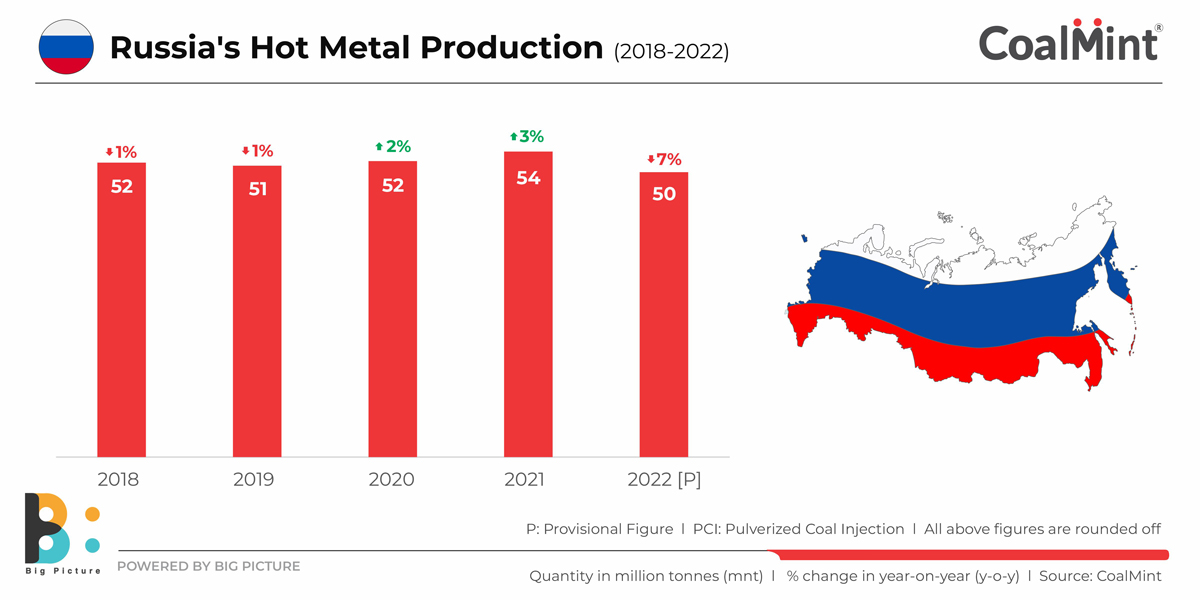

2. The war with Ukraine took a toll on Russia’s steel production as well as exports. Data show that hot metal production in 2022 decreased by over 7% y-o-y to 50 mnt from 54 mnt in 2021. This left Russian miners with higher volumes for exports. After sanctions were imposed by the European countries on Russia following its invasion of Ukraine, the country started exporting coal at cheaper prices to Asian countries like China and India, resulting in a hike in export volumes. It may be mentioned that India imported 9.7 mnt of Russian coking coal in 2022, up 154% on-year, while China imported 21 mnt, an increase of 90% y-o-y.

3. Global energy inflation drove steam coal prices to record highs across the globe, while steel production in many parts of the world suffered owing to high inflation and currency volatility. So, thermal coal prices soared way above coking coal prices globally forcing thermal coal users to switch to coking coal in many cases. This, in part, contributed to higher coking coal trade volumes.

4. Although China’s crude steel production declined 2% 2022, domestic production of coking coal also fell marginally, thereby creating room for exports. Moreover, pandemic restrictions impeded the movement of domestic scrap for steelmaking, impacting EAF steel production. Higher shipments by Russia and Mongolia also account for higher imports by China. Mongolian shipments doubled y-o-y in 2022 as COVID-related restrictions were eased enabling truck movement across the border, while Russian cargoes were available at much cheaper rates since sanctions against Russia came into force in August.

Outlook

WSA has predicted steel demand to increase by 1% in 2023 to over 1.8 billion tonnes. Steel markets are expected to normalise in 2023, excluding China. Fitch expects global steel consumption to shrink by 60-65 mnt in 2022, with capacity utilisation dropping from 80% to 77%. China’s targeted reduction of steel production will account for 20-30 mnt of this, with the rest coming from demand destruction outside China. Incremental growth in steel consumption in 2023 is expected in India, Southeast Asia and the US.

Therefore, coking coal demand will remain stable. Coking coal imports by India from Australia are also expected to remain stable in 2023, with the FTA between the countries leading to duty-free inflow of coal. Prices remained strong after a bumper 2022, driven largely by global energy prices and shortages cause by the Russia-Ukraine war. The other big-ticket item in January was the news that China is set to end its unofficial ban on importing coal from Australia, which is largely positive for global coking coal prices.

Three central government-backed utilities and China’s top steelmaker would be allowed to resume imports. A recent report in the Australian Financial Review also indicates that Australian coking coal imports might displace lower quality and higher cost Chinese domestic or US coking coal, particularly for Chinese steelmakers in the southern region. Note that China’s proposed import duty on coal leaves Australia and Indonesia unaffected.

Australia had diversified its coal exports to non-traditional buyers and ramped up supplies to traditional ones in the absence of China from the seaborne market. But now Chinese inquiries are expected to rise which may push prices higher. However, the continuing recovery of supplies from Australia will lead to an eventual correction, even if not significantly.

Interestingly, Mongolia’s recent move to auction coal through the country’s stock exchange instead of direct sale by producers and traders at the border will directly impact Chinese buyers of Mongolian coking coal. We have to wait to see whether auction sales by Mongolia result in rationalisation of prices. Also, easing coal supplies via road from Mongolia after the withdrawal of pandemic restrictions and new investments in railway infrastructure are expected to reduce logistics costs and, therefore, coal prices.