The massive surge in coal consumption led by ever-expanding power demand has left India scrambling to secure adequate supplies despite a significant push seen towards increasing domestic production.

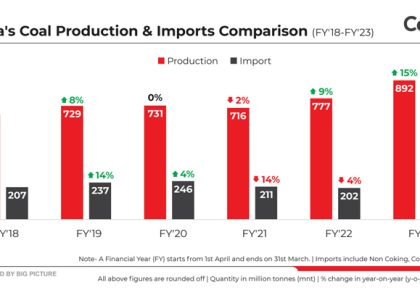

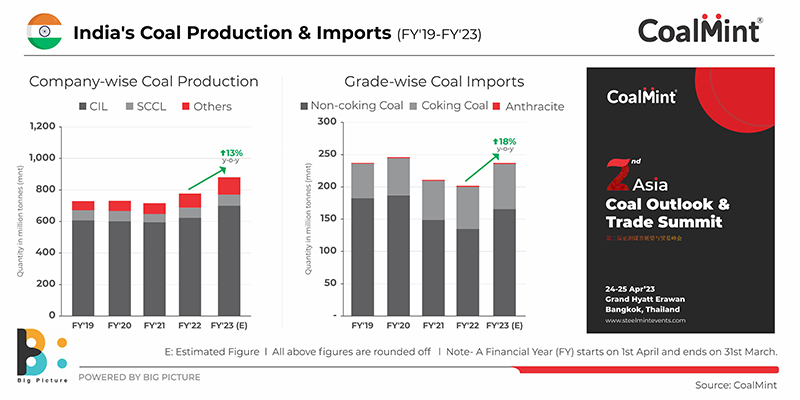

In FY2022-23, the country scaled new heights in coal production. Till February, total coal production increased by 15% to 784.41 million tonnes (mnt), thereby surpassing the previous high of 777.26 mnt recorded in the previous fiscal.

Leading from the front, state-run miner-Coal India Ltd (CIL) has maintained higher production and is well on course to meet the fiscal target of 700 mnt. In addition, gradual opening of new captive mines has also provided remarkable contribution in production growth.

India’s dependency on coal imports, particularly of thermal coal, hit a low on the backdrop of Covid-induced demand disruption. However, improvement in economic activities paved the way for higher imports last year, and there is an increasing likelihood that the pattern would be followed again in a situation where present demand outstrips domestic coal supply.

Govt intervenes to ensure energy security

Reinstating its stance towards imports, the Ministry of Power (MoP) has instructed power plants to resort to imports by procuring 6% (by weight) of their needs for blending with domestic coal till September, 2023 failing which curtailment in domestic supply has been proposed.

The decision has been taken to ensure smooth operations at thermal power stations. Interestingly, similar provision was also introduced last year. That time, the blending ratio was kept at 10%.

In this regard, India’s largest power producer, NTPC, has decided to import around 5.4 mnt of coal during first half of next fiscal (FY2023-24). The company has already floated two separate tenders seeking a total of 2 mnt of imported coal. The due date for bid submission is 18 April, 2023.

Also, for the second time, the ministry has asked imported coal-based (ICB) power plants to resume operation at full capacity this year by invoking the emergency law under Section 11 of the Electricity Act, 2003.

In addition, a tender has been floated to procure electricity from ICB plants for April-May when power availability is expected to be less than demand.

These provisions would provide ICBs an avenue for power sale, due to which these utilities will need to explore the global market for running their operations.

Challenges facing non-power sector

In India, the power sector accounts for a lion’s share of domestic coal supply. Hence, at a time when coal demand from the power plants had increased this year, domestic miners were left with no choice than to lower the supplies meant for the non-power sector.

Incidentally, CIL had diverted additional production volumes towards sales against Fuel Supply Agreements (FSA), which refers to long-terms contracts initiated with the power utilities. On the other hand, allocations via regular e-auctions, which constitute 20% of CIL’s sales, were curtailed.

Under these circumstances, CIL’s coal dispatches to the non-power sector are set to decline for the second straight year in FY23.

Moreover, CIL’s decision not to renew long-term contracts for coal supplies under linkage auctions meant for the non-power sector, has further escalated the supply crunch for this sector at a time the demand for power is showing no signs of slowing down.

Price factor

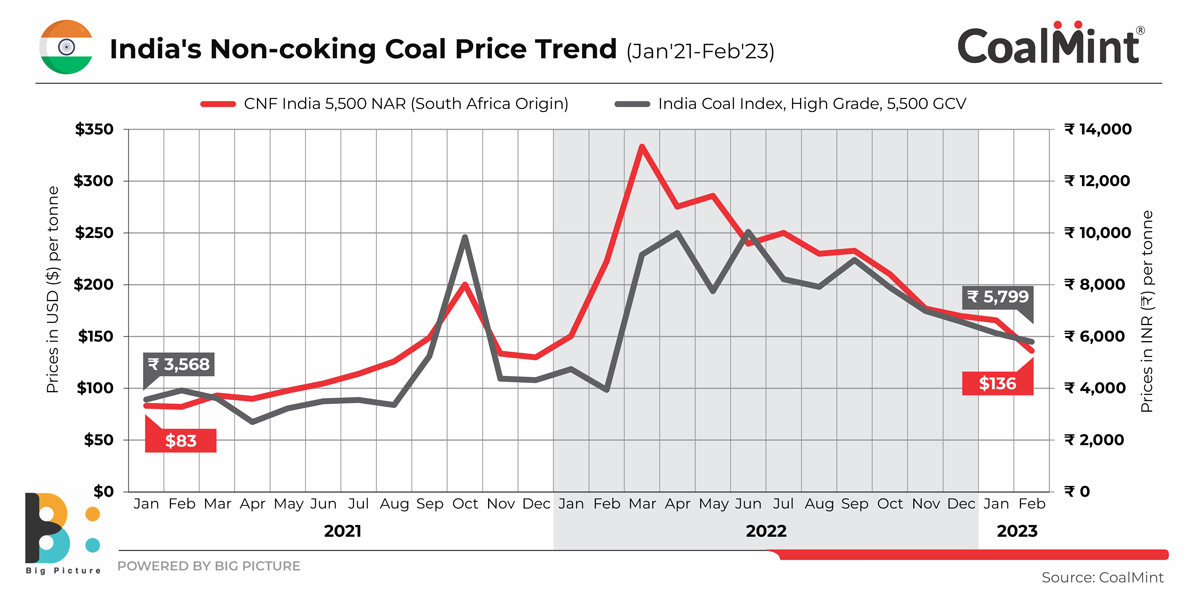

In the aftermath of the Russia-Ukraine war, coal supply chains had altered which resulted in prices touching record highs. However, prices have started to decline since the second half of 2022 amid reduced appetite from China and rise in production seen from the major exporter Indonesia.

Meanwhile, reduced Russian coal exports to Europe were balanced by hike in supplies from Colombia and South Africa.

In India, domestic prices touched unprecedented levels due to factors arising from geopolitical turmoil and prevailing supply cuts. Notably, healthy competition was seen amongst the buyers to procure the limited material offered at auctions. In addition, the introduction of the single window auction, which brought the entire gamut of customers on to a common platform, also pushed bid prices higher.

Upon improvement in supplies, prices have seen significant correction, but still are assessed above year-ago levels. In the scenario where both global and domestic prices have come down, but the latter is still overpriced given its low energy-content, the Indian buyer will be banking more on seaborne material as it provides greater value in terms of quality.

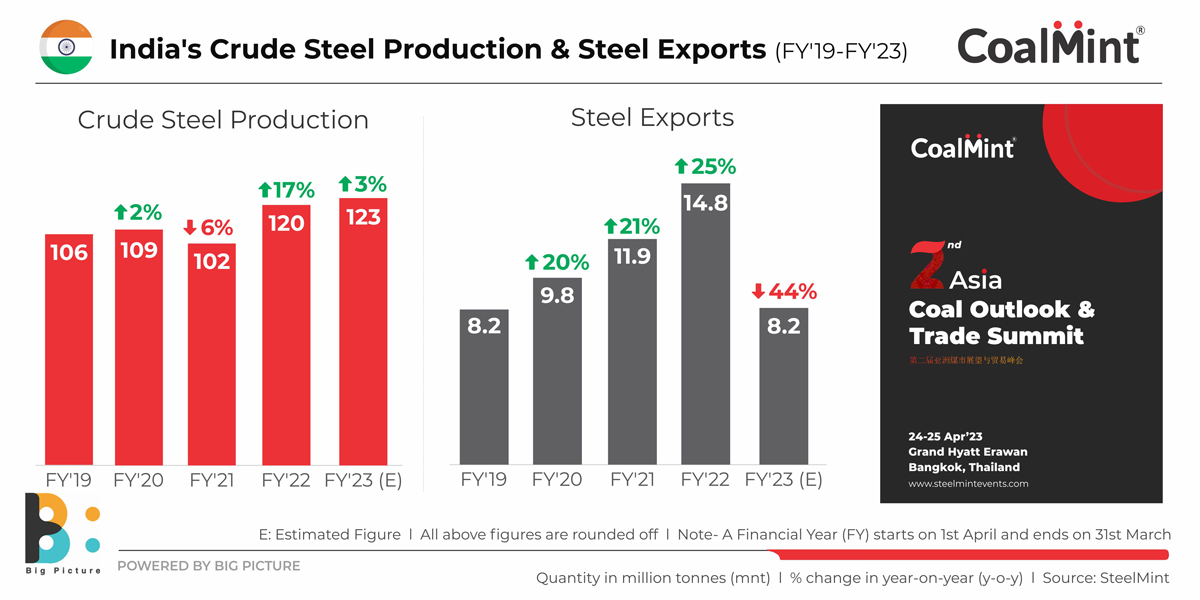

Thrust on steel production

Augmenting steel production is essential to supporting economic growth. At the same time, the government’s thrust on import substitution in the steel sector has resulted in the Performance-Linked Incentive Scheme (PLI) being introduced.

Moreover, there is a strong case for increasing output after the government had lifted the 15% export duty imposed on finished steel. This move might prompt the steelmakers to explore the export market to fetch higher price realisations.

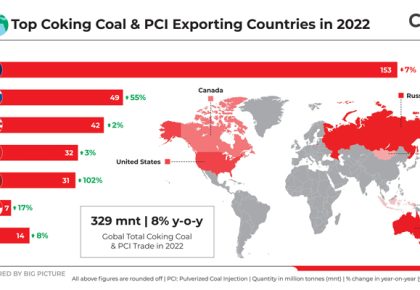

Therefore, the dependence on coking coal as well as PCI imports is bound to increase with the higher generation of liquid steel through the primary route. Given that India has scarce coking coal reserves, of which only a meagre portion has low ash content, the big steel companies are not in a position to reduce their dependence on imports in the foreseeable future.

Outlook

Stepping up the plan to increase domestic coal availability, the government has introduced several policy reforms to support the mining sector. These include extension of mining lease period, eliminating prior approval required for capacity expansion, along with creation of a single window system.

Moreover, regular auctions are being conducted for allocation of coal blocks under the commercial mining scheme. In view of the dwindling response from the prospective bidders, the sale was made lucrative by providing relaxation in payment terms and improving the feature of blocks offered in the lot.

These measures paid off as a total of 25 blocks were sold in the recently concluded sixth tranche, marking the highest allocation recorded for a single tranche.

CIL is also exploring opportunities to re-open abandoned mines which had been closed mainly on account of difficult mining conditions and financial losses.

With elections round the corner and the pressing need to avert a power crisis, imports are likely to play a key role in satiating rising demand.

2nd Asia Coal Outlook & Trade Summit

There has been no let-up in India’s coal imports of late and 2023 may be another year likely to witness sustained growth. Will imports continue on an upward trajectory or will government intervention and the projected rise in domestic coal output help to rein in imports? To follow the debate, make sure you attend CoalMint’s 2nd Asia Coal Outlook & Trade Summit in Bangkok, Thailand, on 24-25 April, 2023.