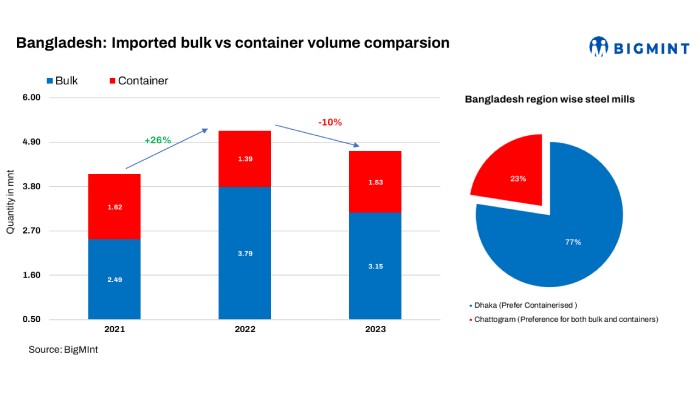

Bangladesh has emerged as one of the top three importers of ferrous scrap in South Asia. Over the last three years (2021-2023), bulk scrap imports have grown from 60% to 67% of the country’s total imports.

Overall bulk scrap imports in CY’23 witnessed a significant 17% drop to 3.16 million tonnes (mnt ) compared to 3.80 mnt in CY’22.

Almost 15-20 bulk scrap vessels are booked every month by Bangladesh, which fell to 9-10 per month during the second half of CY’23. This decrease was attributed to challenges in LC openings and a weaker foreign exchange reserve. The country’s steel sector observed sluggish movement amid weaker sentiments for finished steel, followed by prolonged LC issues and subdued demand from downstream sectors in CY’23.

Furthermore, shipments from the US and Japan decreased, with Turkish and Indian bulk buyers capitalising on the favourable parity situation.

In the last two years (CY’22 and CY’23), container scrap volumes have witnessed a fluctuating trend (a 10% rise in container volumes at 1.52 mnt as against 1.38 mnt in CY’22). On the other hand, in CY’22, the container volume saw a 14% drop as compared to 1.61 mnt in CY’21).

A sharp rise in freight rates, longer lead times, and unavailability have impacted the container market, and the container volume share dropped to 33% from 39% in 2021. The country is lately also exploring newer supplier geographies for container shipments including Singapore, Malaysia, and Hong Kong.

Currency depreciation: The BDT has depreciated by 25%, and a majority of Bangladeshi importers who rely on usance LC due to the relative stability of the currency are making substantial losses now.

However, due to a lack of port facilities, unloading at jetties is very slow, and vessels have to be unloaded at anchorages. In the event of imports edging higher, the problem is likely to intensify. Steel decarbonisation goals will raise global scrap demand, while supplies struggle to keep pace.

Major exporters, such as the EU, are likely to prioritise local consumption and may discourage exports. This could have a major impact on the steel industry in Bangladesh.

Weaker foreign reserves weigh on LC openings: Amid mounting pressure on foreign exchange reserves and exchange rate volatility, the country’s central bank has implemented measures to tackle the trade imbalance. Interest rates have increased in LC issuance, hampering scrap imports towards the second half of CY’23. The deposit required for LC approvals has also increased to 20% from the earlier 10%. Forex issues and remittances have dropped in the last two years. In response to higher imports compared to exports and remittances, however, some banks still impose 100% LC margins on essential commodities, impacting importers’ competitiveness.

Price trend: BigMint’s yearly average price assessment for US-origin bulk HMS (80:20) stood at $430/t CFR Chattogram in CY’23 as against $501/t CFR in CY’22, followed by Japanese H2 bulk scrap yearly average assessment which stood at $425/t in CY’23 as against $505/t CFR in CY’22.

BigMint’s yearly average price assessment for UK-origin containerised shredded and HMS (80:20) stood at $455/t and $430/t CFR Chattogram in CY’23, as against $534/t and $503/t respectively on a CFR basis in CY’22.

Over the past two years, foreign exchange reserves have steadily declined due to high external payment obligations surpassing inflows from exports and remittances. Reserves plummeted from $40.7 billion in August 2021 to approximately $19 billion towards the end of CY’23. The dollar shortage has resulted in delayed or renegotiated import payments, with banks granted additional time to acquire the necessary foreign currencies.

To meet IMF loan programme requirements and address the net reserve condition, the Bangladesh Bank introduced currency swaps with banks for the first time, allowing banks to provide foreign currencies in exchange for interest instead of the central bank directly purchasing dollars.

As of January 2024, Bangladesh’s repo rate stands at 8%, up from 7.75% in December 2023, aimed at curbing inflation to 6%. LC settlements hit a three-year low in December 2023 at $4.53 billion, with the lowest recorded at $4.41 billion in November 2020. Bankers are now issuing two types of LCs: sight and deferred. Economists attribute improved liquidity in banks to increased remittances, foreign loans, and aid. While sight LCs require immediate payment, deferred LCs allow 90-180 days for settlement.

Outlook

The projected growth in urbanisation is set to drive new project announcements by 2027, fuelling increased steel demand. Improved infrastructure and a favourable global trade environment may stabilise forex reserves and unlock economic opportunities. Bangladesh’s top steel manufacturers are expanding capacity to meet rising steel demand in construction projects, signalling positive prospects for the steel and ferrous scrap import markets. Optimism prevails for steel mills as they look to stabilise import volumes, potentially boosting scrap trades in the near term.

4th Bangladesh International Trade Summit

Bangladesh, a strategically significant country in the Asia Pacific, is emerging as a hotspot of economic growth. The country’s phenomenal economic expansion is fuelled by a buoyant steel sector which is on an expansion spree. This is expected to encourage the participation of more global companies and attract precious foreign reserves for the country.

BigMint Events will be hosting the 4th Bangladesh International Trade Summit on 14-15 May 2024, at Hotel Pan Pacific Sonargaon, Dhaka, Bangladesh. The two-day conference looks to bring together key stakeholders from the steel, cement, and power sectors, including industry stalwarts, policymakers, traders, and investors. It seeks to provide a network for collaboration and an ideal platform for discussion of prevailing industry trends and challenges.