- Imported coal usage increasing at power plants

- Scarce natural gas supplies support imports

- Thermal coal imports may touch 19 mnt by 2026

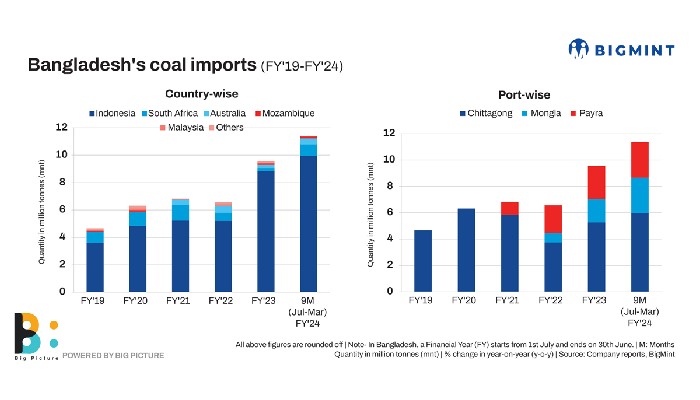

Morning Brief: In the midst of its escalating energy demand, Bangladesh has witnessed a significant 44% y-o-y increase in coal imports in the Financial year 2023 (FY’23), reveals BigMint data. Volumes surged to nearly 12.75 million tonnes (mnt) last year compared to 8.83 mnt in FY’22, underscoring the nation’s growing reliance on imported coal.

Factors pushing up coal imports

Increased demand from power sector: The increase in coal imports can be attributed to several factors. Notably, a key reason lies in the heightened requirement of imported coal for power generation. Inflation-related issues and coal supply shortages have been leading to electricity disruptions. With the addition of the Matarbari power plant in the current fiscal year, demand for coal has experienced a remarkable upsurge. In fact, six power plants across the country are now operational, utilising imported coal as a primary fuel source.

Natural gas shortfall: Bangladesh has also been experiencing a persistent shortage in domestic fuel supply, notably evident in the natural gas sector. Despite its historical dominance, the country’s natural gas reserves struggle to meet escalating demand, leading to a greater reliance on coal and imported natural gas. In a latest development, Petrobangla has invited bids for oil and gas exploration wherein nine shallow-sea and 15 deep-sea blocks have been put on offer.

Nonetheless, given the time required to develop these gas blocks, coal appears to be a viable option to meet the growing energy needs of the country in the near term.

Insufficient domestic coal supplies: In response to the surging energy demands, Bangladesh has witnessed a remarkable increase in domestic coal production, notably facilitated by the Barapukuria Coal Mining Company Limited (BCMCL). Several factors have contributed to this surge, including successful agreements with the Chinese contractor XMC-CMC Consortium, aimed at roadway development and maintenance, alongside continued coal extraction activities from underground mines. To meet the growing demand, BCMCL increased coal production by 57% y-o-y to 767,307 tonnes in FY23.

However, despite the substantial increase in production, the country’s domestic coal supply still falls short of demand. This demand surge is evident in the country’s Annual Performance Agreement (APA) for the financial year 2022-2023, which aimed to sell 500,000 t of coal to the Bangladesh Power Development Board (BPDB). Due to BPDB’s high demand and BCMCL’s increased production, 0.76 mnt of coal were sold to BPDB in 2022-2023, surpassing the initial target. Notably, BCMCL ceased coal sales to local buyers from 19 March 2018, further accentuating the reliance on imported coal.

Coal emerges as a cost-effective solution: Despite the availability of gas reserves, gas-based power plants dominate Bangladesh’s total power generation capacity. However, a persistent shortfall in natural gas supply, from as early as 2014, as highlighted by Petrobangla in its annual report, has led to a growing dependence on coal and imported natural gas.

A comparative cost analysis reveals that while gas remains the cheapest source of power generation, coal emerges as a more economical option compared to alternative power sources.

Falling prices led to higher imports: Furthermore, declining coal prices have further incentivized imported coal procurement. Prices of RB2 (5500 NAR), South African coal and 4200 GAR Indonesian coal dropped 50% and 27% y-o-y respectively and were assessed at $105.35 FOB Richards Bay and $63.3/t FOB Kalimantan in CY’23. This declining trend encouraged end-users to increase their purchases of imported coal, shaping Bangladesh’s coal import landscape.

Tightened supply coupled with declining coal prices on the international stage prompted the country to recalibrate its approach to coal procurement. Notably, increased sourcing from Indonesia in CY’22 and a 34% rise in intake from traditional markets like South Africa, fuelled by falling prices, have shaped Bangladesh’s coal import landscape.

Outlook

It is anticipated that Bangladesh’s coal imports will likely increase in the near future due to escalating energy demands amidst inadequate domestic supply. Despite challenges like currency devaluation and supply disruptions, coal capacity expansion projects are underway to meet future energy needs. Projected coal consumption is expected to reach 19 mnt by 2026 from the present 13-14 mnt, driven by capacity additions and economic growth. Coal consumption is set to increase with plants like Matarbari and Banshkhali that are nearing commercial operation.

4th Bangladesh International Trade Summit

Bangladesh, a strategically significant country in the Asia Pacific, is emerging as a hotspot of economic growth. The country’s phenomenal economic expansion is fuelled by a buoyant steel sector which is on an expansion spree. This is expected to encourage the participation of more global companies and attract precious foreign reserves for the country.

BigMint Events will be hosting the 4th Bangladesh International Trade Summit on 14-15 May 2024, at Hotel Pan Pacific Sonargaon, Dhaka, Bangladesh. The two-day conference looks to bring together key stakeholders from the steel, cement, and power sectors, including industry stalwarts, policymakers, traders, and investors. It seeks to provide a network for collaboration and an ideal platform for discussion of prevailing industry trends and challenges.