- Around 10% of 50 mnt of seaborne trade impacted

- Global miners increase export offers for June shipments

- Chinese demand surges but domestic supply remains tight

- Weak import demand for Indian Mn alloys may cap prices

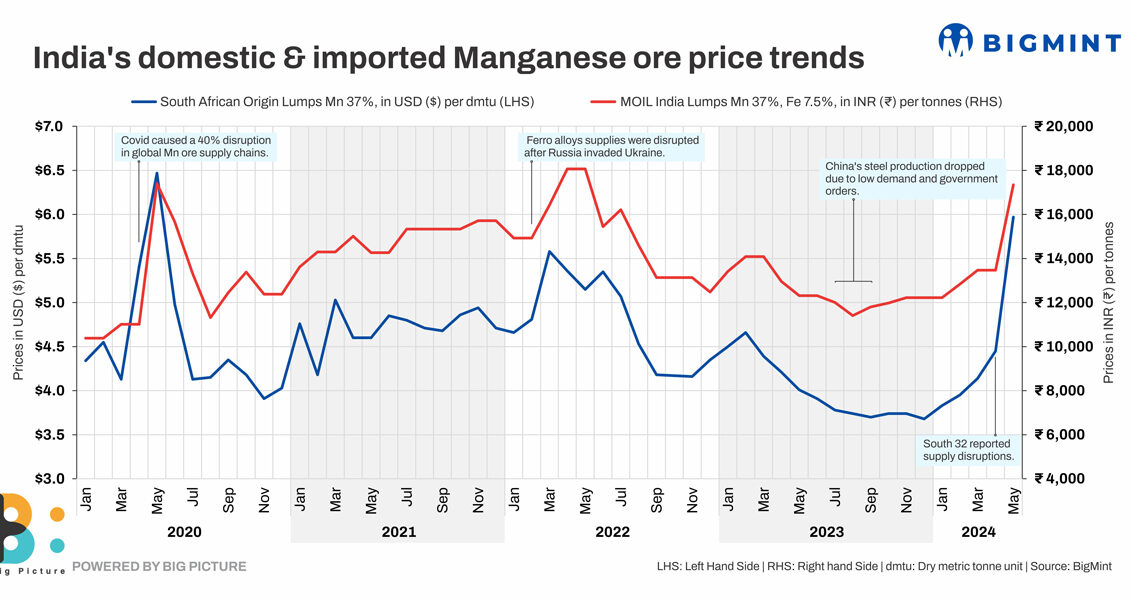

Morning Brief: In a significant development, imported manganese ore prices hit over a 4-year high in May, 2024. The disruption mirrored a similar event in May 2020 and has significantly impacted the manganese ore market. Prices of manganese ore lumps (Mn 37%), CNF east coast, India, (South African-origin) were recorded at $6.4/dmtu last week, the highest since May 2020.

Global miners like South32 Ltd and Eramet Comilog hiked their offers. South32, the world’s leading miner, has increased offers for its 37% grade South African manganese ore lumps by $2.2/dmtu to $6.50/dmtu CIF China for June shipments. Additionally, its 37% grade South African semi-carbonate lumps rose by $5.1/dmtu CIF China.

Eramet Comilog, a leading manganese ore exporter based in Gabon, has announced its June shipment prices of manganese ore destined for China. The price of Gabonese lump ore with 44.5% manganese content increased significantly by $2/dmtu, to $6.90/dmtu CIF China. Limited mine supply, along with China’s reduction of stockpiles, have bolstered manganese ore prices. Moreover, India’s largest manganese ore miner, MOIL, raised offers. Prices of grades above 44% have witnessed a 40% growth m-o-m, while lumps below 44% have increased by 25% in May 2024.

Supply disruptions have impacted about 10% (5 mnt) of the total seaborne trade of around 50 mnt, BigMint understands.

Reasons behind price hike

Cyclone disrupts operations at South32: Following tropical cyclone Megan’s structural damage to its terminal and other infrastructure at the mine, Groote Eylandt Mining Company (GEMCO) decided to cease production at its 6 million tonnes/year (mnt/y) mine. It may be noted here that 60% of GEMCO is owned by South32, with Anglo American holding the remaining 40% share. The miner withdrew its 3.4 mnt guidance for its portion of GEMCO’s production in the financial year ending 30 June, shortly after the hurricane made landfall. South32’s GEMCO output for the previous fiscal year was at 3.55 mnt.

Derailment issue in Gabon: Gabon, the world’s second largest manganese ore mining country, experienced a derailment accident on 26 April, with nearly 300 metres of track damaged and 26 empty cars impacted. The repair time may take about two weeks to a month. With a monthly manganese ore transportation volume of over 5,00,000 tonnes (t) per month in Gabon and a long-term supply stoppage of South32 manganese ore, and if the repair time at Gabon’s transportation railway is too long, there may be further tension in manganese ore supplies. Complexities surrounding this issue also drove imported manganese ore prices higher.

Return of Chinese mills post-holidays: The enthusiasm of Chinese enterprises for procurement has also increased manganese ore prices as they returned to the market after a series of holidays, starting with the Lunar Year in February and ending with Labour Day in May. However, the enthusiasm of manufacturers to replenish inventory has decreased. The increased demand has decreased the number of inventory days by more than 30% compared to the beginning of the year. In the past month, inventory in Ningxia and the southern production hub have slightly rebounded from absolute lows. The main reason behind the decreased inventory was the rise in demand amid tight supply of raw material (manganese ore) which had rendered major manganese ore producers temporarily out of operation. China is the largest buyer of manganese ore from Australia but supply was scant from here too as miners had rationalised production because of weather issues. And delayed shipments of high-grade manganese ore also created a panic situation forcing these Chinese smelters to increase import volumes from Gabon, and South Africa.

Outlook

South32 anticipates restarting export sales and wharf operations in Q3FY’25 (January-March 2025) based on their initial estimates. However, sources acknowledged challenges. “We are exploring alternative shipping options to mitigate the impact of the wharf outage. These options may create a limited export capacity for ore in the near future. This may drive prices higher,” said a company spokesperson.

Samancor’s joint venture, on the other hand, is planning to resume mining at South32’s GEMCO unit in June post-suspending in March, aiming to build stockpiles before the 2024-2025 wet season. Recovery measures from March’s cyclone impact include de-watering and infrastructure repairs. Wharf operations and exports are set to recommence in Q3FY’25.

Global miners expect prices to remain on the higher side for about a month. However, the outlook is mixed for the next couple of months. Factors that may weigh down prices include weak demand for Indian manganese alloys from traditional markets like the European Union (EU), Japan etc. This may lower exports and divert volumes in the domestic market which may cap the price hike.

In addition, Indian steel demand may pick up in H2 which may boost manganese alloys demand, but in the short term no significant increase is expected. The manganese ore cargoes booked by Indian smelters in March-April at lower price levels will be arriving in June.