Mughal Iron & Steel Industries Ltd. is Pakistan’s largest steel producer and perhaps the largest importer of scrap as well. From a modest beginning as a trading company in 1950, it moved to steel production and today it plays a significant role in the region’s economic development. One of the people at its helm is Mr Fahad Javaid Mughal, a director in the company, who holds a bachelor’s degree in international business from Australian National University, Australia.

Here follows excerpts from a telephonic interview with Mr Mughal:

1. How is the global steel scrap market looking this year?

The US halved its 50% tariff on Turkish steel imports this month and the market spiked up instantly. But I’m thinking, demand is not going to stay very high for Turkish steel because I see US fulfilling its demand for steel domestically and it might take some time for Turkey to establish itself in the US market after a lull.

2. What is your price forecast for steel scrap?

I see prices in Pakistan under $330-335/tonne, CFR, in the next few months as against $320-325/tonne at present. Currently, Turkish scrap prices have been at $295-297/tonne on average, though variations do occur because of demand. However, I can see Turkish scrap rates staying over $290/tonne, CFR. Turkish rebars are seen around $490/tonne. Pakistan’s buying price is approximately $25-30/ tonne higher than that of Turkey due to freight.

3. How is the local market for steel doing in Pakistan?

Demand in Pakistan might rise in two month’s time as the government is to release funds for some projects. There could be an upward impact on prices to the extent of $10-15/tonne. Turkey may start buying aggressively and that might also have an impact on prices. Once US starts to to buy, the market dynamics will change.

4. How are the China Pakistan Economic Corridor (CPEC) and Silk Road projects shaping up? How much of a boost will these projects mean for Pakistan’s steel producers?

The premier of both China and Pakistan had a meeting recently and we are expecting new tenders for the projects. Four new MoUs were signed. The new tenders would be modified tenders. Demand is expected to arise by the end of this year. The local industry is working along with CPEC even though it is not supporting all the steel mills. It depends on the brand and prices.

5. How is the demand for steel in Pakistan’s home market?

At present, the per capita consumption of long-rolled steel products in Pakistan is 24kg which is the lowest in the Asia-Pacific region. Our neighbouring country, India, has per capita consumption of long-rolled steel products of 50kg. So in the coming years, Pakistan steel market will definitely grow and our expectation is that the per capita consumption will increase to 35kg. Demand from commercial and home sectors are doing good. Now government has to allocate a good amount of funds for new projects like dams, flyovers, motorways and others. As per the new budget announced in June, Government has imposed a Federal Excise Duty of 17% and abolished special sale tax procedures on scrap and billet import. This is favourable for the steel industry as a whole, as tax net will expand and it will make a level playing field for all the manufacturers in steel sector.

6. How is the Pakistani government protecting the industry from the onslaught of Chinese exports?

There is protection. For instance, there is a 43% tariff on rebars especially from China. Steel industry is happy and has invested in furnaces.

7. How much steel will Pakistan produce in 2019-20?

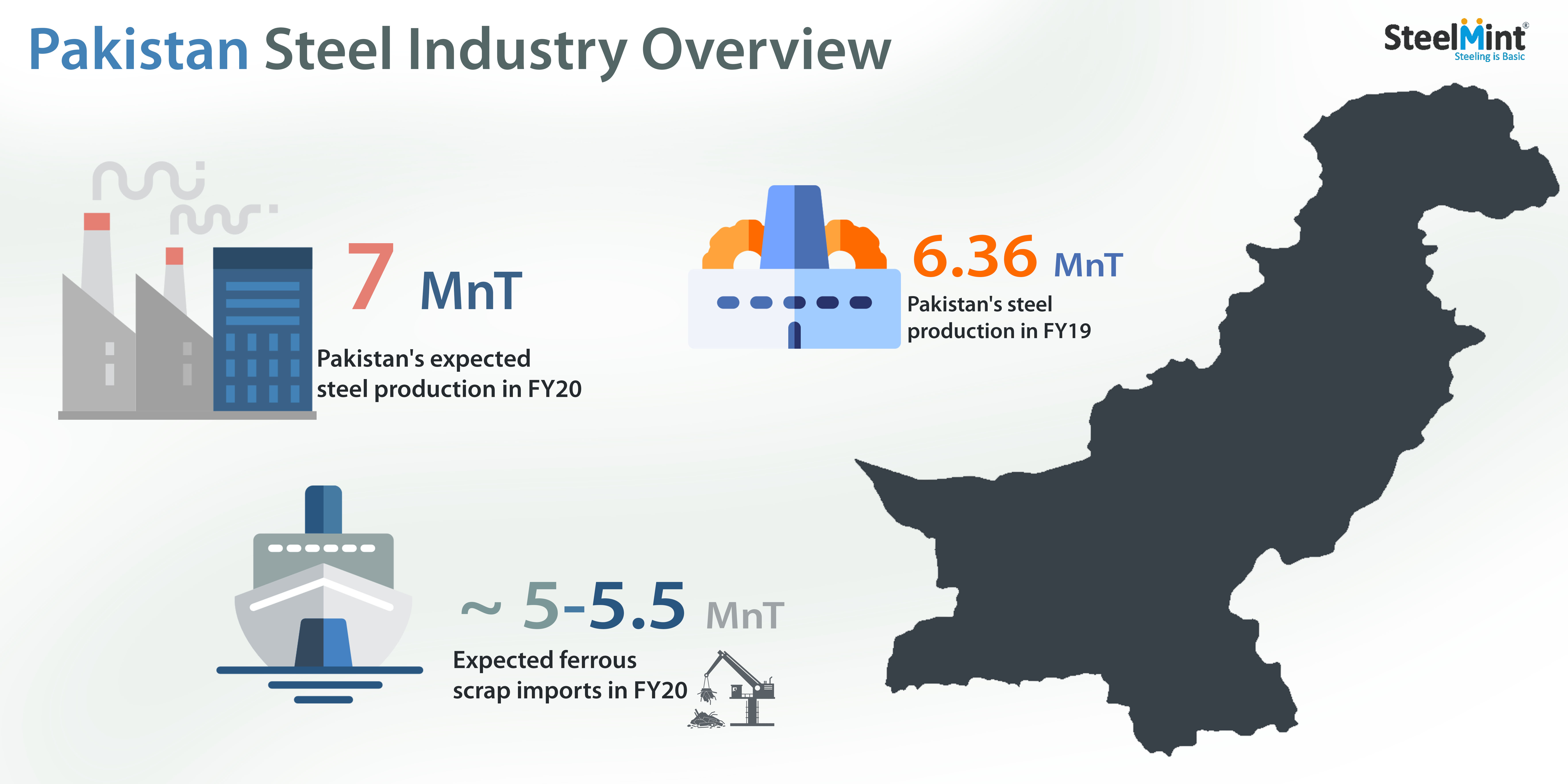

Pakistan is expected to produce 7 MnT of all steel products this year. In 2017-18, Pakistan produced 7 MnT of steel, but in 2018-19, it fell by 9.2% owing to the depreciation of the local currency. Pakistan’s rupee depreciated by 40%, scrap prices went up and duties also went up. The industry could not pass on the cost to the customer. From 2020 onwards, we expect a steady rise from current levels.

8. What are the expansion plans of Mughal Iron & Steel Industries?

We are the largest producers of steel in Pakistan with a capacity of 0.7MnT. In another two months our capacity will rise to 1.1 MnT. We also have a 60 megawatt coal-based power plant coming up which is expected to be ready in one and half to two years from now.

9. How much of steel scrap will Pakistan buy this year (2019-2020)?

Pakistan will buy tentatively 5 MnT of steel scrap this year, but this can further increase if the upcoming steel capacities become operational in 2019-20.

In order to know more on Pakistan steel and scrap trade markets, book your seat at SteelMint’s 4th Steel Scrap, Billet & DRI Trade Summit. The conference is being organized during 27-29’th Aug’19 in Bangkok, Thailand.

~ Inputs by Ruchira Singh