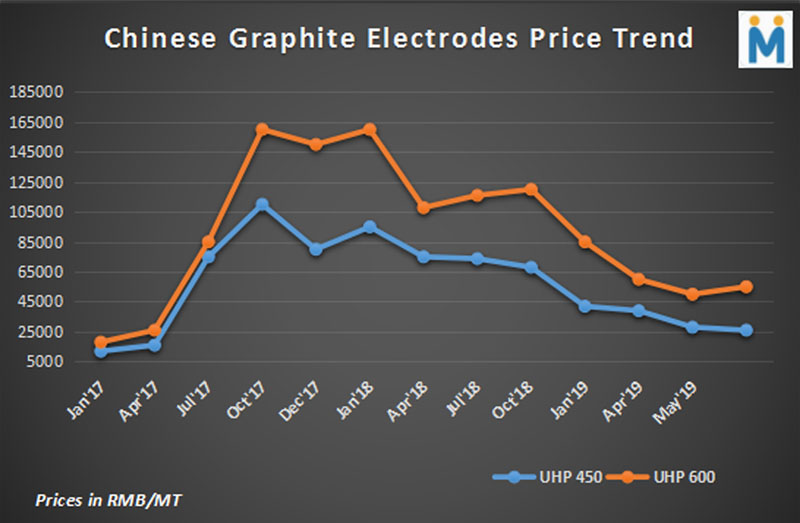

With the GE prices in China falling since November last year and then becoming stable over past one month, the big question hovering is where is the country’s electrodes prices are heading to. To get an answer to this let us analyse few of the important happenings in the country’s GE and steel market.

As per the SteelMint sources, although the lower grade graphite electrodes prices plunged down further this week, the UHP grade GE prices of higher size continues to remain unaltered over past one month.

The current prices in China of UHP grade GE of size 450mm are heard to be in the range of RMB 24,000 – 26,000/MT (USD 3,470 – 3,760/MT) whereas that of size 600mm are in the range of RMB 48,000 – 60,000/MT (USD 6,940 – 8,675/MT). The price of HP grade electrodes of 450mm are in the range of RMB 21,000 – 22,000/MT (USD 3,040 – 3,760/MT), according to China based CBC data.

The demand for higher grade electrodes of size 600mm-700mm have increased in the overseas market as the quality of the same have improved over the period of time, thus supporting their prices. However, in case of non-UHP grade and lower size UHP electrodes, there is a situation of overcapacity amid tepid demand from downstream sector and difficulties in development of EAF steelmaking. In fact few small GE units have temporarily shut down their operations and have adopted wait and watch approach.

Obstacles in steel production via EAF route

As highlighted by director of Iron & Steel department of China’s MIIT (Ministry of Industry & Information Technology) costs are restricting the development of EAF steelmaking in the country. The cost of EAF steel is higher by around RMB 400-500/MT (USD 58-72/MT) compared to that from converters and reason being higher raw material costs. The scrap prices that adds up to around 75% of the EAF costs are currently trending at a higher range. In most favourable condition, the scrap prices of around RMB 1,600/MT would make EAF more competitive against blast furnaces, but current scrap prices are around RMB 2,300-2,400/MT making electric furnaces a costly route of steel production. Apart from scrap higher cost of electricity, which comprises 6-15% of the total cost of EAF production is also contributing to slower development of EAF steelmaking facilities in China.

Availability of scrap might also prove to be hindrance for EAF steel manufacturers in the near term. This is because in 2018, steel produced in China Steel produced down the EAF route in China in 2018 was almost 90 MnT. Total scrap use in all steelmaking was 220 MnT. But with integrated steelmakers consuming 160 MnT, only 60 MnT was used by EAFs and thus if the percentage of EAF steel output increases, scrap will be in short supply therefore in the near term.

The likely price trend of GE in near term

As per the market survey carried out by an agency, the average operating rate across 33 Chinese electric arc furnace (EAF) steelmakers that use steel scrap, rather than iron ore, as feedstock is expected to dip from 80% in May to 79% in ongoing month of June.

This downtrend have been supported from the fact the mills in south are facing heavy rainfall thus, hurting demand and weighing down on prices, pushing mills into losses. As a matter of fact some mills have curtailed their production amid anticipation of heavy losses.

Given the EAF market scenario, the GE prices especially that of non-UHP and lower size, are unlikely to move up in the upcoming time period. In case of UHP grade electrodes of higher size, the positive overseas demand is likely to support their prices