There is a distinct possibility of low-grade Chinese GE flooding the Indian market with the duty hike imposed by the US on Chinese imports.

Adding a new chapter in the ongoing trade war between two major global economies, the US and China, the former created a stir last week by announcing a hike in tariffs on certain goods from the existing 10% to 25%. The laundry list of products with increased duties includes Graphite Electrodes (GE). It would be interesting to analyze whether this additional levy might impact China’s GE exports to the US.

The dominant steelmaking route in the US is EAF. In 2018 the country’s electric furnace capacity stood at 76 MnT, which means the country’s GE requirement is quite high. The US is home to the GE behemoth GrafTech International with a total installed capacity of 230,000 tonne from four plants located in the US, Mexico and Europe.

US reliant on GE imports

Nevertheless, the US is still dependent on GE imports to meet it requirements because GrafTech’s US plant, with a capacity of 28,000 tonne, is lying idle (with effect from the second quarter of 2016) as a part of the overall capacity reduction in the industry that began in early 2014.

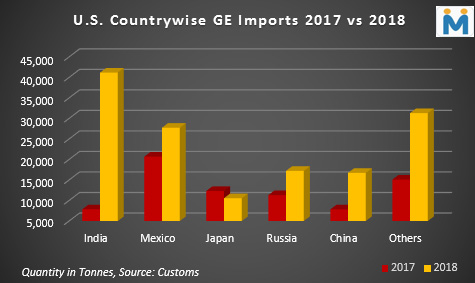

As per US customs data, in 2018 the economic superpower imported about 127,586 tonne of GE with highest imports coming from India (32%) followed by Mexico (22%) and Russia (14%). The percentage share of China in total US GE imports stood at 13%. Thus, although not a major exporter to the US, China has a share in that country’s electrodes imports, and now with the tariff surge that share is likely to decline.

Opportunity for other GE exporters

This situation could well throw open opportunities for other GE exporting countries such as India, Russia and Japan to cater to US demand that was hitherto supplied by Chinese exporters. In fact, India’s share in US GE imports has already registered a significant uptick on a Y-o-Y basis from 10% in 2017 to 32% in 2018. India’s exports to the US must also have increased as supplies to a key importer, Iran, stopped after the imposition of sanctions on the Islamic Republic by the US in August last year.

Chinese GE exports to India to Spike Further

According to market sources, China mainly exports HP grade electrodes to the US. The US’ share in China’s total GE exports in 2018 stood at 7% and with the new tariff system in place China will divert its GEs to other countries like India. India has become a key destination for lower grade (HP/RP) electrodes exports for China after the anti-dumping duty on GE imports into India was removed in August last year. China’s share in India’s total electrode imports increased from 14% in 2017 to 56% in 2018.

China’s GE market scenario

Chinese GE prices that were falling incessantly for almost six months have now turned stable. Current prices in China of UHP grade GE of size 450mm are heard to be in the range of RMB 26,000 – 28,000/MT (USD 3,800 – 4,100/MT) whereas 600mm GEs are in the range of RMB 48,000 – 53,000/MT (USD 7,000 – 7,700/MT). The price of HP grade electrodes 400mm in size are in the range of RMB 22,000 – 24,000/MT (USD 3,200 – 3,520/MT).

After the end of the winter heating season in March, Chinese steel mills scale up production. Therefore, during this period GE prices in that country surge too. But this year, domestic steel demand in China has turned tepid amid slow growth in the automobile and infrastructure sectors. Thus, at present steel mills in China have adopted a wait and watch policy resulting in GE prices turning stable.

On the raw materials front, domestic needle coke prices too remained stable this week. Domestic needle coke price is heard to be in the range of RMB 20,000-25,000 per tonne (USD 2,950 – 3,660/MT) whereas the imported offers are heard to be in the range of USD 4,000-4,600/MT.

Fluctuating GE price dynamics

As China already has excess GE supplies, amid the surge in taxes, China’s electrodes exporters will have two options: either to lower their GE offers further and continue exporting to the US or interrupt the price dynamics of lower grade GEs of other countries, especially India, with their increased supplies. How will Chinese GE exports affect global price dynamics this year? To know more register for the 2nd Global Graphite Electrode Conference to be organized by SteelMint Events from 27-29 August, 2019 in Thailand.