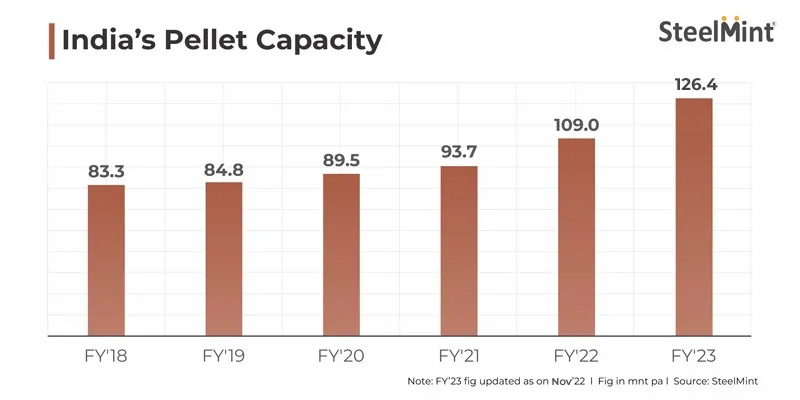

India’s pellet-making capacity has expanded rapidly in recent years along with the steady rise in crude steelmaking capacity. SteelMint estimates that the country’s pellet production capacity currently stands at 126 million tonnes (mnt), which is 16% higher than 109 mnt in FY22.

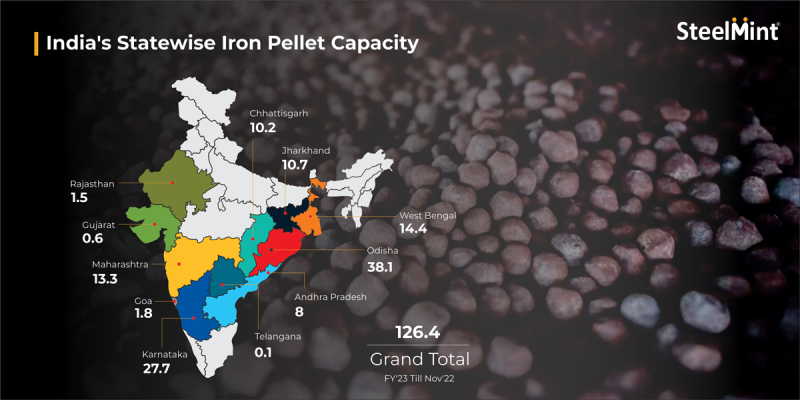

Karnataka’s share in India’s total pellet capacity is around 21% at 27.7 mnt currently. It has the second-largest pellet production capacity among Indian states, with Odisha topping the list at over 38 mnt. Karnataka emerged as the second-largest iron ore producing state in India in FY22 with production of about 40 mnt – roughly 16% of the country’s total production.

Pellet capacity expansion

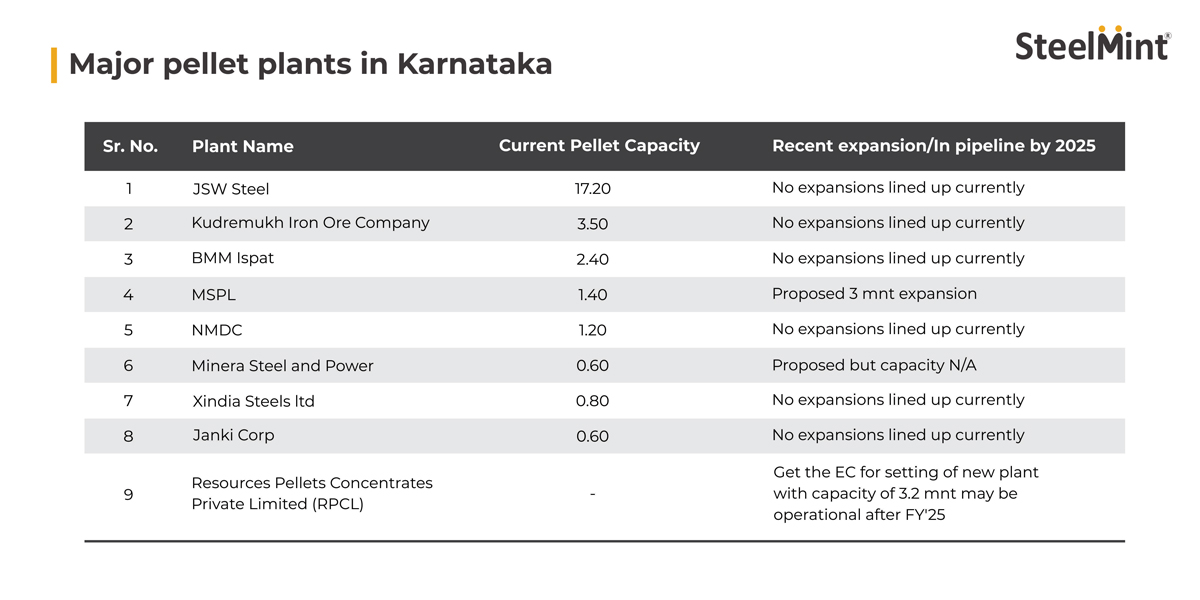

SteelMint data shows that there are a few pellet capacity expansion projects in the pipeline in Karnataka. These are the following:

- MSPL is looking to expand its plant capacity to 3 mnt by 2025 from around 1.4 mnt at present.

- Minera Steel and Power has proposed to raise its pellet capacity. The company’s current capacity is 600,000 t per annum.

- Vedanta Limited has invited expressions of interest (EoI) from competent Indian and international business partners for establishing a 3 mnt per annum pellet plant in the state supported by captive iron ore supply. The Sesa Goa iron ore mine in Karnataka has an operational capacity of 6 mnt/year.

- Resources Pellets Concentrates Private Ltd. has received EC for setting up a 3.2 mnt/year pellet plant, which is expected to start operations after 2025.

- Steel major JSW Steel’s present pellet plant capacity in Vijaynagar is 17.2 mnt. The company increased its capacity by about 8 mnt from 9.2 mnt previously.

Why are pellet capacities increasing?

Rising crude steel capacities to boost pellet usage – In conjunction with rising crude steel capacity in India, DRI (sponge iron) production is growing simultaneously. The country’s DRI output, which was a little under 40 mnt in FY22, is expected to rise to 50 mnt by 2030. Likewise, pellet usage in sponge iron production is increasing fast. The share of pellet-based DRI in India has increased to around 65% against 35% for iron ore lump-based sponge iron. One key reason is that iron ore lump availability and deliveries remain tight, and so sponge players are shifting towards pellets for quicker deliveries.

Lower coke consumption – Use of pellets in blast furnace steelmaking is also gaining traction. This is because increased use of pellets enables permeability in the furnace and seamless gas flow within it, as well as smooth descent of the ferrous burden. This facilitates energy efficiency by way of reduced coke consumption and chemistry control. The primary mills have increased the pellet burden in BF to around 25% at present, which is expected to go up to 30-35% in the coming time, SteelMint estimates. With India’s steelmaking capacity projected to climb to over 250 mnt by 2030 and with production from the BF-BOF route expected to be around 55% of the total at around 140 mnt, pellet usage in primary steelmaking is set to increase.

Benefits over sinter usage – Pelletisation is a cleaner process than sintering with a substantially reduced carbon footprint. With the massive push for decarbonisation and green steel, India’s targeted 300 mnt/year crude steel capacity by 2030 will have to be supported by pellets. Unlike sinter, pellets give mills the flexibility to handle low-grade ore. Higher grade reserves are getting depleted over time, making sintering costly and less environment friendly.

Increased iron ore availability in Karnataka post lifting of mining caps – Karnataka’s iron ore production stood at around 40 mnt in FY22, while total demand is estimated at around 35-38 mnt. India’s Supreme Court has raised the iron ore production ceiling in Karnataka from 35 mnt to 50 mnt from the A and B category mines. The production cap in Bellary has been raised to 35 mnt from 28 mnt, while in Chitradurga the ceiling has been raised to 15 mnt from 7 mnt. Going forward, the production cap may be relaxed further ensuring increased supply of ore for pellet production.

Ease of export restrictions – The Supreme Court has recently lifted curbs on exports of iron ore and pellets from Karnataka and eased restrictions on sales from the districts of Bellary, Chitradurga and Tumkur. This has gone a long way in opening up the market for producers and has given an edge to pellet-makers to enhance capacity in the years to come.

What may happen?

India’s crude steelmaking capacity is projected to increase to around 200 mnt by 2025 from around 150 mnt at present, as per SteelMint estimates. Likewise, iron ore demand is estimated to rise to nearly 250 mnt by 2025 from around 200 mnt at present. Therefore, the prospects of pellet capacity expansion in the short term are bright not just in Karnataka but across the country.

Karnataka Road Show

How is Karnataka’s iron ore and pellet industry shaping up post SC verdict? What is the potential in terms of production, demand, exports, and sales? Are you an industry stakeholder keen to find answers to these and several other queries? Book your seat at SteelMint’s Road Show-cum-Conference on Karnataka’s Mining Sector to be held on 19-23 January, 2023.