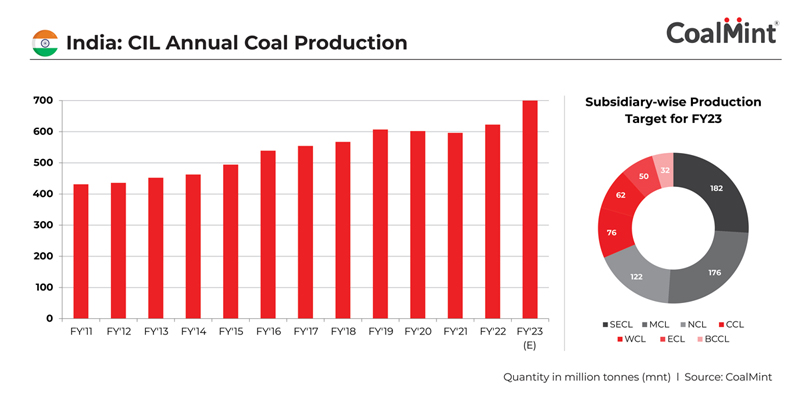

State-run miner Coal India Ltd. (CIL) has attained new highs in terms of coal production. The company breached the 400-million tonnes (mnt) production mark in the quickest time since its inception. The milestone was attained on 24 November of the ongoing fiscal, 31 days ahead compared to 25 December of last year.

During April-November 2022, total production reached 412.6 mnt, up 17% y-o-y. The company is striding towards its target of 700 mnt set for FY23, which will be a new production milestone.

Turning the tides in its favour, the company registered higher sales to keep pace with robust demand which helped it to deliver consolidated profit after tax of INR 14,878 crore in H1FY23 – the highest ever recorded during H1 of any fiscal so far.

With demand for coal showing no signs of slowing down in the near term, the introduction of latest policy reforms is likely to further boost price realisation from coal sales.

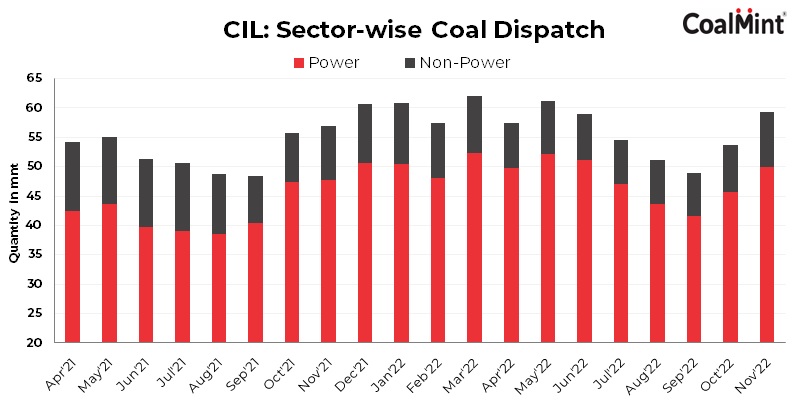

However, despite the increase in production is CIL being able to cater to all segments of coal consumers?

Premium on coal supplies

CIL has decided to charge a premium of 40% over the notified price across the entire range of coal grades supplied under bridge linkage.

This provision refers to temporary coal supply till the time an end-user company commences operations from an allocated coal mine. This price structure is applicable for existing as well future contracts for both power and non-power customers from 1 June, 2022.

Similar facility has been kept for coal supplied under flexi utilisation policy, which was the introduced to transfer coal linkages of one power station to another for reducing the cost of power generation.

However, this revision would be applicable specifically for the thermal power plants lifting coal against this policy that do not have fuel supply agreement (FSA) with individual CIL subsidiaries effective from 22 November, 2022.

Challenges confronting non-power sector

The CIL board has decided not to renew long-term contracts for coal supplies under linkage auctions meant for the non-power sector.

These auctions are held across various tranches for different sub-sectors namely sponge iron, cement, captive power, steel and others. Till date, five tranches of auctions have been successfully conducted.

As per policy guidelines, the tenure of FSA against these auctions was five years, which was initially proposed for extension for another five years upon mutual agreement.

However, the company has informed that the expiring FSA contracts under tranches II and III auctions held during January-November, 2017 would not be renewed beyond five years. Similar instruction was also issued in case of contracts under tranche-I auctions.

The decision has come as a big blow to the non-power customers who are already facing supply tightness amid CIL’s disparity in coal allocation.

In a latest development, CIL has come-up with sixth tranche of auctions starting with sales for sponge iron sector in the first phase from 23 December. It is expected that these auctions would witness aggressive procurement as customers will look to secure fresh supplies against their expiring contracts by placing higher bids for the coal being offered.

The Standard Linkage Committee has decided not to extend nomination-based coal linkage supplies to the thermal power plants that are executed under Letter of Assurance (LOA) route beyond 31 March, 2022.

This indicates that the power producers would now have to secure coal linkages via competitive bidding under various auctions marked under SHAKTI (Scheme to Harness and Allocate Koyla Transparently in India) policy, instead of procuring coal at fixed notified price in the previous regime.

Single window auction

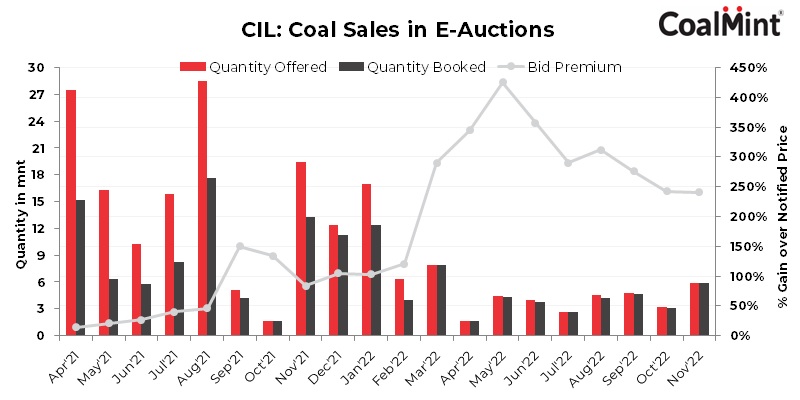

Apart from FSA contracts, CIL’s coal sales via regular auctions has been the bright spot led by the spurt in bid prices as the buyers are aggressively procuring the limited material put up on sale.

This comes after the company’s supply prioritisation for the power sector had resulted in drastic curtailment of material offered at auctions.

The new scheme has ensured a uniform rate for all consumers, thus making the gradual shift from the price discrepancy-based system that was adopted earlier. Besides, it also eliminated the variation seen in allocating coal for sale to different sets of consumers. Wider participation helped CIL to fetch better premiums.

During April-November 2022, sales via auctions garnered a premium of 308% over the average notified price assessed for the allocated coal grades as against 50% recorded in April-November, 2021.

CIL has developed a new scheme for conducting coal sales under the auction route by the introduction of a two-stage bidding process.

The new policy is still under development stage with Eastern Coalfields being the sole subsidiary to have implemented it so far. However, the proceedings of the auction suggest that it will promote competitive bidding amongst the participants for preferential loading points.

2nd Asia Coal Outlook & Trade Summit 2023

CIL has increased production rapidly over the last decade, but is it being able to cater to all segments of coal consumers in India? The non-power sector is facing a supply crunch and buyers don’t have enough material to bid for at CIL auctions. What steps may CIL and the larger policy establishment take to implement import substitution more effectively in India? Sign in for CoalMint’s 2nd Asia Coal Outlook & Trade Summit 2023 to be held in Bangkok, Thailand, on 24-25 April, 2023, where experts will discuss these issues threadbare.