Australia’s Foreign Minister Penny Wong met with her Chinese counterpart Wang Yi in Beijing on 21 December, 2022, as the trading partners seek to stabilise their diplomatic relationship. Wong’s visit is the first by an Australian minister since 2019 and the first formal talks in Beijing since 2018.

It is widely expected that a thaw in the bilateral relationship will have a positive outcome for trade. If market chatter is anything to go by, the possibility of China lifting its informal embargo on a host of Australian exports, most prominently coking coal, is by no means remote.

China had levied an informal ban on its top coal sourcing destination in the latter half of 2020 as tensions escalated between the two trading partners over a series of issues. China was one of the leading coal importers from Australia till 2019 with the latter exporting about 25% of its total coal (both thermal and coking) exports to China.

As relations between the two countries are heard to be improving, speculation is rife that coal trade might resume once again.

China-Australia trade dynamics: how it changed?

Australia accounts for 58% of global seaborne trade in metallurgical coal, while China, the world’s largest steelmaking hub, accounts for 55% of global steel production.

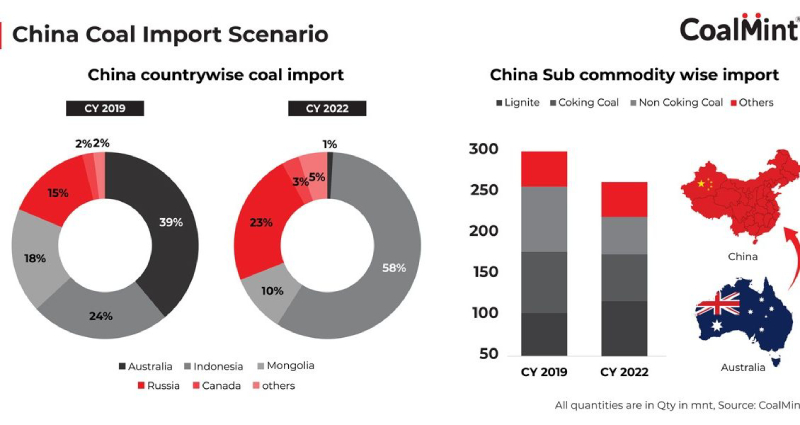

China imported 197 million tonnes (mnt) of coal in 2019 (before the informal ban), of which 40% was imported from Australia. Commodity-wise, Australia’s share in China’s coking coal imports stood at 40%, while for thermal coal it was 60%.

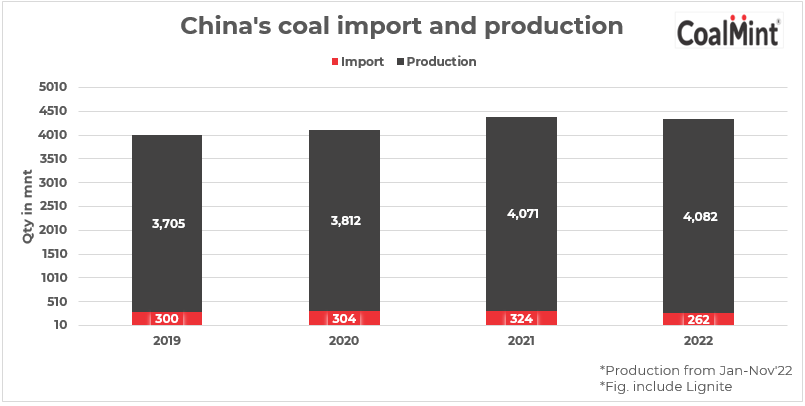

Post 2020, China focused on increasing its domestic coal production. Compared to 2019, China’s domestic coal production jumped 20% to 4,452 mnt in 2022.

While imports continue to arrive in China, the absence of Australian cargoes has been filled by met coal imports from the US, Canada and Russia. For thermal coal, imports from Indonesia, Russia and Colombia increased substantially.

Interestingly, the share of Russian coal in Chinese imports increased noticeably after the Russia-Ukraine war earlier this year and subsequent sanctions imposed by European countries.

Russia’s share in China’s total coal imports have gone up to 22% this year against 10% in 2019 and 12% in 2022. Chinese buyers favour Russian coal for its high quality and low prices.

What might happen if China-Australia trade resumes?

As per CoalMint analysis, even if trade resumes between the two countries the situation is unlikely to revert to what it was in 2019.

This is because the Russia-Ukraine war has changed global coal trade flows. With sanctions on Russia by a majority of western countries and a few Asian ones too, Russian coal is being diverted to China at much cheaper rates.

On the other hand, Australian coal has found favour in key economies such as Europe, Japan, and South Korea. This has resulted in Australian coking and thermal coal prices trending at high levels. Australian thermal coal prices are still elevated by about 24% as against January this year.

While global steel and thermal coal demand remains slow at present due to Covid and recessionary pressure, in the long run if Australian coal miners are hoping for Chinese buyers to make a return to the market, their hopes are likely to be dashed. Given the fact that Australian coal is massively uncompetitive against its rivals coupled with the fact that China is raising its domestic output, it is uncertain whether Australian coal exports to China will resume in a big way.

Asia Coal Trade Summit 2023

Keen to attain insights on Asian coal trade flows and the emerging demand-supply dynamics in the continent? How may China’s coal demand pan out in the near term and what factors are likely to shape met coal trade flows in 2023? Sign in for CoalMint’s Asia Coal Trade Summit to be held at Bangkok, Thailand, in April 2023