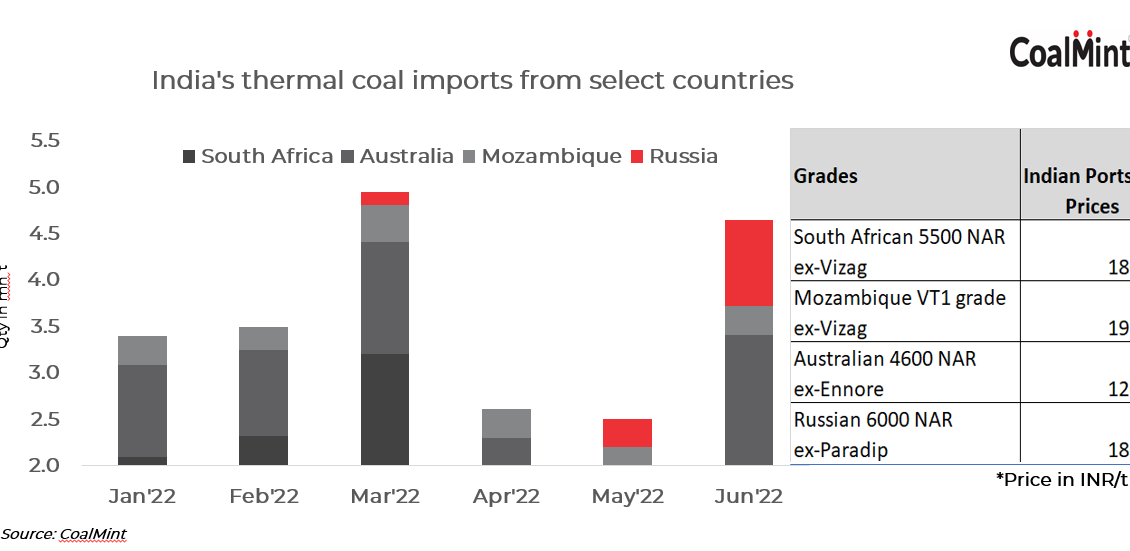

Depressed sponge iron demand in the Indian domestic market, coupled with elevated South African coal prices and limited availability of domestic coal for the non-power sector, has compelled Indian DRI producers to experiment with coal from Mozambique, Russia, and even Australia.

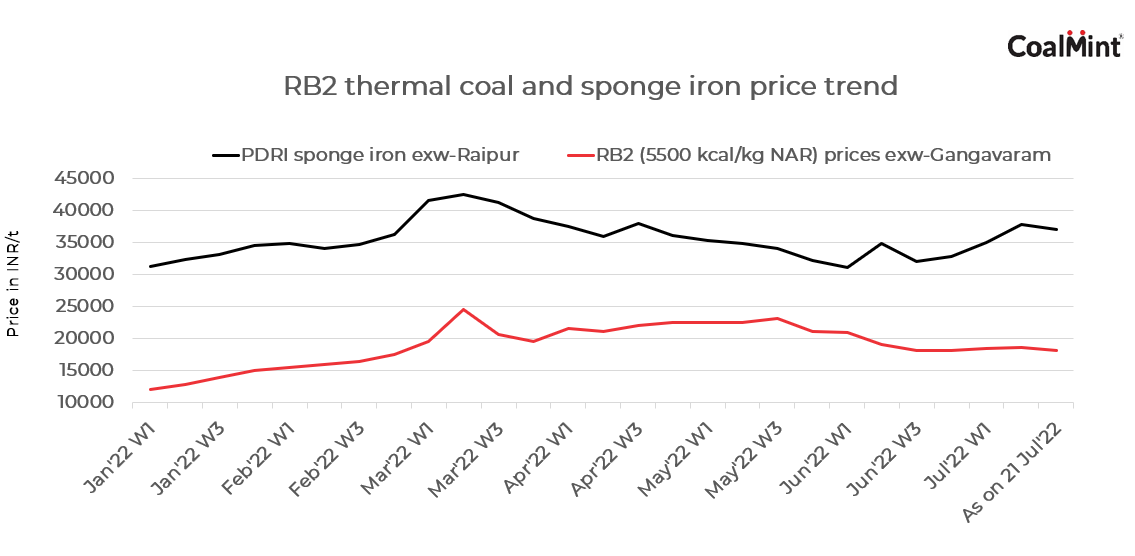

In fact, diversion of high-grade South African coal to Europe have already pushed sponge iron units in India to switch from the most popular RB2 (5500 kcal/kg NAR) grade coal from the country to low-CV RB3 (4800 kcal/kg NAR) since the past few months.

As 4800 NAR has lower fixed carbon content vis-a-vis 5500 NAR, a higher quantity of the former is required to produce one tonne of DRI.

Shrinking margins of DRI producers due to high South African coal prices have compelled them to look for alternate blends. Although sponge iron prices have picked up since the sharp decline following the government’s introduction of an export duty on steel, any major fall in coal prices has remained limited due to elevated global prices.

CoalMint learnt from various mill sources that DRI producers are experimenting with various blends of Russian, Mozambican and Australian coal; any blend that fits the bill should have to be one that helps manufacturers tide over sluggish domestic demand and optimise costs of production that have more than doubled in one year.

Mozambican coal: Steelmaker JSPL, after some initial experiments, has come up with certain findings pertaining to Mozambican VT 1 grade coal (from Vulcan Energy), which is a suitable alternative to South African RB2. About 0.8 t of this coal will be required to produce 1 tonne of sponge iron.

However, some sponge iron producers in Chhattisgarh informed that while Mozambican coal seems a suitable alternative for DRI, it is low in volatile matter as compared to South African coal, which fails to make it an exact replacement for the latter. In fact, a blend of the two might give sponge iron units the desired results, sources informed. Very low-VM coal affects sponge metallisation rate.

Russian coal: High-CV Russian thermal coal that is making its way to India at quite cheaper rates has also attracted the attention of sponge iron manufacturers. Although not used widely, experiments by a few indicate that it has South African RB1 grade coal qualities and its good FC and low sulphur content would make it an ideal choice for sponge producers. However, users are not very sure of the exact results and are of the opinion that a blend of South African and Russian coals could give desired outcomes.

Australian coal: Interestingly, Australian thermal coal, not usually preferred by sponge iron plants because of its very high VM, is now being experimented with by few sponge iron units in south India as they are completely import-dependent.

While Australian thermal coal is not coming into India in huge volumes since the past few months, a reputed importer, having its own mine in Australia, is heard to be bringing 4400-4600 NAR grade coal with low VM and FC, which is being used in a ratio of 70:30 (5500 NAR S. African: 4600 NAR Australian) for one tonne of sponge iron.

Concerns persist

While various blends are a ray of hope for the sponge iron sector, market participants have also highlighted a key concern that these blends make sense against the backdrop of sluggish demand in which plants do not have to function at full capacity and lower yield is expected.

However, it would be interesting to see if any of these coals or blends can give higher yields during a period of buoyant demand. If successful, this could be a game changer for the sector as better realisations coupled with lower cost of production would help producers improve margins in the long run.