- Chattogram, Matarbari to ease congestion, boost scrap imports

- Mills eye production increase to feed additional demand

- Urbanisation, improved global scenario to support mills

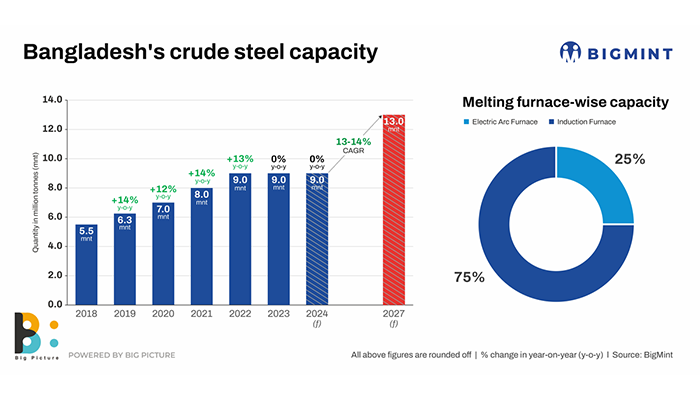

Morning Brief: Bangladesh, a key South Asian country, is set to see an increase in steel demand in the medium-to-long term. Working towards this end, the country’s steel melting capacity is expected to increase by another 3 million tonnes (mnt) or over 40% to 13 (mnt) by 2027 from 9 mnt in CY’24 and crude steel production is seen rising over 35% to 8 mnt from almost 6 mnt in CY’24.

A slew of infrastructure projects is nearing completion while a cache of new ones is likely to be announced, which will contribute 25-30% of steel demand. As a result, the country’s steel consumption is slated to increase 25% to around 10.60 mnt by 2027 from 8.5 mnt in CY’24.

Current steel market overview

Total crude steel production in 2023 was at 4.9 mnt with an utilisation of 60-65% of the 9 mnt capacity. Steel is produced through the electric furnace route with induction furnaces contributing 75% and electric arc furnaces the balance 25%.Current consumption is at 7.6 mntpa and increasing at 10% per annum. Out of the current consumption, 70% is contributed by government projects.

Bangladesh was one of the fastest growing economies in the Asia Pacific last year, with a CAGR of 8.5% over 2019-22.

Expansion plans of key mills

Keeping future steel demand in mind, Bangladesh’s key mills are looking at expansion.

Meghana Group of industries : Meghana is coming up with 1 mnt melting capacity is expected to complete it by FY2025.

Abul Khair to increase melting capacity in 3 years: Abul Khair’s rerolling mills are expected to be completed by FY2025. It is planning to expand melting capacity by FY’27.

Plans are also afoot to set up a 1.6-mnt rebar capacity by March. Thus, a total capacity of 3 mnt in rolling, and 1.6 mnt in crude steel production is in the pipeline.

BSRM: Leading steel producer BSRM has announced plans to increase MS rod capacity by 0.5-0.6 mnt. The current melting capacity is 2.2 mnt, and rolling capacity, at 1.8 mnt. BSRM will add 0.6 mnt rolling capacity in the near future.

It’s notable that other mills like Basundhara, Unitex and Haqeez are expanding their melting capacities, despite the extended completion period to FY27. This reflects the dynamic landscape of the steel industry, with companies strategically positioning themselves for future growth.

Factors that will support increased steel demand

Development of port facilities is being undertaken which will not only raise demand, but also facilitate increase in steel-and raw material-related trade. Development of port facilities will address limitations of existing infrastructure, allow entry of larger vessels, ease imports of scrap and boost trade and economic growth.

These projects cumulatively are expected to increase steel demand by 20-25% over the next three years.

Chattogram Port expansion: Chattogram Port, the premier seaport of Bangladesh, is undergoing significant development and expansion to meet growing import and export needs. The Bay Terminal is the most significant ongoing project, aiming to increase Chattogram Port’s capacity six times. The project involves constructing four terminals to accommodate larger vessels and handle increased cargo. Construction is expected to start in 2024 with partial operation targeted for 2026. Global port operators like PSA Singapore and Dubai-based DP World are expected to invest in the project, bringing in foreign investment and expertise.

Matarbari to ease larger vessel movement: The Matarbari Deep Seaport project is progressing well. The channel construction was completed in November 2023. The foundation stone for the first terminal was laid in the same month. Construction is expected to be completed by December 2026.

Once operational, Matarbari will allow the entry of larger vessels, facilitate easier imports of bulk cargo, and reduce congestion at Chittagong Port. The project is expected to attract new investments in steel and other industries due to improved import capabilities.

Patenga Terminal to reduce congestion: This newly-built terminal, inaugurated in 2023, aims to reduce congestion at existing facilities with a capacity to handle 2.5 million TEUs of containers annually. The terminal is expected to facilitate faster cargo handling and improve overall port efficiency.

Expansion of existing terminals: Existing terminals like Chittagong Container Terminal (CCT) are also undergoing expansion and modernization. Projects include upgrading equipment, increasing yard space, and improving automation to handle larger cargo volumes.

Focus on technology & efficiency: The Chattogram Port Authority (CPA) is focusing on implementing digital solutions to improve efficiency and transparency in port operations. This includes initiatives like online cargo tracking, paperless documentation, and automated gate systems. Such advancements will increase ease of doing business.

Other infra projects near completion: The Metro Rail and Dhaka Airport expansion projects are ongoing. The former, slated for completion this year, has seen cost and time overruns and may see closure in 2025. The latter will likely see completion of its third terminal by April 2024.

Scrap import scenario

Since there are no iron ore mines in Bangladesh, it is solely dependent on imported scrap for producing steel and has emerged as a key price setter in the seaborne scrap trade, along with Turkiye.

The volume of imported ferrous scrap (both bulk and container) into Bangladesh stood at 4.68 mnt in 2023, down 10% against 5.2 mnt in 2022. The country is lately also exploring newer supplier geographies in containers that include Singapore, Malaysia, and Hong Kong.

Bangladesh is the second largest destination for ship dismantling in the world and is coming up with four Green ship recycling yards, underscoring that it is active in domestic scrap generation which is at around 0.3 mntpa.

Current challenges

The country is currently battling some challenges in the post-Covid and war era.

Inflation: The average inflation rate of 9.5% in 2023 was the highest in a decade. Rising interest rates have also stymied purchasing power and steel demand at present.

LC constraints: Interest rates have increased in LC issuance, hampering scrap imports. The deposit required for LC approvals has also increased to 20% from the earlier 10%. Forex issues/remittance have dropped in the last two years. FY’21 saw the highest remittance flow at $24.77 billion but which dropped 18% in FY’22, rising slightly by 2.75% in FY’23.

Outlook

Growing urbanisation will see new project announcements by 2027, which will increase steel demand. Improved infrastructure and a global trade environment may also stabilise forex reserves and create room for better economic opportunities.

4th Bangladesh International Trade Summit

Bangladesh, a strategically significant country for Asia-Pacific, is emerging as a hotspot of growth through sustainable practices. The economic expansion is expected to encourage the participation of more global companies and attract forex for the country.

BigMint Events will be hosting the 4th Bangladesh International Trade Summit on 14-15 May 2024,at Hotel Pan Pacific Sonargaon, Dhaka, Bangladesh. The two-day conference shall bring together key stakeholders from the steel, cement, and power industries, including industry stalwarts,policymakers, traders, and investors. It shall provide a network for collaboration and an ideal platform for discussion of prevailing industry trends and challenges.