The Odisha government has called to start afresh the process of mineral block auctions on 06 Dec’19 and it is expected to restore sanity in the system of online bidding. Moreover, the revised tender rules are set to promote equal competition for all iron ore and manganese blocks on offer as opposed to frenetic bidding for a single coveted block.

The state government has also inserted some additional conditions in the tenders for the expiring merchant mine leases. A successful bidder, after obtaining all statutory clearances, needs to produce in the first two years at least 80% of what the mine actually produced in the preceding two years.

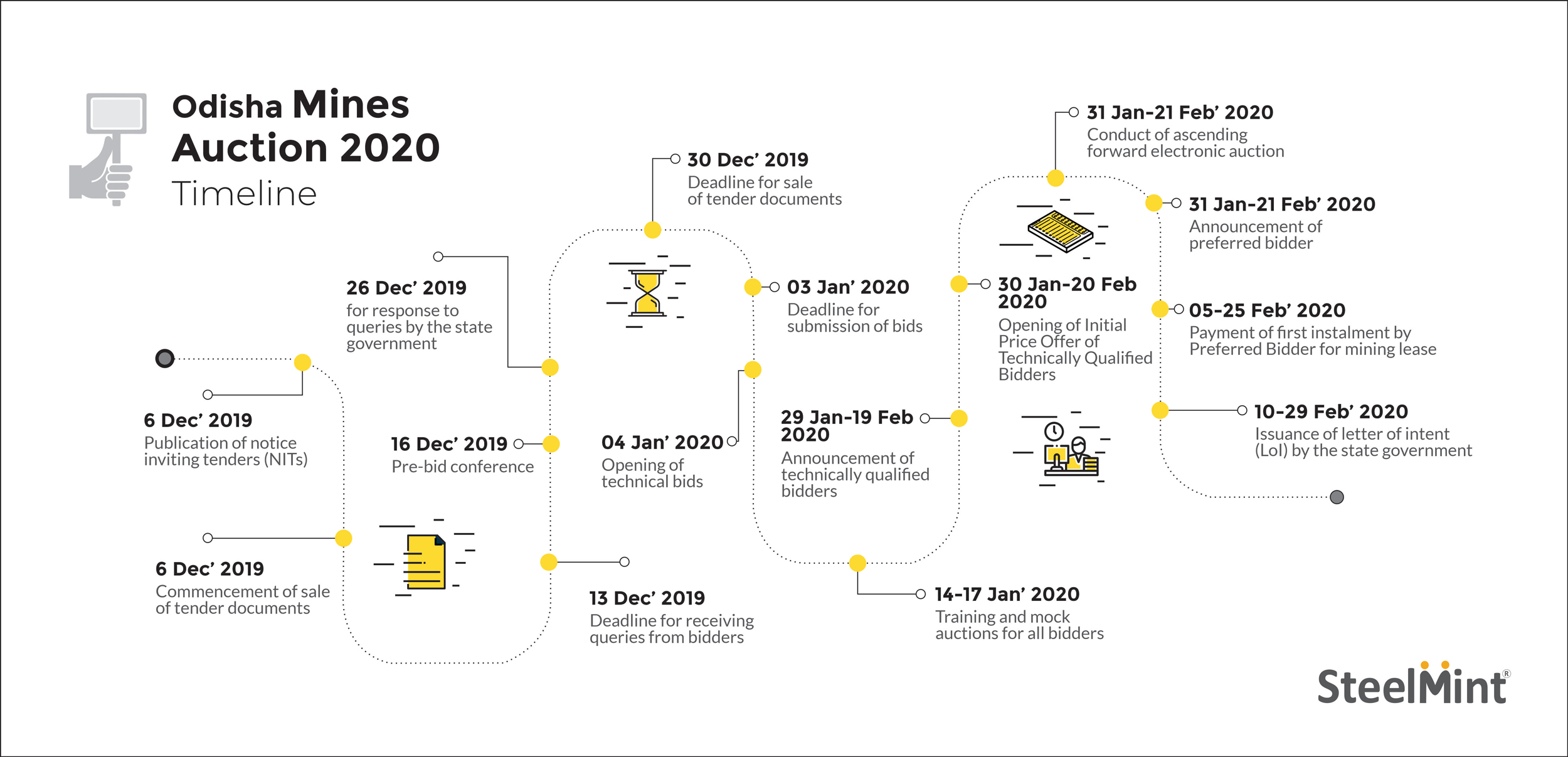

Here is the timeline for Odisha mine auctions –

Breakdown of 20 mining blocks notified for auctions

A. Iron ore mines reserved for captive use

| Mine | Present lessee | Area (in ha) |

Resources (in MnT) |

Mine capacity (in MnT/annum) |

|---|---|---|---|---|

| Thakurani | Kaypee Enterprises | 228.04 | 180 | 5.5 |

| Gonua | P K Ahluwalia | 86.88 | 119.2 | 0.36 |

| Narayanposi | AMTC | 349.25 | 190.6 – Iron Ore, 0.05- Manganese | 6 |

| Jaribahal | Patnaik Minerals | 106.53 | 8.15 | 0.9 |

| Tanto, Roida-II | K N Ram & Company | 74.86 | 29.38 | 2.2 |

B. Blocks set aside for merchant miners

| Mine | Present lessee | Area (in ha) |

Resources (in MnT) |

| Nuagaon | KJS Ahluwalia | 767.28 | 792.93 |

| Siljora-Kalimati | ML Rungta | 715.63 | 4.02- Mn, 0.72- Iron |

| Jiling | Essel Mining | 456.1 | 79.12 |

| Jurudi | Kalinga Mining | 73.22 | 4.79 |

| Mahulsukha | AMTC | 399.83 | 32.81- Iron, 0.77- Mn |

| Gorumahisani | GS Mishra | 349.5 | 18.4 |

| Badampahar | Lal Traders | 129.61 | 6.16 |

| Jajang | Rungta Mines | 666.15 | 58.5 |

| Katasahi | Rungta Mines | 196.86 | 0.66 (Mn) |

| KanthorKoira | Rungta Mines | 73.65 | 0.06 (Mn) |

| Nadidihi | BICCO | 73.85 | 27.04 |

| Nadidihi | Feegrade | 121.4 | 23.69- Iron, 0.05- Mn |

| Teherai | BICCO | 137.46 | 11.52- Iron, 0.07- Mn |

| Kolomong | Rungta Mines | 218.53 | 1.39- Iron, 3.73- Mn |

| Balda | Serajuddin | 335.59 | 210.17 |

Will India See a Major Iron Ore Disruption?

To learn how the mines auction 2020 unfolds, be a part of SteelMint Events’ 4th Indian Iron ore, Pellet and DRI Summit‘ which is scheduled on 2-3 March 2020, in Hotel LaLiT, New Delhi.