Mr. Tao Jiangshan, deputy secretary general of China Association of Metalscrap Utilization (CAMU) – DRI Working Committee, has been engaged in DRI production and consultation for 23 years. Mr. Jiangshan set up Tianjin Overworld Technology Consulting Co Ltd and also worked at Tianjin Pipe Group, in charge of technical and process work and head of new project. His early days were at pellet plant of Minmetals Luzhong Metallurgical Mining where he got familiar with the DRI process. He was also chief editor of China CCM.com taking care of information on steel raw materials and compilation of field reports.

Mr Jiangshan graduated from China Central South University, majoring in pellet/sinter DRI of mineral processing department. Here are excerpts from an e-mailed interview

Q: What is CAMU’s forecast for steel scrap usage in Chinese domestic steel mills in 2019 versus actual use in 2018?

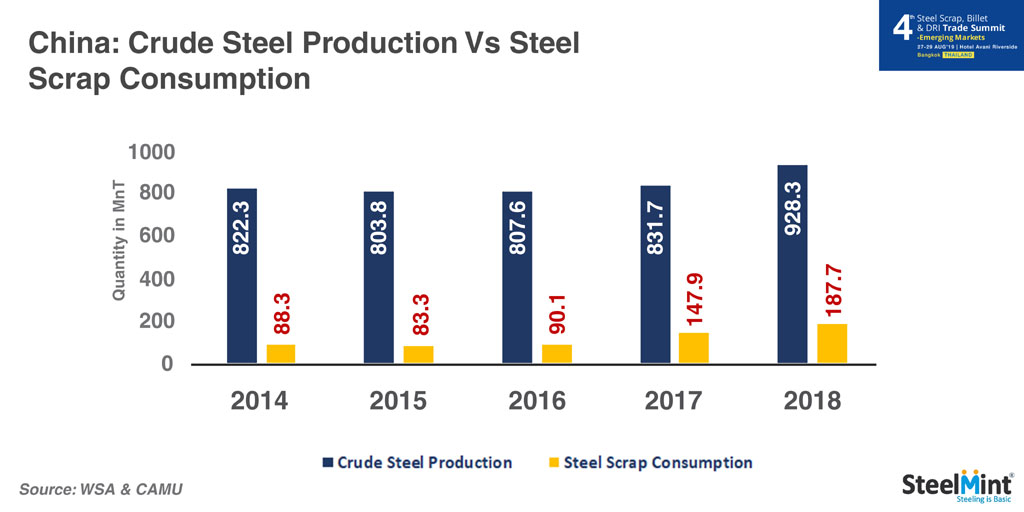

A: The quantity of scrap steel usable in the market will be more and more, scaling up by 10 million tons each year, while crude steel output will shrink. Secondly, steel mills will have more incentive to use scrap steels and the proportion of scrap will be higher. Thirdly, short route smelting will take up more proportion and the scrap ratio in EAF smelting as well we EAF steel ratio in output of crude steel will be higher. These three points highlight the optimistic trend in the course of scrap steel utilization and a promising future.

Q: What is CAMU’s forecast for scrap generation in China in 2019 versus 2018 actual generation?

A: The usable steel scrap in the market will become more and increase at pace of 10 million tonnes each year. The output of steel scrap in 2018 was 220 million tonnes and is expected to reach 230 million tonnes in 2019.

Q: Will China have enough scrap to export? What is your forecast on steel scrap exports both near term and long term?

A: Given that the fast increase in EAF steel output in recent years, coupled with gradual consumption by blast furnaces, the scraps are expected to be mainly consumed by domestic mills.

Q: What are the government policies or incentives coming up that could encourage the setting up of more electric arc furnaces?

A: By way of environmental protection and production limit as well as phase-out of outdated capacity, China’s government is taking the policy leverage to encourage legitimate steel mills to set up new EAF mills through capacity replacement.

Q: What is the current price of steel scrap in China and what is the average price likely to be this year? At this price is it cheaper to produce steel via electric arc furnace than blast furnace?

A: The average price of HMS1 during Jan-Mar 2019 was at RMB2,320/ton while HMS2 at RMB 2,120. In China, the production cost by blast furnace is more economical.

Q: Going forward, what is your outlook for steel scrap industry in China and the world?

A: With the further deepening of structural de-capacity on supply side, steel mills especially scrap processing enterprises are set to embrace promising opportunities.

The “Green Industry Development Plan (2016-2020)” issued by The Ministry of Industry and Information Technology proposed that “by year 2020, the utilization of scraps recycled will reach 150 million tonnes” and this target will most probably be met in this October.

And the provision “by year 2025, steel made of scrap should account for 30% of the total” proposed in “Steel Industry Adjustment Policy” is also achievable. “The 13th five-year plan for Steel Scrap” enacted by CAMU has proposed that by year 2020, the steel made of scrap will take up 20% of total output, which doubled the target as proposed in “the 12th five-year plan” and is achievable before this year end. All those achievements have signaled that an era of mass utilization of steel scrap has come.

To know more on China’s rising scrap generation, consumption and growth of EAF in steel making, be a part of 4th Steel Scrap, Billet & DRI Trade Summit in Bangkok, Thailand, to be held from 27-29th August 2019.

~ Inputs from Ruchira Singh with the help of Arthur Li