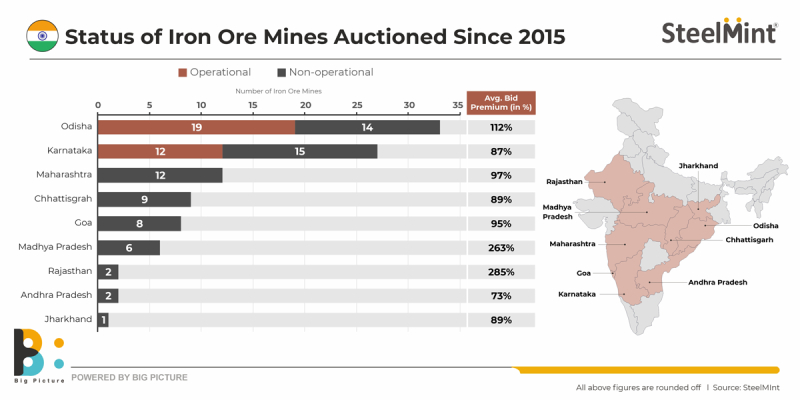

- Over 60% of auctioned blocks in Odisha, Karnataka since the MMDR Amendment Act, 2015

- Average auction premium at over 100%

- Production to increase as many auctioned mines may come onstream

Around 100 iron ore mine blocks have been successfully auctioned in India since the historic amendment of the Mines and Minerals Development & Regulation Act (MMDR Act) in 2015, as per SteelMint data.

MMDR Amendment: Key facts

The landmark MMDR Amendment Act, 2015 paved the way for the introduction of the auctions regime in India’s mining and minerals sector by replacing the older first-come-first-serve system in a bid to ensure transparency in allocation of mineral blocs.

The reforms undertaken in 2015 have resulted in successful auctions of 273 mineral blocks in different states of the country since 2016. Importantly, the pace of mineral auctions has quickened since the MMDR Amendment Act of 2021, with around 105 iron ore blocks getting auctioned in FY’23.

This has been possible due to radical reforms in the 2021 Amendment such as the abolition of the ‘end-use’ restriction for auctions and uninterrupted transfer of valid old environmental clearances to the preferred bidder.

It bears recall that the 2015 MMDR amendment had set forth specific clauses as regards renewal of mine leases. While merchant mines had their leases extended till 2020, the captive iron ore mines were given a timeline till 2030 after which those mines must come under the auction hammer.

In order to augment domestic iron ore supplies, Section 8(A) of MMDR Act was further amended allowing any lessee of a captive mine to sell minerals up to 50% of the total mineral produced in a year after meeting the requirement of the end-use plant linked with the mine. This, however, would require an additional amount to be paid to the concerned state government.

Similarly, government companies or corporations whose mining leases have been extended after the commencement of the MMDR Amendment Act, 2015, shall also pay such additional amount for the mineral produced after the commencement of MMDR Amendment Act, 2021.

The additional amount for extension of mining leases is 1.5 times the prevailing rate of royalty for iron ore mines.

Auctioned blocks

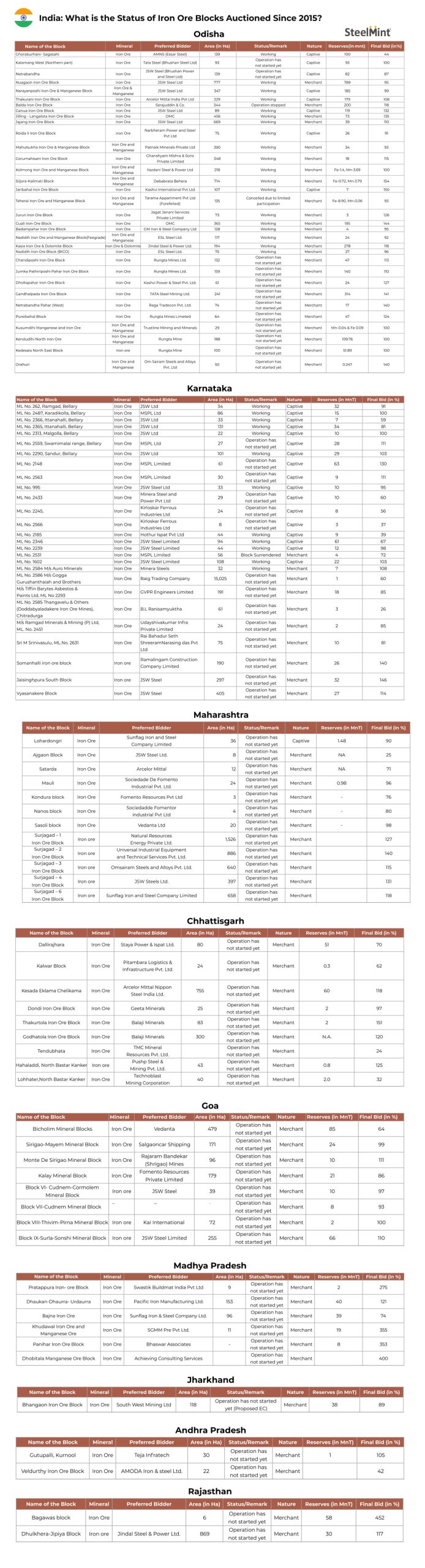

Notably, out of the 100 iron ore blocks auctioned thus far, 33 are in Odisha and 27 in Karnataka – India’s leading iron ore producing states. Among the other key producers, 12 blocks are in Chhattisgarh, 9 in Maharashtra and 8 in Goa.

Details of auctioned blocks

There are blocks in Madhya Pradesh and Andhra Pradesh, too. However, major iron ore-producing-state Jharkhand has just one block. A lion’s share of that state’s iron ore production is accounted for by captive steel producers.

In an indicator of over-enthusiastic participation in iron ore auctions – mainly by steel players eager to secure long-term supplies in view of surge in capacity – the general average auction premium quoted stands at over 100%, as per SteelMint estimation.

Outlook

India’s iron ore production in FY’23 inched towards 260 million tonnes (mnt). Out of the auctioned blocks, just over 30-odd are in working status which shows that many more mines – especially those auctioned since 2021 – will move towards operationalisation sooner rather than later.

Therefore, SteelMint’s outlook is positive as regards iron ore production even as domestic steelmaking capacity gathers pace.

What are the key government policies that may reshape the Indian minerals industry and how long might high premiums sustain for mineral block auctions? Gain cutting-edge insights from experts on these issues and much more at SteelMint Events’ flagship 6th Indian Iron Ore & Pellet Summit to be held from 24-26 August at JW Marriot, Kolkata.