About the Conference

CoalMint’s Asia Coal Outlook & Trade Summit will focus not only on the day-to-day dynamics of the global coal market but the underlying trends that could make a long-term impact. From the impact of geopolitical conflicts and altered trade dynamics to sustainability paradigms and the upheavals in the world energy market, the conference will witness engaging discussions on the topics which are at the core of the energy transition. Delegates can look forward to informative sessions on disruptive mining technologies, hedging and risk management, the evolution of carbon trading and its significance and the impact of decarbonisation on the mining and shipping industries. The focus, as always, will be on intense knowledge sharing and interpersonal interaction.

The ‘Asian Century’

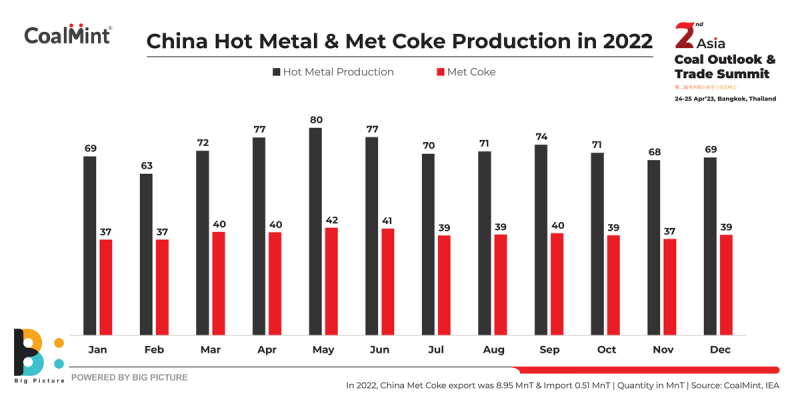

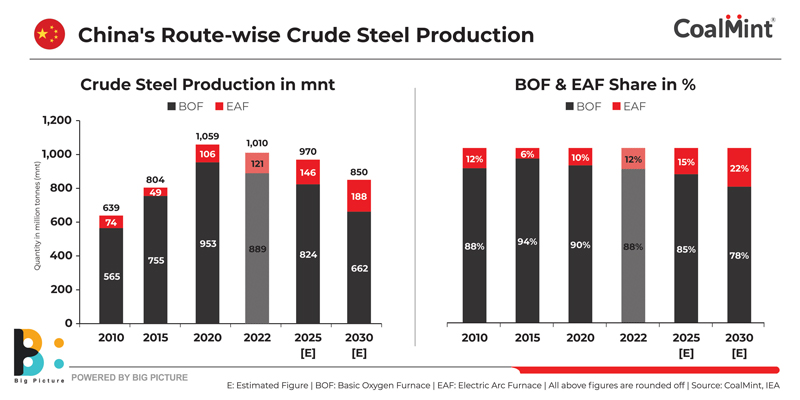

The Asian Development Bank (ADB) forecasts the continent’s growth at 5.3% in 2023. Is it possible to imagine that growth sans coal? For Asian coal consumers, the challenge is to ensure energy security while conforming to sustainability paradigms. The future of metallurgical coal and coke also revolves around Asia, the epicentre of global steel production.

Why Asia

|

|

Esteemed Speakers

Mr. Frank Zhong

Chief Representative, Beijing Office

World Steel Association, China

Mr. Simon Nicholas

Lead Energy Finance Analyst

Institute for Energy Economics & Financial Analysis (IEEFA), Australia

Mr. Yoshinobu Kusano

Executive Advisor

Renova Inc. , Japan

Mr. Hendra Sinadia

Executive Director

Indonesian Coal Mining Association, Indonesia

Mr. Zoljargal Jargalsaikhan

Executive Director, Mongolian Coal Association, Mongolia

Mr. Riza Suarga

Chairman

Indonesia Carbon Trade Association,

Indonesia

Mr. Satyendra Nath Tiwary

Ex-Director (Marketing) & Sr. Advisor, Coal India Limited, India

Mr. Sanjiv Bhargava

CEO

Bulk Marine Limited, Hong Kong

Mr. Rajat Handa

Vice President – International Trade

Agarwal Coal Corporation Singapore Pvt. Ltd, Singapore

Mr. Prabaharan Gopalan

Expert Associate Partner

McKinsey & Company

Indonesia

Mr. Yang Lu

General Manager & Executive Director

China Risun Group Co. Ltd., China

Mr. Tiankuo Jiang

Trader

Century Commodities Solution

Singapore

Mr. Sabyasachi Mishra

Business Head

JSW International Tradecorp, Singapore

Mr. Jiyuan Wang

Marketing Manager

Shaangu Group, China

Ms. Ashima Tyagi

Economics Associate Director – Pricing and Purchasing

S&P Global Market Intelligence, Singapore

Mr. Wilson Wirawan

Maritime Analyst, Dry Bulk Team Lead,

BRS Shipbrokers, Singapore

Mr. Kshitij Saxena

Virema Impex Group, Indonesia

Captain Ravi Shukla

General Manager

Bulk Marine Limited, Hong Kong

Ms. Olga Gyarkina

Consultant

Far East Asia Consulting Ltd.

Hong Kong

Key Focus Areas

Key Discussion Points

Coking Coal

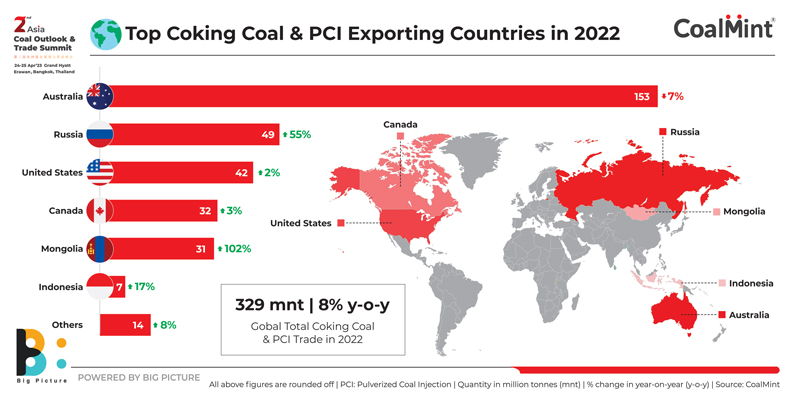

- China’s top coal supplier Mongolia switches to Auctions. How will this impact Chinese Coking Coal market?

- How are global steel mills changing their fuel mix to tackle carbon emissions?

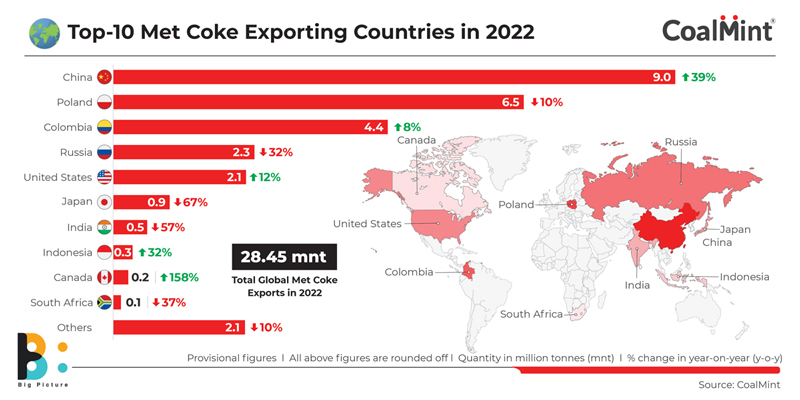

- How will Global Coking Coal and Met Coke Trade Dynamics Play Out in 2023?

- Low Carbon Transition of the Global Steel Industry

- Is Indonesia going to be the world’s largest met coke exporter by 2025?

Non-Coking Coal

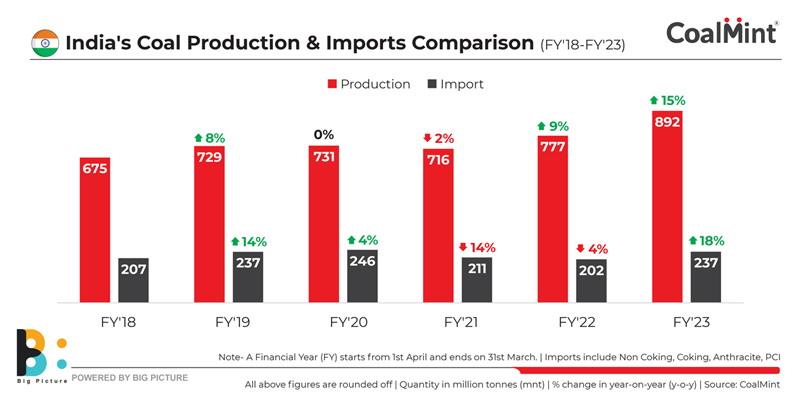

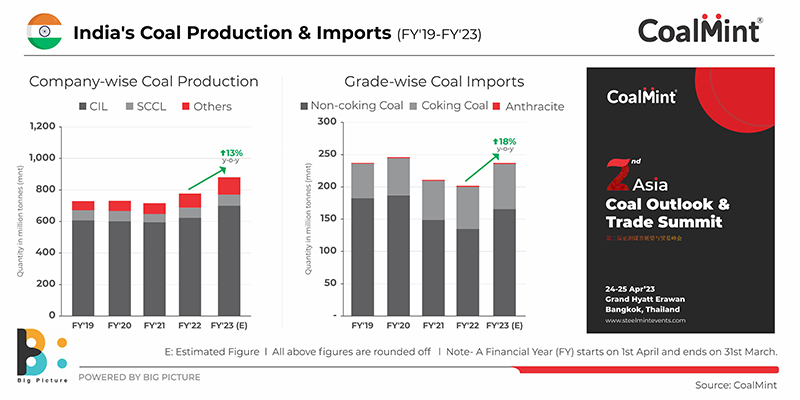

- As India’s Domestic Coal Production Increases, Will India’s Coal Imports Decrease In Short To Medium Term?

- Changing dynamics of Indonesian coal exports

- How is coal demand panning out in emerging markets such as Vietnam, Thailand, Pakistan & Bangladesh

- Sanctions on Russia and its pivot towards the East

Pricing Picture

- Price outlook for non-coking and coking coal markets in short to medium term

- Effective hedging strategies to mitigate price risk

Future Trends

- What are carbon markets and why are they important?

- Disruptive mining technologies and decarbonisation in mining

- Increasing usage of biomass in Japan’s coal-based power plants

Shipping & Freights

- Have dry bulk freight rates bottomed out? Predictive analysis

- Climate change – Challenge for Shipping

Media Partner