About Conference

- With a steel demand of roughly 2.5 mn t pa, Nepal has been focusing a lot on reconstruction. The country’s construction sector is said to contribute 10-11% in its GDP.

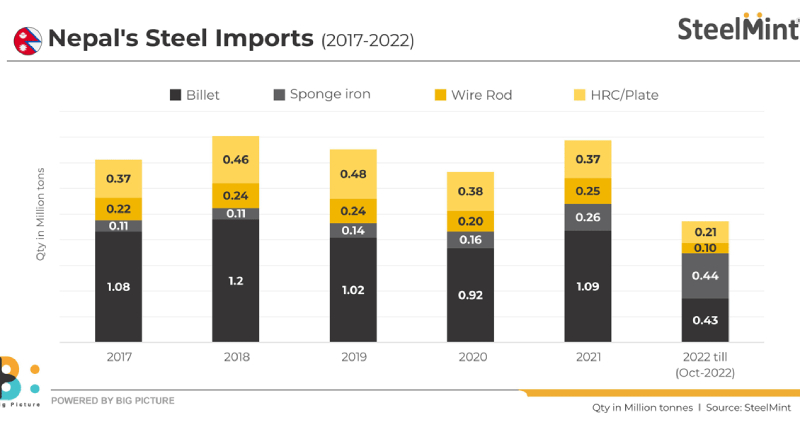

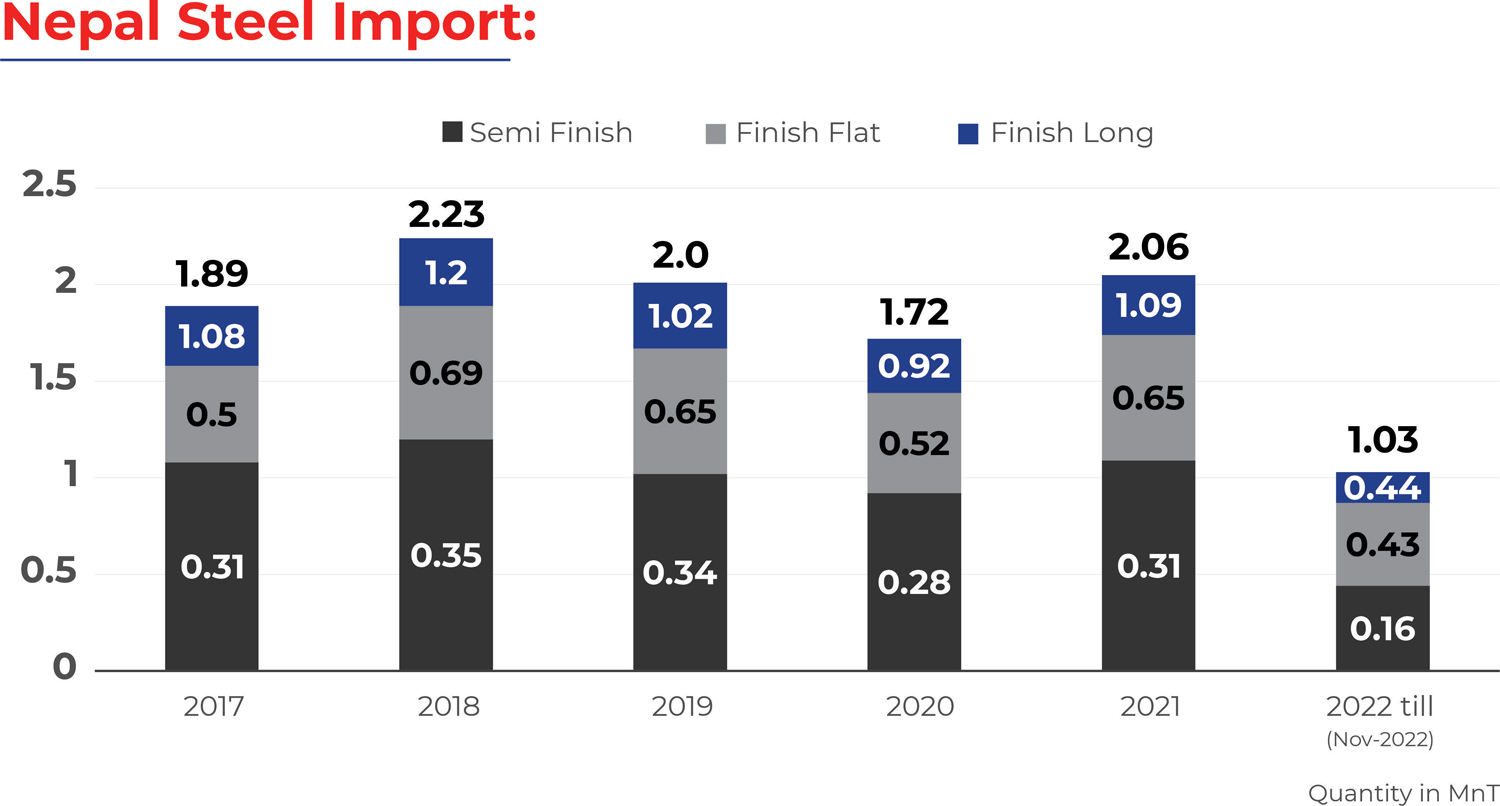

- Nepal imports nearly 1-1.5 mn t semi-finished steel and 1 mn t finished steel annually (both flats and longs) with India being the largest supplier with a share of ~95%.

- With upcoming infrastructure and power transmission & distribution projects and the recent budget by the Government of Nepal (GoN) targets to reduce reliance on imports by 20% in the next fiscal year steel demand in the country is likely to gain momentum.

- The government’s policy of encouraging the iron rod industry to produce billets within the country itself has lead to a total of NPR 8.44 billion is being invested in a new steel industry as well as in the few mills that are currently operational.

- About ~32 iron rod and steel units are operational in the country. However, only around 20% of these have been producing billets in the country using sponge iron and scrap.

- The total annual capacity of the existing industry is about 3.5-4.0 million tonnes per annum and the annual steel demand is about 2-2.5 million tonnes.

- According to Nepal Cement Producers’ Association, the Himalayan nation has the potential of exporting cement worth NRs.150 billion.

- Subsidy of 8 per cent in cash to companies exporting cement using Nepali raw materials.

Why Nepal?

- 4.2% GDP growth

- 30 Million Population

- Sponge Iron import up by 120%, likely to cross 5,00,000 t in CY’22

- Pig Iron imports crossed 47,000 t in CY’22

- 1 MnT of Billet Imports annually

- 1 MnT of Finished Steel Imports annually

- 5 MnT of Steel Melting capacity by 2025

- 22 MnT annual cement production capacity.

- ~77% of India’s total coal export goes to Nepal

Key Focus Areas

- To gauge the current scenario of Nepal’s steel industry – Macro & Micro overview

- Key government policies impacting the industries.

- Sponge iron future outlook for CY’23, will the import cross 1-mnt mark by CY’23

- Cement industry at Nepal – Exploring the Opportunities

- Rising importance of quality steel production through IF route.

- Current challenges faced by the Steel industries

- Backward integration — a way to manage margins?

- Nepal coal import overview, opportunities & challenges.

Session Overview

- Opening Address : Government policies and their impact on Nepal’s economy

- Changing dynamics of global steel markets

- Outlook on Nepalese steel and cement industries

- Raw material sourcing options for Nepalese steel and cement industries

- Price outlook on key steelmaking raw materials

- Technical Session: The right mix of feedstock in steel melting from Nepal’s perspective

- Technical Session: Focus on steel melting technologies & improving efficiencies

Platinum Partner

Gold Partners

Silver Partner

Supporting Partners

Speakers

Madhu Kumar Marasini

Secretary, Ministry of Industry, Commerce & Supplies, Nepal

Pradeep Kumar Shrestha

Managing Director,

Panchakanya Group, Nepal

Rabi Singh

President, Federation of contractor’s Associations of Nepal

Dhruba Thapa

President Cement Manufacturers Association, Nepal

Rajendra Malla

Chairman, Nepal Chamber of Commerce

Vishnu Kumar Agrawal

President, Confederation of Nepalese Industry

Abhijeet Mahanta

Director, Sales and Business Development

Atlas Commodities,UK

Anurag Sharma

Director & Business Head (Steel)

Jagdamba Steels Ltd. (Nepal)

Dr. Swaren Bedarkar

VP (Projects Metallurgy)

Electrotherm (India) Ltd.

Satadri Chanda

Director,

Megatherm Group, India

Abhishek Tulsian

Director

Ashok Steel Industries (PRIVATE) LTD, Nepal

Vishal Patwari

Executive Director

Jagdamba Enterprises Pvt Ltd, Nepal

Rajesh Kumar Agrawal

Managing Director – Arghakhanchi Cement Pvt.Ltd., Nepal

Dhruv Jeewani

Director/Head Sales

Jeewani Fuels Private Limited

Ujjawal Shrestha

Executive Director – Panchakanya Group, Nepal

Rohit Kedia

Director, Vijay Shri Steel Private Limited, Nepal

Himanshu Golchha

Director, Hulas Steel Industries, Nepal

Hemanshu Desai

CEO, New India Electricals, India

Barbara Luck-Pithavalla

Managing Director, Cyrus Vibration Machines India Private Limited

Varun Jay Rana

COO, YOGIJI DIGI, India

Ramesh Datta

Chief Representative – India, Macsteel International Far East Limited

Subhendu Khandai

General Manager (International Trade Division), SAIL, India

Sunil Pandita

Assistant General Manager, Inductotherm (India) Pvt. Ltd

Abhijit Sur Roy Chowdhury

Head – Iron Ore Trading (Minerals)

Tata International Limited, India

M.K.Sheshadri

Plant Head – Giridhan Metals Pvt. Ltd