The global ship-breaking or ship recycling industry has witnessed a major shift in recent years owing to environment concerns. On one hand, ship-breaking is a green process wherein a ship at the end of its life cycle is dismantled for further re-use. On the other hand, it is a complex process of dismantling that includes issues like workers’ safety and health aspects and further challenges to the environment.

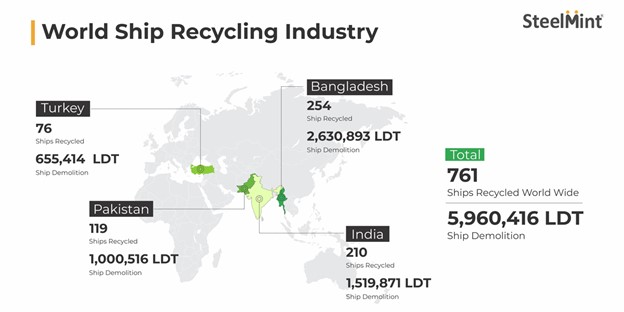

However, the ship recycling market is gaining momentum annually. A total of 761 ships were broken worldwide in CY2021 against 631 in CY2020, out of which 583 were sold to the beaches in South Asia – the world’s largest ship recycling hub in 2021.

There has been a noticeable improvement in ship-breaking volumes in 2021. Lockdown restrictions had pulled down import volumes in 2020. Diversion of oxygen for medical purposes also impacted volumes.

Ships can be classified into six broad categories like general cargo, bulk carriers, oils tankers, passengers ships, drill and war ships. The approximate age or lifespan of a ship is 25-30 years.

South Asia recycling market

South Asia has been referred to as the “World’s ship scrapping yard”, with India, Bangladesh and Pakistan collectively dismantling and processing scrapped vessels globally. India, Pakistan and Bangladesh together accounted over 80% share of the global ship recycling market in 2021.

- India: India, with its natural geographical advantage, recycled 210 ships and demolished 1,519,871 LDT in 2021 as against 203 ships, amounting to 1,757,983 LDT, in the previous year. Similarly, the country demolished 770,000 LDT in H1CY2022 at Alang Port.

- Bangladesh: Bangladesh recycled 254 ships amounting to 2,630,893 LDT in 2021 compared to 1,843,442 LDT and 144 recycled ships in 2020. In H1CY2022 the country demolished 760,000 LDT of ships at Chittagong Port.

- Pakistan: Pakistani players recycled 119 ships with a collective tonnage of 1,000,516 LDT in 2021 compared to 778,256 LDT and 99 recycled ships in 2020. In H1CY22 the country demolished 380,000 LDT of ships at Gadani Port.

Price trends

- India’s ship-breaking import prices jumped to $525/LDT in 2021 as compared to $360/LDT in 2020, significantly up by $165/LDT.

- Pakistan’s ship-breaking import prices surged to $544/LDT in 2021 as against $364/LDT in 2020, significantly up by $180/LDT.

- Likewise, Bangladesh’s ship-breaking import prices rose to $552/LDT in 2021 in contrast to $361/LDT in 2020, significantly up by $191/LDT.

The average material recovery depends upon the type of material extracted from the ship. Re-rollable ferrous scrap recovery is 67%, meltable ferrous scrap around 12% whereas cast iron is 4% and non-ferrous scrap, 1%.

HKC and green recycling

Considering the hazardous nature of the industry, one key obstacle is that there is no fixed legislation to follow. The Hong Kong International Convention for the Safe and Environmentally Sound Recycling of Ships was adopted at a diplomatic conference held in Hong Kong in 2009.

The convention was adopted to ensure that ships, when being recycled after reaching the end of their functioning lives, do not create any unnecessary hazards to human health, safety and to the environment.

South Asian countries have decided to ratify and implement the Hong Kong Convention. Towards that, the relevant ministries have drafted regulations to make the ship recycling industry safe for their workers and the environment by implementing the Hong Kong Convention (HKC).

Outlook

Amid the current scenario, availability of vessels is limited and prices remain steady due to sluggish economies and low steel demand from end-user industries. As a result, market sentiments are gloomy and buyers cautious.

But ship-breaking volumes may increase in the short term due to favourable weather conditions which will support increased construction activities. It may be mentioned, a major portion of ship-recycled scrap finds its way into the construction sector.

SteelMint Events will be hosting the 3rd Steel & Raw Material Conference, Emerging Bangladesh, on 20-21 September, 2022 at Hotel Radisson Blu, Chittagong, Bangladesh. The conference will explore key issues like the country’s steel production and demand outlook, global scrap trade flow changes, especially post-the Russia-Ukraine war, the ship recycling scenario, key emerging sectors, price trends and a lot more.