Turkiye is one of the largest ferrous scrap importing countries in the world. Other key industries that contribute to the country’s economy include textiles, chemicals, cement, motor vehicles and construction. The country provides certain leverages for international trading and is a key destination for trade between Europe and Asia.

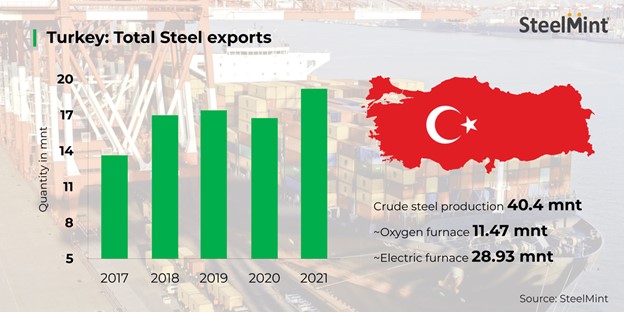

Turkiye produced 40.4 million tonnes (mnt) of crude steel in CY 2021 out of which 11.47 mnt i.e. 28.4% was churned out from oxygen furnace (BOF) and 28.93 mnt i.e. 71.6% was produced from electric arc furnace (EAF), as per World Steel Association (WSA) report. Higher crude steel output resulted in increased scrap consumption.

- Pig iron imports up: Turkiye’s pig iron imports stood at 1.2 mnt in 2021 vis-à-vis 1.14 mnt in the corresponding period last year (CPLY), up slightly by 5.3% y-o-y. The country’s entire consumption in 2021 was 11.6 mnt.

- Steel exports see 15% rise: Total finished steel exports from Turkiye jumped 15% to 19.2 mnt in 2021 compared to 16.75 mnt in 2020.

Also, according to the Turkish Automotive Manufacturers’ Association (OSD), total car production in CY21 stood at 1,276,140 units wherein exports amounted to 937,005 units, marking an increase of 2% as compared to 916,538 units in CY20.

Turkiye’s scrap market in 2021

- Ferrous scrap import shipments increase: Turkiye recorded ferrous scrap imports at 24.37 mnt in 2021, an increase of 10% against 22.18 mnt in 2020, as per SteelMint data. USA accounted for the largest share of 16% in total exports to Turkiye in CY21 followed by the Netherlands at 13% share and the UK at 10%.

If compared on m-o-m basis, the country’s imports rose by 22% to 2.49 mnt in December 2021 vis-a-vis 2.04 mnt in November. Notably, import volumes in December were the highest in 2021.

Reasons behind the rise in imports–

- Imported ferrous scrap demand in the Turkish market rebounded in CY21 as mills remained active in booking deep-sea scrap cargoes throughout the year as buying interest picked up slightly.

- There was an improvement in demand of billets and long steel products in the Turkish market. Market participants believe that strong demand for billets kept scrap bookings active.

- Freight rates from the US coast to Turkey fell which eased scrap prices, boosting buying interest.

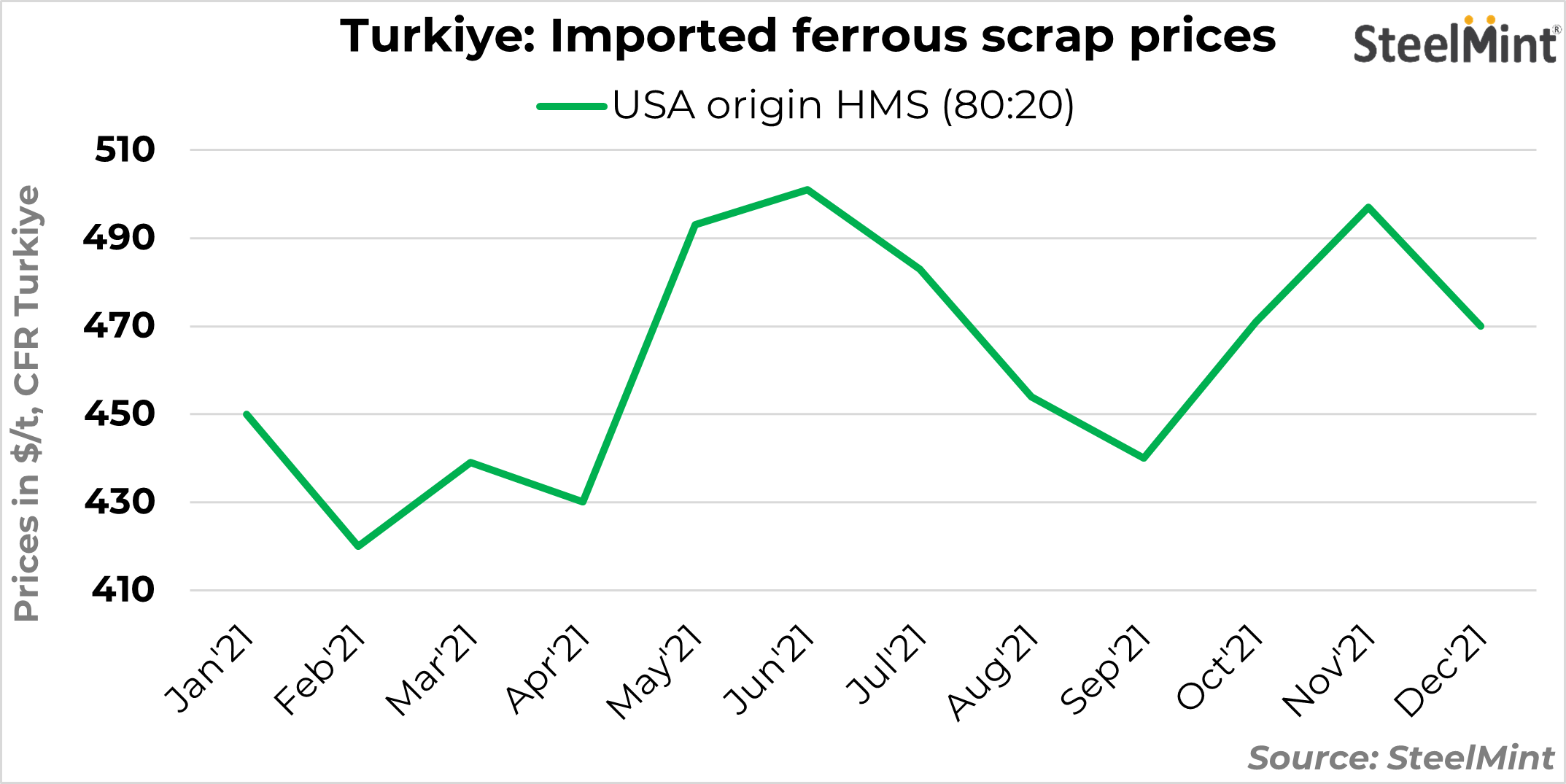

Imported scrap prices rise in CY21

SteelMint’s assessment of US-origin HMS 1&2 (80:20) stood at $459/t CFR Turkey in January-December 2021 against $291/t CFR in January-December 2020, up by around $168/t CFR Turkey y-o-y.

Prices surged as Lira eroded against the dollar to settle at TRY 13.31 in 2021 which was at 7.37 towards the end of 2020. The volatile market situation and a sharp fluctuation in the national currency put pressure on steel mills to lower their local scrap prices in 2021. Also, sluggish domestic and overseas demand, especially from China amid the winter months kept Turkish market under pressure.

Hassles in scrap market:

- Suspension of operations at mills on higher electricity costs: EAF steelmakers announced suspension of crude steel production in the first few months amid increased electricity costs. As a consequence, buying activities in the regional market decreased. The heavy snowfall also caused logistical problems in the market.

- Russia hikes scrap export duty: Russia approved an almost three-fold hike in the export duty on ferrous scrap, effective 1 May’22, to support domestic raw material availability and control the rise in steel prices. The minimum duty on exports of ferrous metals outside the Eurasian Economic Union was increased from EUR 100/t to EUR 290/t.

- Government declares surge in energy tariffs: The start of summer season was accompanied by a sharp rise in energy tariffs. Economic factors and the global hike in energy costs are among the reasons behind it. The Turkish Energy Market Regulatory Authority increased prices depending on the customer category.

- Rising billet imports: Also, the country’s billet imports in H1CY22 increased sharply as its prices were almost at par with those of imported scrap. Russia was the top exporter with 75% share followed by Ukraine with 5%.

Way forward:

The input costs of Turkish steel mills are anticipated to increase further after the country’s Energy Market Regulatory Authority elevated electricity prices for industrial use by 50% on 31 August 2022. State gas distributor Botas also raised natural gas prices for industrial use by 50.8% from September 2022. This may lead in Turkish steel mills opting for production cuts or lift prices despite the sluggish market as their margins are lower.

SteelMint Events will be hosting the 3rd Steel & Raw Material Conference, Emerging Bangladesh, on 20-21 September, 2022 at Hotel Radisson Blu, Chittagong, Bangladesh. The conference will explore key issues like the country’s steel production and demand outlook, global scrap trade flow changes, especially post-the Russia-Ukraine war, the ship recycling scenario, key emerging sectors, price trends and a lot more.