Objective

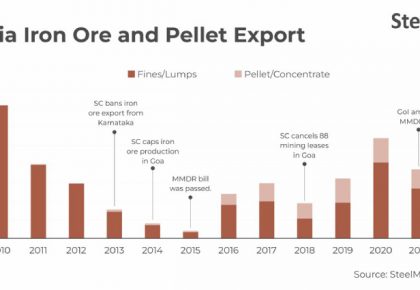

The Supreme Court (SC) recently lifted the 10-year ban on iron ore and pellet exports from Karnataka’s Bellary, Chitradurga and Tumkur districts. Miners can also sell directly with e-auctions as a sales platform having been scrapped.

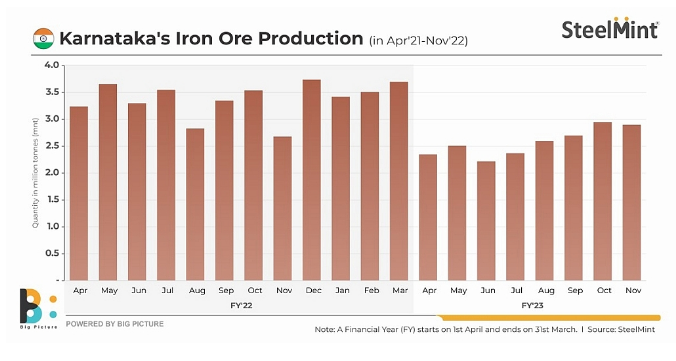

In another significant development, the SC recently raised the iron ore production cap in Karnataka from the current 35 million tonnes (mnt) to 50 mnt from the A and B category mines in the state. This decision had been pending for some time and it was only expected that restrictions on production would be eased as well.

It may be recalled the apex court had lifted the five-year-old ceiling on production from 30 mnt to 35 mnt for A and B category mines in 2018. There was no cap on C category mines or those subsequently auctioned in the state. The SC-appointed Central Empowered Committee had categorised 166 mining leases into A, B and C as per the extent of environmental illegalities committed by them.

The recent seminal changes are bound to impact Karnataka’s iron ore mining sector, and which merit a closer look especially since it is the 2nd-largest iron ore producing state in India, with over 40 mnt, in FY’22.

SteelMint is looking to explore the repercussions of the SC orders through a full day event at Hotel Hyatt Place, Vidyanagar (Bellary), Karnataka on 20th Jan’23, followed by Mines/Plant Visits on 21st Jan’23. It is important to keep an ear close to the ground post-SC order. What is the potential in terms of production, demand, exports, and sales? What will be the impact on the iron ore mining industry from here? Industry stakeholders are keen to find answers to these and several other queries.

Key Focus Areas

Decoding Supreme Court order on Karnataka mining

- How has Karnataka’s mining industry changed post SC order in May’22

- Buyers’ take on evolving market scenario

How will production levels edge up post SC order?

- Impact of raising iron ore production cap from 35 mnt to 50 mnt per annum

- Production ramp up plans of key miners in the state

Current and future iron ore demand-supply situation

- Karnataka’s iron ore demand-supply outlook for 2025

- Increasing production from existing and freshly-auctioned mining leases

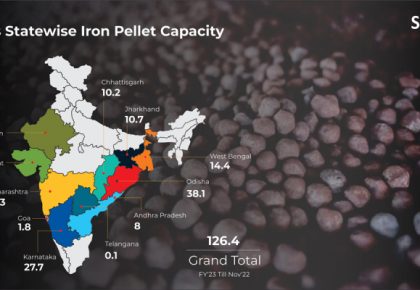

- Karnataka’s pellet production capacity to cross 35 mnt

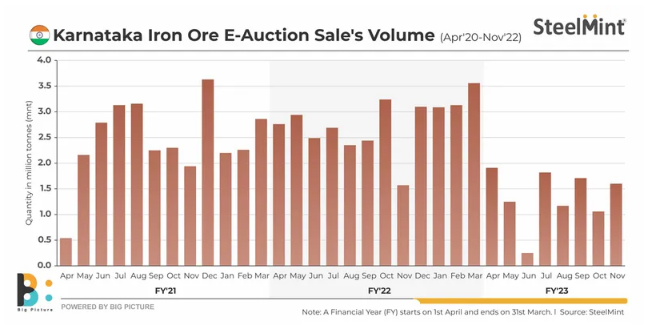

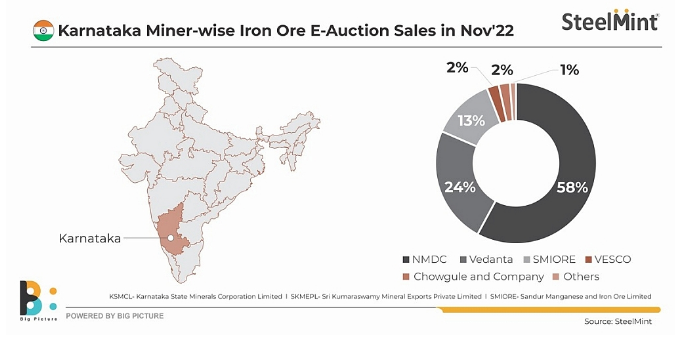

Miners’ perspectives on e-auction v/s direct sales

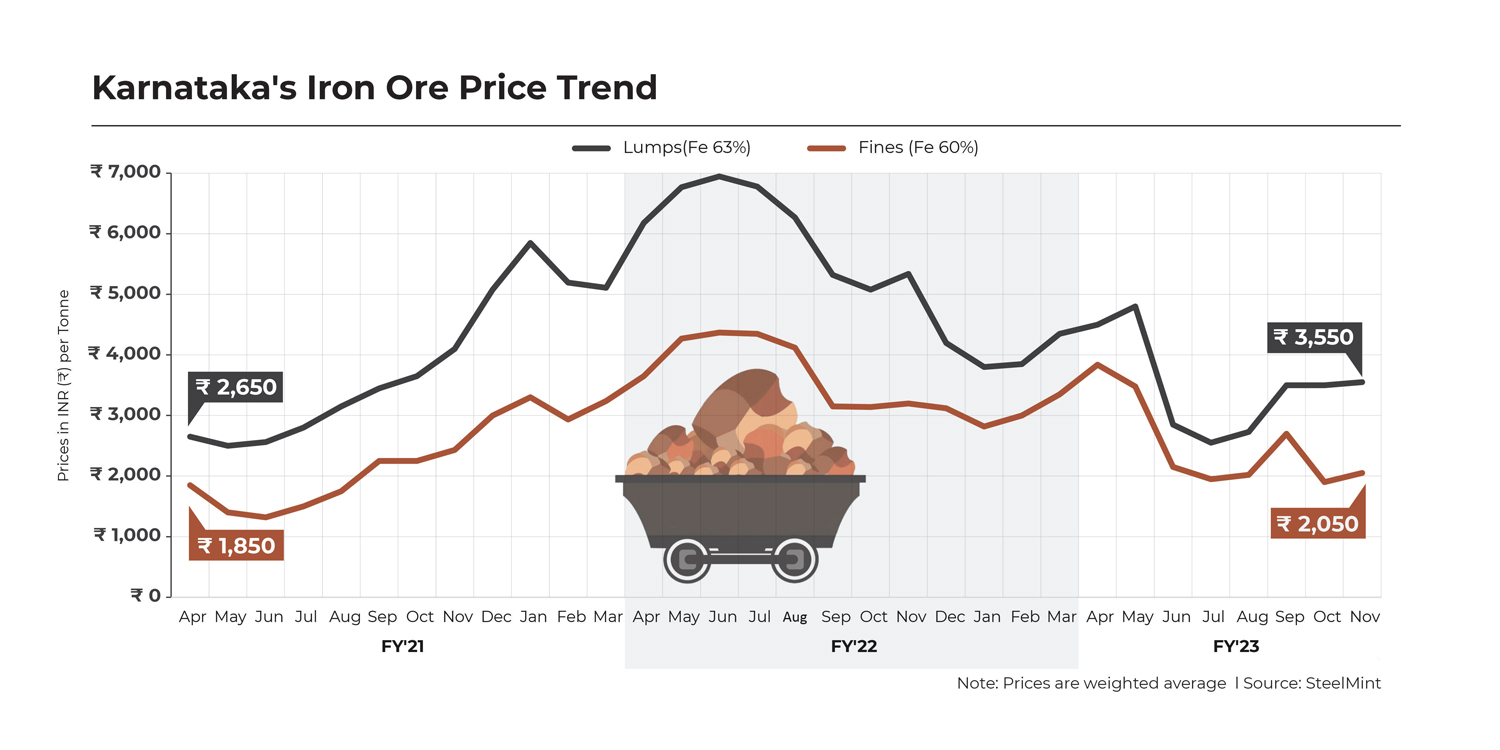

- Pricing policy of public and private miners

- Changes in royalty, DMF and NMET payment patterns

- Share of direct sales and LTAs to rise vis-à-vis auction sales?

Karnataka resumes iron ore exports after a decade – What’s next?

- Impact of export duty withdrawal on iron ore and pellets

- Inventories and available volumes for exports

- Global iron ore price outlook and demand-supply dynamics

Mineral block auctions – Updates and Way Forward

- Present status of auctioned mineral blocks in the state

- Upcoming mineral block auctions – process and challenges

Platinum Sponsor

Gold Sponsors

Silver Sponsors