EAF steelmaking in China has witnessed considerable capacity enhancements of late mainly due to the surging environmental concerns and the burgeoning demand for higher grades and specifications. From the current 12%, crude steel produced through the EAF route is expected to contribute to around 20% of overall crude steel production in China by 2020. However, UHP grade Graphite Electrodes (GE) of sizes <600mm are still hard to come by owing to the relative scarcity of high-specification needle coke. There is still a prevailing opinion that China lags behind the US, Japan and India when it comes to manufacturing premium quality GEs to run global standard EAF units.

Amid such doubts in the minds of prospective investors and buyers about the real market scenario in China and also with a view to the fact that China is slowly emerging as a nerve centre of global GE demand and trade, SteelMint came up with a unique idea of organizing the International Graphite Electrode & Needle Coke Roadshow from April 8 to 12, 2019 that included visits to GE and Needle Coke plants to assess the ground reality in China.

As part of this roadshow, SteelMint visited Jingyang Technology, a needle coke plant located in the Shandong province. The company has a nameplate capacity of 60,000 MTPA of needle coke and is striving to double its output in the next three years. Below are excerpts from an interview with Shen Jianfeng, Deputy General Manager, Marketing and Sales, Jingyang Technology:

Can you please elaborate on Jingyang Technology’s business and market share in China?

SJ: Jingyang Technology started its journey in October 2014 and is mainly focused on manufacturing petroleum-based needle coke. We have a market share of 25% in China. At present our plant’s production is about 65,000 tonne for calcined needle coke, 20,000 tonnes for green coke which means about 85,000 tonnes in total. We expect to increase our capacity to 150,000 tonne by October 2019 after much-awaited expansion plans are implemented. With this expansion the needle coke manufactured is suitable for the production of GEs ranging 600mm and above in size.

Currently the sulphur content of the needle coke we produce is 0.45%. We use hydrogen to remove the sulphur. After expansion, the sulphur content in our GE can reach below 0.4% (roughly 0.35%) which is equal to the level that the US and Japanese needle coke manufacturers maintain.

Who are your customers in China? Do you also export to India?

SJ: Currently our major clients in China are Fangda Carbon, Nantong Yangzi Carbon, Jilin Carbon and Xinxing Carbon to name a few. With regard to the anode material segment, our clients include Shan Shan Tech and Zhongke Electric. And there is one renowned GE manufacturer which is located in Sichuan province and is using our product to manufacture 700mm GE.

Jingyang Tech has been exporting since 2017 and we have regular orders of 2,000 tonne per month from Russia. Last month we exported 500 tonne to Italy. A few months back we signed a supply contract for 300 tonne per month with a Japanese GE producer. Last year we exported 200 tonne to India and plan to ramp up exports to India.

What is the current needle coke market situation in China? There is talk of large needle coke capacities coming up in China. How much capacity will be added in the next two years?

SJ: The current needle coke capacity in China is around 280,000 tonne with coal tar pitch-based needle coke and petroleum-based coke having a percentage share of 71% and 29% respectively in the market. The additional capacities (both coal tar pitch-based and petroleum-based) that are expected to be added is around 720,000 tonne by 2020, thus taking the country’s total needle coke capacity to around 960,000 tonnes.

Will this capacity addition ease the demand-supply imbalance and lower prices in China?

SJ: The needle coke manufactured in China is used by two sectors: GE and anode materials. The demand for needle coke from both the segments will likely be around 1 MnT by 2020. However, supplies in the next two years will be around 960,000 tonne, which means that the demand-supply imbalance will continue and prices may not fluctuate much in the next two years.

Is the quality of petroleum coke-based GE different from that manufactured using coal tar pitch-based needle coke? Are these suitable for making UHP electrodes required in big EAF plants?

SJ: There is no major difference between GE manufactured using petroleum or coal tar but there is always scope for improvement. However, like Japan, China can also make good quality coal tar pitch-based needle coke that can be used to manufacture electrodes of bigger sizes and specifications. For example, a Chinese needle coke manufacturers have made a breakthrough in production of high quality coal tar pitch-based needle coke used to manufacture 700mm UHP GE. At present, petroleum-based coke is expensive than coal tar pitch based, roughly by RMB 2,000-3,000 per tonne.

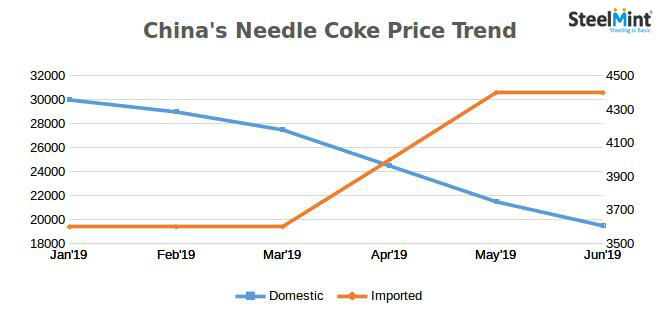

What is the current needle coke price scenario in China?

SJ: Currently the price in China is around RMB 20,000-25,000 per tonne but it is difficult to make any predictions. Judging by the willingness of customers it seems prices have bottomed out since early April and it is likely that the market will be better in the future.

How does Jingyang Technology maintain its needle coke quality?

SJ: We regard quality as supreme and have put in place a whole set of measures to strictly control quality with regard to raw material selection, production control, online monitoring, checking prior to dispatch, customer follow-up, third party inspection and appraisal, etc.

We have a professional team with rich experience in this industry and it accepts only quality raw materials after sample testing. They comprehensively process the raw materials from difference resources to make the finished product. In the warehouse, we maintain around 40,000 to 50,000 tonne of raw material to stay away from market fluctuations. As regards the final product, 20% is earmarked for anode material and the rest is used in GE production.

What is the ground level progress of EAF in china? How much capacity can come online in the next two-three years?

SJ: In my opinion to some extent, the development of needle coke banks on the increase in EAF capacity but the EAF output of steel in China is unlikely to exceed 20% in next 2-3 years. At present current EAF route capacity is less than 12% in total.

What is the lead time of setting up a needle coke plant in China?

SJ: It takes about 2 years to set up a needle coke plant for others normally but for us only 10 months are sufficient to set up a new needle coke plant given the knowledge and resources we have.

Do you have any further plans after the capacity expansion?

SJ: We plan to start manufacturing of nipples used for electrodes of size 600mm to 650mm.

How the winter production was cut in 2018 and is likely to be in 2019?

SJ: Last year the production cuts policy not too strict as policy no longer took the approach of ‘One size fits all’. We had production cuts of 30% in winters of 2018 and will make up for the lost capacity most likely during summers. Besides, this our production majorly complies with the environmental protection requirement with water treating systems in place and thus for 2019 winters, production cuts would not have major impact on us.

Know More