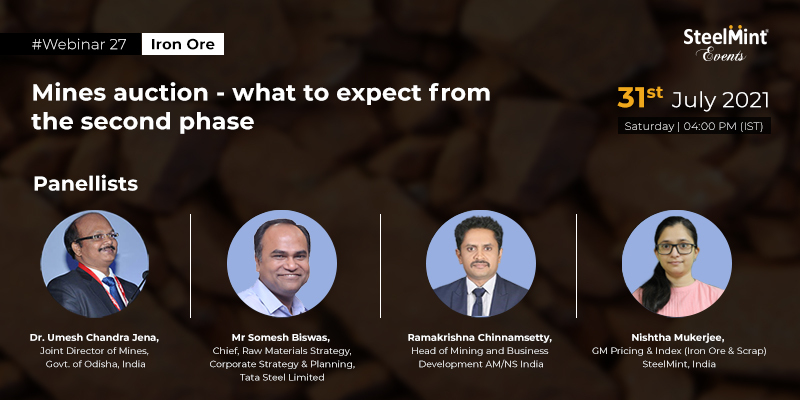

Govt of Odisha has recently invited bids for the grant of 11 mineral blocks. Out of the mineral blocks put up for auction, seven are of iron ore, two iron ore & manganese blocks, one iron ore & dolomite and one bauxite block. The list includes seven virgin blocks. This move will surely enhance the iron ore availability in the country especially in a time when iron ore prices have hit a record high in Odisha. Let’s get insights from industry stalwart on the current scenario and the way forward.

Key points of discussion –

- Details of the mineral blocks that have been laid out for auction in Odisha

- What is the auction timeline

- Any major changes in rules/participation criteria

- Status of mines auctioned in 2020

Speakers:

- Dr. Umesh Chandra Jena, Joint Director of Mines, Govt. of Odisha, India

- Somesh Biswas, Chief, Raw Materials Strategy, Corporate Strategy & Planning, Tata Steel Limited

- Ramakrishna Chinnamshetty, Head of Mining and Business Development,AMNS India

- Nishtha Mukerjee, GM Pricing & Index (Iron Ore & Scrap), SteelMint, India

Date: Saturday, 31st July, 4:00 PM (IST), 6:30 PM (Singapore time), 2:30 PM (Dubai time)