The political friction between the US and Iran took a turn for the worse in the beginning of this month with the former imposing a new round of sanctions on Tehran, severely restricting the Islamic Republic’s trade with other countries.

After pulling out of the 2015 nuclear deal with Tehran, the US had announced the first tranche of financial sanctions on Iran in August last year, targeting the purchase of Iranian currency thereby affecting key industries. The sanctions restricted Iran’s purchase of US dollars – the most preferred currency in global trade.

Again in November 2018, the US slapped a second round of sanctions on Iran, this time targeting the country’s precious oil sector. Any country importing Iranian oil today naturally invites secondary sanctions upon itself. And, to top it all, in early May this year the Trump administration imposed the latest round of sanctions on Iran’s metal industry including the iron and steel industry, aimed at cutting off revenue to Iran. These sanctions are a warning to other nations that allowing Iranian steel and other metals into their ports will attract secondary sanctions.

GE Imports Steady Despite Sanctions

Amid these trade restrictions being imposed on Iran one of the key sectors that will take a major hit is steel. This is because about 85% of steel production in Iran takes place through the EAF route and the remaining via BFs. The key raw material required to produce steel in electric furnaces is Graphite Electrodes (GE) and Iran is totally dependent on imports to meet its GE requirements.

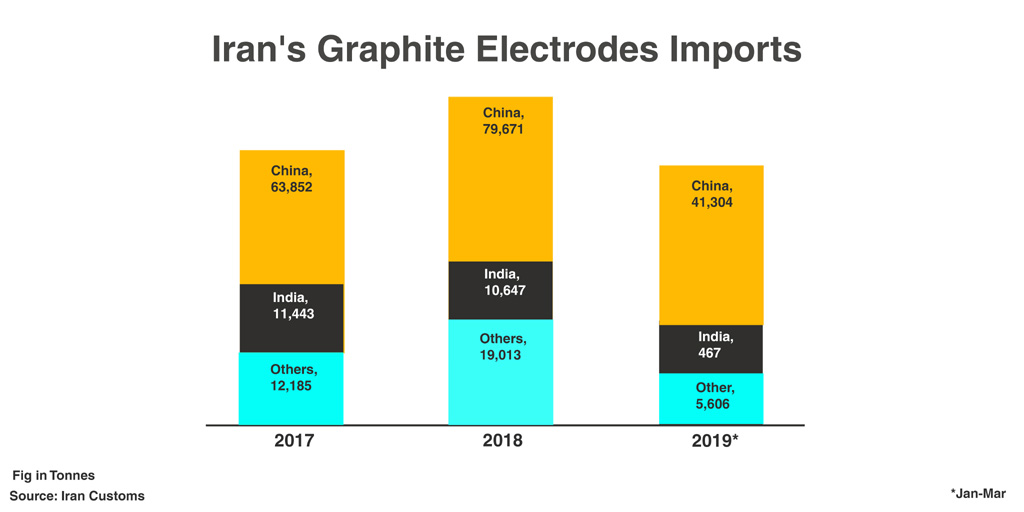

Iran imported about 85% of its GE requirement from China and India last year. With the sanctions in place, it was anticipated that the country’s electrodes imports would suffer a setback and so would steel production. However, Iranian customs data show that GE inflow into that country has not only continued after the clampdown of sanctions but have actually registered a Y-o-Y rise.

In 2018, Iran imported about 109,331 tonne of GE against 87,480 tonne in 2017 – a 25% rise on a Yo-Y basis. In fact, Iran’s GE imports post sanctions, i.e. from Aug to Dec’18, have surged by 24% against the corresponding period of the previous year.

Country-wise GE import trends over the past few years show that the highest imports came from China followed by India. However, the scenario changed in 2018 as GE exports from India to Iran dropped to almost negligible levels after August. But China has remained the top GE exporter to Iran despite sanctions; in fact during Aug-Dec’18, China’s GE exports to Iran recorded a surge of 42% against the corresponding period of 2017.

During Jan-Mar 2019 Iran imported about 47,377 tonne of GE against 29,166 tonne in the same period last year, thus registering an increase of 62%. Now, out of the total imports of 47,377 tonne in the first three months of the ongoing year, about 87% came from China followed by UAE (6%) and Germany (5%) whereas imports from India were quite insignificant.

Subverting the Sanctions

While analyzing import data one major question that arises is how Iran is able to import GE from China despite the sanctions in place. And the answer to this riddle lies in the fact that circumvention of the sanctions by the trade participants is being made possible through collusion with shipping agents in Oman and Turkey.

As per market sources, Chinese exporters are directing their exports to Oman or Turkey in the Middle-East. After altering the bill received upon landing in which the origin of the shipment is changed at the port, the goods are channeled to Iran thus making evasion of the US sanctions possible. Although none of the industry participants from China will acknowledge that such a trade arrangement is in place, China’s GE export data is testimony to continuing – even increasing – exports to Iran. China’s customs data show that out of the 76,172 tonne of GE exported from China in 2019, about 13% were directed to Oman and Turkey during the first three months of the current year and the trend was almost similar after the sanctions were imposed last year.

Thus, with its GE requirements properly met, Iran has been able to continue churning out steel. In fact the country’s crude steel production in 2018 registered an increase of 5% (Y-o-Y) at 21.3 MnT. During Jan-Mar 2019 production stood at 6.5 MnT, up 7% compared to the same period last year.

Increasing production apart, tepid domestic demand is forcing Iran to export cheap steel to other Middle-East and Southeast Asian countries including India, hurting Indian manufacturers. As per trade sources, about 65,000 tonne of steel, mostly HRC, entered India after the import papers were altered in the UAE, thus subverting the US sanctions.

Big Burning Question

The Indian steel industry is demanding imposition of effective trade barriers on cheap steel imports from Iran. The big question is whether Iranian importers as well as exporters will continue trade by circumvention of the sanctions or will the US come up with stricter regulations for global trade with Iran in the near future.