Connect with us on Friday, 11th Sept, 12:30 PM (IST), 3:00 PM (Singapore time), 11:00 AM (Dubai time) as we gain insights from our panellists to understand the effect of COVID-19 on the Iron & Steel Industry.

Panellists :

- Mr Liu Biao, Deputy Director – Marketing, China Iron & Steel Association, China

- Ms Hongmei Li, Head Of Content, Mysteel Global, Singapore

- Ms Victoria Zou, English Editor, Mysteel Global, China

- Mr Andrew Glass, Founder & Managing Director, Avatar Commodities, Singapore

- Ms Madhumita Mookerji, Editor, Steel 360, India

An unusual period in history, the coronavirus pandemic has unleashed a series of unprecedented events affecting every industry. Staying on top of trends and accurate analysis is paramount now more than ever to manage uncertainty, change and continuously adapt to new and evolving market conditions.

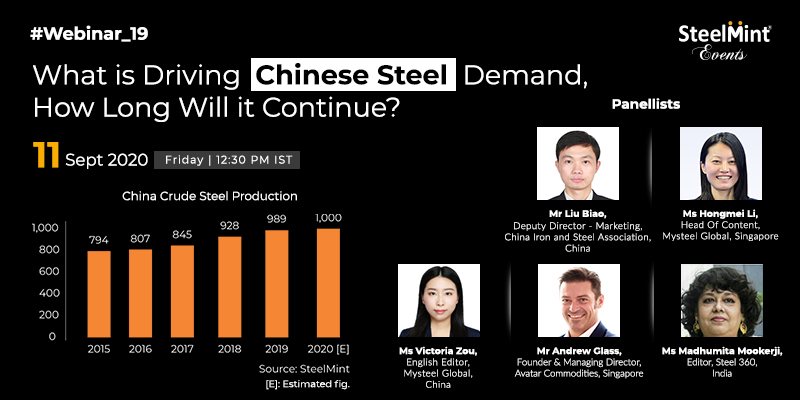

According to July’s custom data, China’s iron ore imports have surged up by 24% making it a record from a year earlier. This is driven by shipments from miners and buoyant demand as the economy bounced back after disruptions from the coronavirus pandemic. China steel output is set to rise by 4%, rupturing 1 Billion MT for the first time. How has China’s steel production and demand managed to stay ahead during these unprecedented times when the rest of the world is still recovering from the COVID-19 hit?

Amid the growing push for decoupling and economic distancing, the changing relationship between China and the rest of the world will influence competition and opportunities in the Steel market. Continuous monitoring for emerging signs of a possible new world order post-COVID-19 crisis is a must for aspiring businesses and their astute leaders seeking to find success in the now changing Iron & Steel market landscape.

Let’s explore the viewpoints from influencers in the market and learn the various opportunities this new normal presents.

Key points of discussion:

- What is driving Steel Imports to China, how long it may continue?

- What is changing the daily business operations globally?

- Prospects for Iron & Steel market in terms of Hedging & Trading

- Indian steel exports at an all-time high, what is the future outlook?

- What new businesses have been triggered globally and will it benefit steel or not?