New Delhi — India is talking clean-ups. India is talking environment. India is talking recycling.

While the government is expected to bring in new laws on scraping and end-of-life vehicles soon, some corporate houses have already taken the first steps into the USD 10 billion scrap market.

Mahindra MSTC Recycling Pvt Ltd, a joint venture between Mahindra group and state-owned MSTC Ltd set up a plant in Greater Noida last year and aims to have 30 plants by 2021-22. Tata Steel Ltd is in a planning stage for a similar venture.

“Recycling is going to be a big thing… I would say in the next 4-5 years there is going to be a struggle in the sector,” Sumit Issar, managing director, Mahindra Intertrade Ltd said in a telephonic interview, referring to the competition with the existing players.

“We would like to bring some change in the way recycling is done in India. That’s what we are focusing on.”

With foreign technology and equipment, Mahindra MSTC has authorizations from the government and is processing automobiles and household appliances in an environment friendly way, selling the output to steel furnaces.

Tata Steel is planning to build a scrap processing facility in Gurgaon and plans to replicate the same in Pune, Sanand and other automotive hubs, Anand Sen, president TQM and steel business, Tata Steel was quoted as having said in an Economic Times report last year.

“We are currently exploring this space and would be in a position to share once our plans are firmed up,” a spokesperson from Tata Steel said in reply to an email seeking further details of their plans.

“In more developed countries, scrap is a well-established industry with a robust ecosystem… The Indian government has recognized this challenge.”

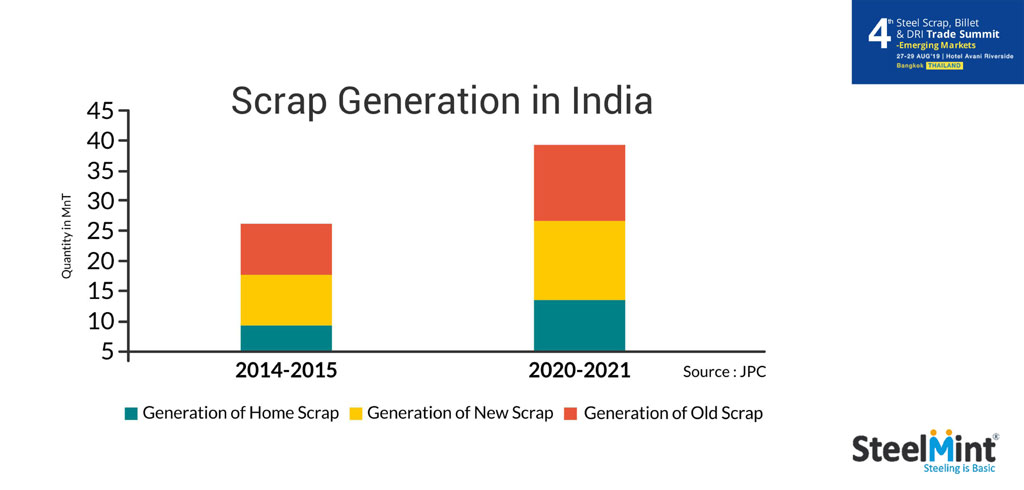

The demand for scrap in India is 30 MnT per annum where domestic generation is 25mt and the balance 5 MnT is imported, according to data from Tata Steel.

It is small as compared to India’s steel production of around 100mt, but supply is likely to increase due to the impending government policies, rapid urbanization and economic activity.

Competitor is a giant – But recycling is unlikely to be a cakewalk for these large corporate. The massive unorganized and fragmented market is seen continuing to dominate the business and be a hard bargain for the corporate recyclers who would have to struggle to break even.

“The challenge is that the informal sector is so big across the country that very little comes into the organised sector,” Issar said.

Companies like Mahindra and Tata Steel are banking on the fact that they could introduce greater degree of processing and value addition to the scrap and have higher safety standards and environmental concerns.

Other companies being named as likely entrants to the recycling business are Maruti Suzuki India Ltd and Toyota Kirloskar Motor Pvt Ltd. The spokesperson of Maruti said the company didn’t wish to comment while the spokesperson for Toyota Kirloskar said there were no such plans at the moment.

Social change

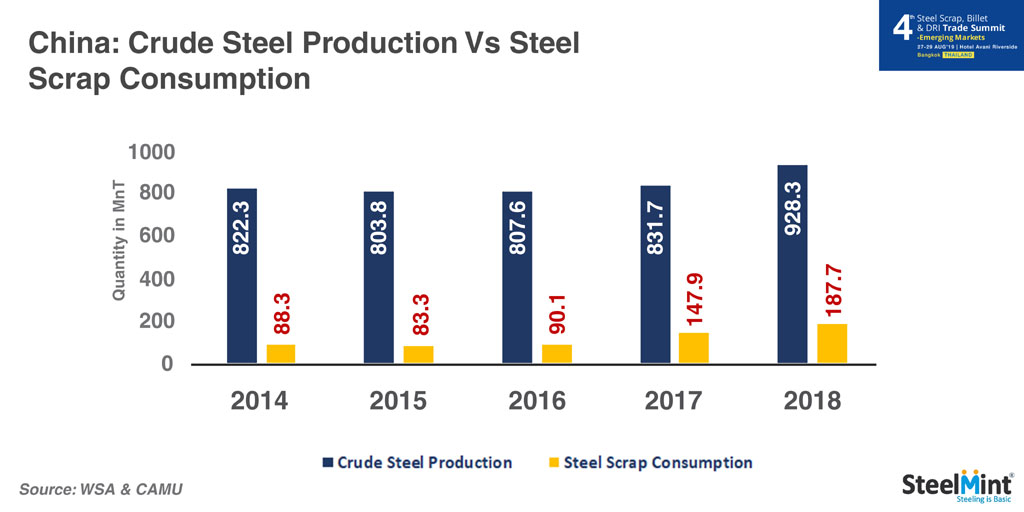

As the economy matures, the call for environmental protection rises. China is an example of this – on the government’s directive, more scrap is being used by steel mills to reduce pollution. India too is following suit.

“The (scrap) policies are in the draft stage… it can be safely assumed that they would address some of the challenges faced by the steel scrap industry,” Tata Steel’s spokesperson said.

“They might stipulate some governance mechanisms like authorizations and de-authorizations, environmentally compliant processes, safety practices and more… they may look at ways to create and nurture the ecosystem for recycling including training and skilling of work force.”

What’s happening with India auto recycling industry?

To know more about Indian recycling scenario do attend 4th Steel Scrap, Billet & DRI Trade Summit to be organised by SteelMint Events in Bangkok, Thailand from 27-29th Aug’19. The event will attract around 550+ delegations including ferrous scrap consumers, traders and processors in the steel industry across the globe. Wherein one can also explore more on What’s happening with India auto recycling industry? in the session scheduled for Mr. Vijay Arora, Vice President – Strategy, Operations And Business Development, Mahindra Group Accelo, India.