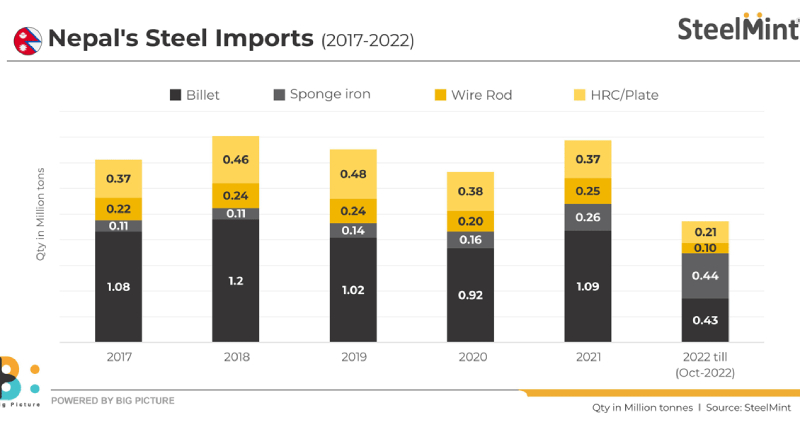

Nepal, a landlocked nation, has registered significant growth in its metallics (sponge iron and pig iron) imports, as per data maintained with SteelMint. The country’s sponge iron imports rose by 120%, while pig iron imports rallied by 390% during January-October 2022 compared to the same period in the preceding year.

The country registered about 440,000 t of sponge iron imports and around 41,000 t of pig iron imports during the first 10 months of 2022. Rising melting capacities in the nation is the key factor behind the constant rally in imports.

Will imports rise further?

SteelMint, in conversation with several industry leaders, learned that Nepal’s sponge iron imports is likely to reach over 500,000 t in CY’22, which will be a nearly two-fold rise against 260,000 t in CY’21.

Along with this, pig iron imports are also expected to cross 45,000 t in CY’22, which will be over three-times higher than 12,600 t in CY’21.

Who are benefitting?

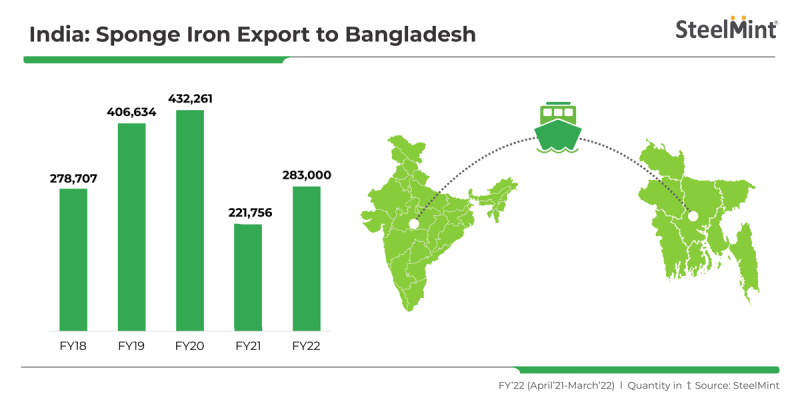

India is the largest producer of DRI in the world and in terms of imports Nepal has become a major importer of Indian DRI (sponge iron) after Bangladesh in CY22.

With the rapid expansion in melting capacities in the neighbouring nations, sponge iron producers based in the eastern region (Odisha, Jharkhand and West Bengal) are largely benefiting from this, due to the advantage of logistics via rail, road and sea routes.

Out of India’s total sponge iron exports, about 90-95% is from eastern India, while the remaining is from the central and southern regions depending on price competitiveness.

Competitive Indonesian billet, wire rod offers

With 15% export duty on Indian finished steels including wire rods, Indian wire rod producers of both the IF and BF routes are worried and hardly any deals have been concluded to Nepal due to competitive offers from Indonesia.

Roughly, the landed cost to Nepal of Indonesian wire rods and billets are cheaper by $100/t compared to Indian material.

Recently, Nepalese mills have placed another order for wire rods (size 6.5 to 7.0 mm) to Indonesia for a total of around 25,000 t for December or early-January shipments, SteelMint learned from trade sources.

The deals took place at around $560/t CFR Haldia basis (east Indian port), which is equivalent to $600-605/t CPT Nepal. Earlier, mills in Nepal had booked a total of around 50,000 t of wire rods and around 25,000-30,000 t of billets.

What’s next?

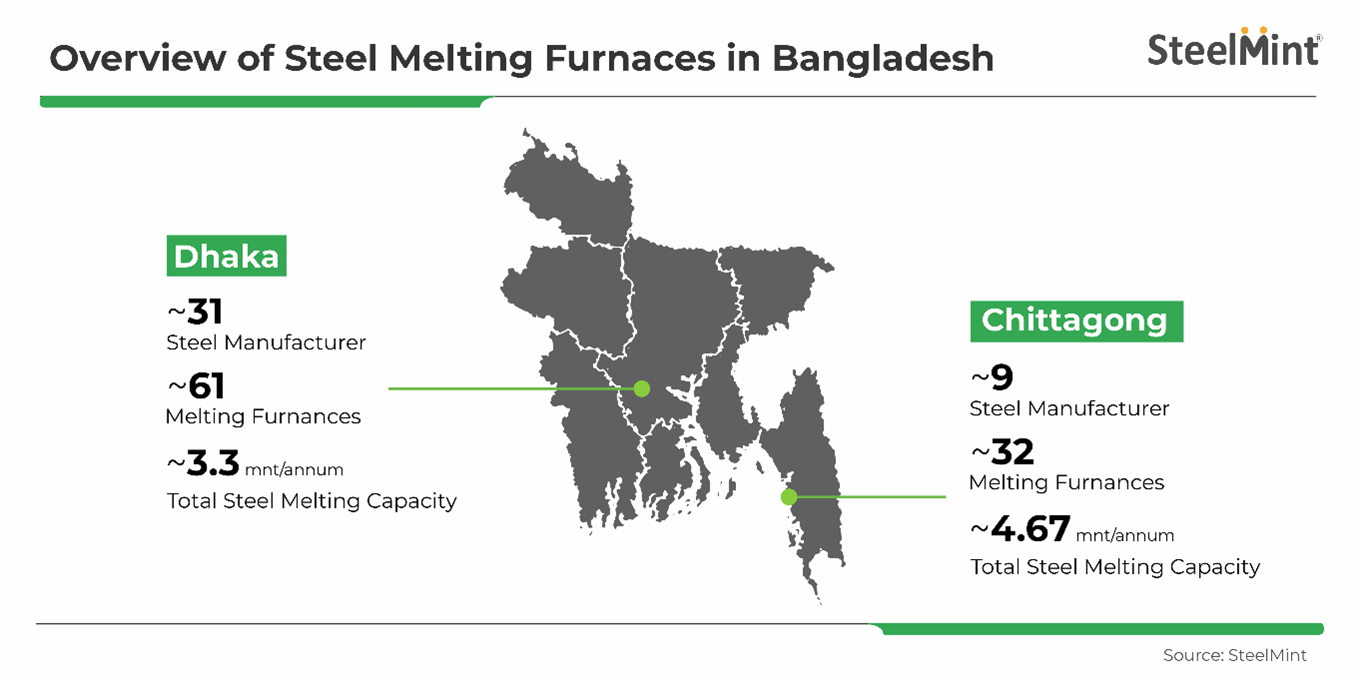

Nepal’s steel industry is growing significantly in terms of capacity. The total annual capacity of the industry is about 3.5-4 million tonnes (mnt) per annum and annual steel demand is about 2-2.5 mnt.

To know more about Nepal’s steel trade dynamics and changing import preferences, book your seat at the 2nd Nepal Steel & Trade Summit on 1-2 March, 2023 at Hotel Soaltee Crown Plaza, Kathmandu and get to hear from renowned industry participants from across the globe.