The 2023 SEAISI Conference & Exhibition is a 4-day event which will take place at Sofitel Philippine Plaza Manila, Philippines on 22 – 25 May 2023 (25 May is the plant tour). This conference presents on the sustainable development in the ASEAN steel industry through Digitalization, Technology, and Innovation. It is a hub for the delegates to network with industry leaders, gain deeper knowledge from experts and explore new opportunities. The international panel experts will share their market views on the current scenario focusing on sustainable development in the steel market. The conference will enable you to market your brand through Exhibition Booth, Sponsorship and Advertising Opportunities. SEAISI is committed to provide value-added opportunities through substantial marketing campaigns to potential visitors and delegates through various media platforms, email circular and web media.

Tag: Steel

-

China may reduce coking coal consumption in steelmaking by 20-25% by 2030

China, the world’s top steel producer, is seeking to cut down on its consumption of coking coal for steel production in sync with its ‘dual carbon’ goal of peaking emissions by 2030 and attaining carbon neutrality by 2060.

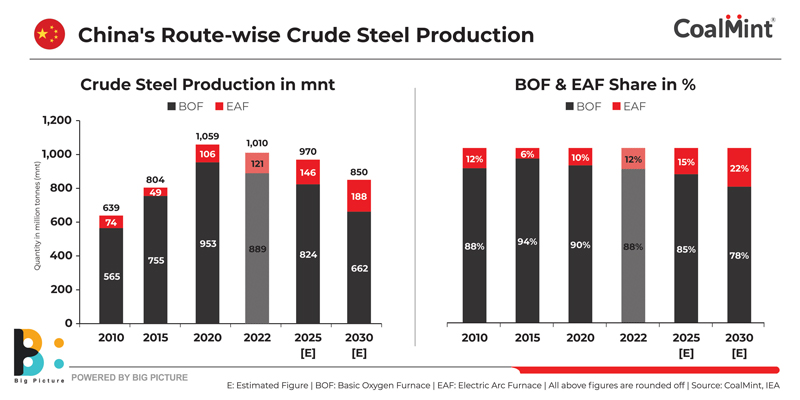

In line with this objective, the steel industry in China is expected to reduce consumption of coking coal by 20-25% by 2030, reports indicate. It is predicted that the share of predominantly scrap or green DRI-based electric arc furnaces (EAF) in China’s total crude steel production will rise to 22% by 2030 from 12% at present.

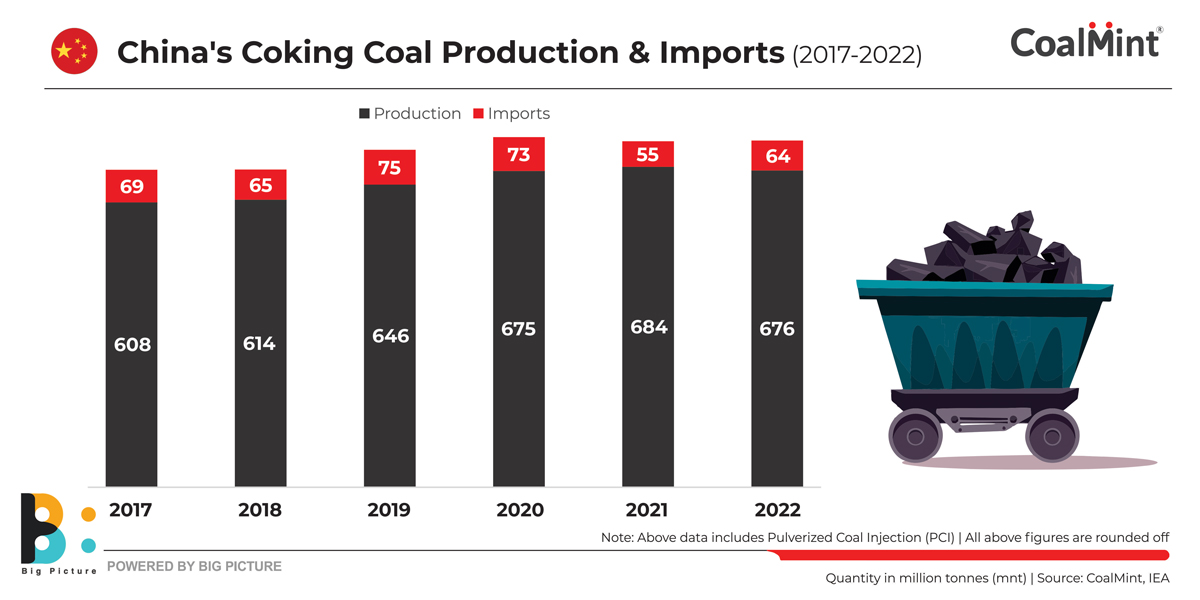

However, the task is huge, considering the fact that the Chinese steel industry is predominantly coal-based. As per CoalMint data, out of 1.01 billion tonnes (bnt) of steel produced in China in 2022, 88% was churned out through the BF-BOF route. This required mammoth consumption of coking coal: in 2022 China’s coking coal production stood at 676 mnt, while another 64 mnt was imported, IEA data reveals.

Due to the heavy reliance on the coal-based BF-BOF route, a polluting steelmaking pathway, steel production accounts for about 20% of the country’s total annual carbon emissions making it the largest industrial emitter, as per Global Energy Monitor (GEM) data. When emissions from electricity used by the sector are included, the share goes up to 24%. Thus, it is a key target in the government’s efforts to curb carbon emissions and improve air quality.

Why might coking coal consumption fall?

1. Steel production to drop: It is expected that steel production in China has almost plateaued. Many experts reckon that the 1.059 bnt of crude steel production in 2020 represented the peak. In 2022, crude steel production fell by 2% y-o-y. It is projected that crude steel production will drop to around 850 mnt by 2030.

The capacity swap scheme is the most important policy intervention in the Chinese steel industry first introduced by the Ministry of Industry and Information Technology (MIIT) in 2014. The 2021 version of the capacity swap scheme revised measures for certain regions, raising swap ratios to 1.5:1 from a previous 1.25:1 in key air pollution control regions.

The new version was also carefully designed to encourage EAF capacity and non-BF capacity expansions. If new iron ore and steelmaking facilities are environmentally friendly, such as EAFs, Corex, Finex, HIsmelt or hydrogen-based ironmaking plants, capacity can be swapped equally. Thus, coking coal consumption in steelmaking will naturally fall.

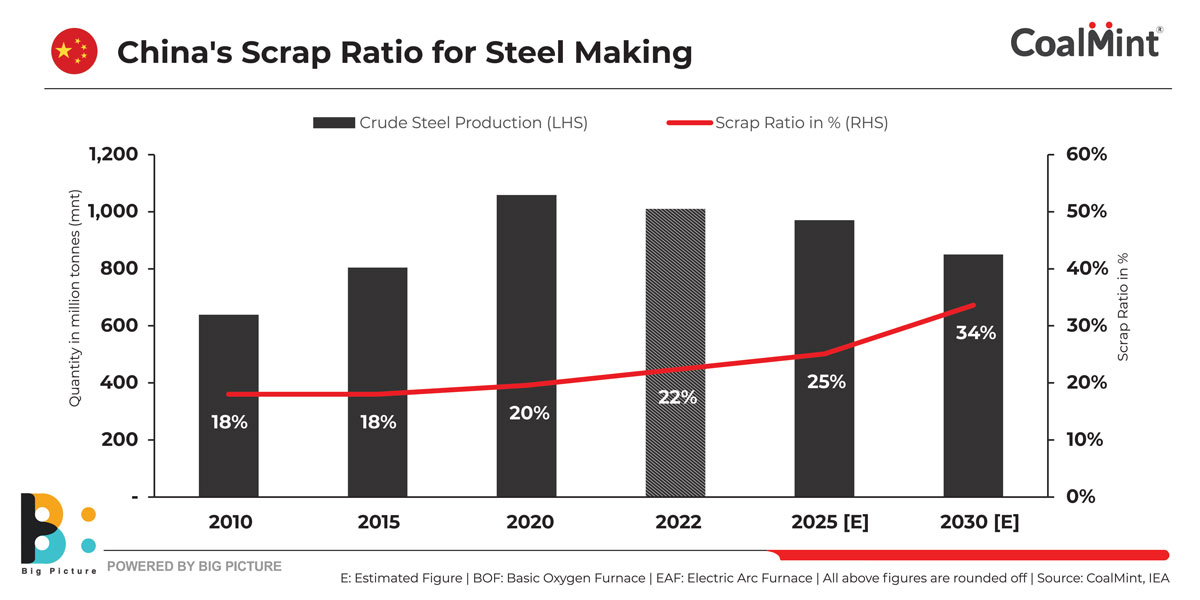

2. Scrap/DRI share in steelmaking to rise: Higher steel scrap usage expectations could eat into coking coal demand. The National Development and Reform Commission (NDRC) sees China’s 2025 steel scrap usage rising to 320 mnt on carbon neutrality goals.

During the 2021-25 period, Chinese crude steel output could plateau, which would cut molten iron output by 50 mnt and trim 21 mnt of coking coal demand in the period, Baosteel Group’s research arm Hwabao Securities has stated. The scrap ratio in steelmaking is expected to increase to 34% by 2030.In 2021, as per GEM data, China approved 39 new EAFs with a total capacity of 28.7 mnt/year through capacity swaps which is more than the sum of 2018-2020. The development of EAF is forecast to play a big role in reducing China’s steel industry carbon emissions.

3. Hydro gen likely to replace PCI coal: An early use of green hydrogen in the steel industry will be in existing blast furnaces to replace pulverised coal injection (PCI) coal. Experts contend that reducing carbon emissions from blast furnaces will involve the use of higher-grade iron ore and the replacement of PCI coal with hydrogen.

Therefore, apart from the use of hydrogen in production of fossil-free DRI which is gaining increasing prominence in China, the move towards higher efficiency in BF-BOF steelmaking will see producers transition from low-grade coking coal (PCI coal) to coke oven gas (COG) first and then hydrogen. Therefore, overall coking coal demand is likely to drop.

Outlook

At this stage of the global energy transition, high coal prices – as well as energy security concerns – are likely to hasten the transition towards alternative technology, including the replacement of PCI coal with hydrogen. Therefore, the long-term demand scenario for coking coal remains bearish, although it will take another decade or so before the final signs of decline become visible.

2nd Asia Coal Outlook & Trade Summit

Want to follow the discussion on how Chinese steelmakers are expected to cut coking coal consumption? Be a part of the discussion on technological breakthroughs in the Chinese steel industry at CoalMint’s 2nd Asia Coal Outlook & Trade Summit to be held at the Grand Hyatt Erawan in Bangkok, Thailand on 24-25 April, 2023

-

CII Steel Summit 2022

A vibrant steel industry has historically been the foundation of a nation’s rapid industrial development. Steel is a crucial input to several downstream ecosystems, such as construction, mobility and automotive, or for mechanical engineering companies. A robust and competitive steel sector signifies a strong economic growth of a country.

In the past couple of years the sector has witnessed a noticeable slowdown in growth due to the decline in trade and manufacturing activity across most industrial sectors, higher policy uncertainty, tightening of financial conditions and increased trade tensions among major economies of the world. Global Steel industry is undergoing a subtle shift across dimensions of technology of steel manufacturing, raw material sourcing, finished steel quality, green field capital investments and environmental sustainability.

The Indian steel industry is competitive at global level despite significant cost of funds, cost of logistics, cost of raw material. In order to drive the next level of growth and a first mover advantage in terms of technological transformation, the Indian steel industry needs to invest in research and development, rethink its production processes and deliver substantial emission reductions in order to stay competitive and contribute to climate neutrality.

Against this backdrop, the Confederation of Indian Industry is organizing the Steel Summit 2022 with the theme “Vision 2047: Towards a Globally Competitive & Sustainable Steel Industry” on 22nd December 2022 at Kamal Mahal, ITC Maurya, New Delhi. The Summit aims to have high-value deliberations on the key themes that will help the Indian Steel industry to reach the next level of growth.

-

2023 Indonesia Nickel Outlook Conference

The government has been trying to woo both foreign and domestic investors to actively participate in nickel downstream projects to produce battery raw materials amid the expected EV boom.

While providing fiscal incentives and facilitates permitting process, the government has also promoted the implementation of environmental, social and governance (ESG) principles from upstream to downstream levels.

Indonesia is known to hold the world’s largest nickel reserves, accounting for 23.7 percent of total global reserves. The country is also the world’s largest nickel producer with Sulawesi and Halmahera being the major producing regions, followed by neighboring country the Philippines. The global nickel demand has soared following the rapid development of the global EV industry.

According to data from the Center for Geological Resources of the Ministry of Energy and Mineral Resources (MEMR), in 2019, Indonesian nickel resources were estimated at 11.78 billion tons and nickel reserves at around 4.59 billion tons.

Most of the operating nickel processing facilities in Indonesia are implementing pyrometallurgy technology, namely Rotary Kiln Electric Furnace (RKEF), which consumes massive energy to process minerals to produce nickel pig iron (NPI), ferronickel (FeNi) and nickel in matte mainly dedicated to the steelmaking industry.

Commodity research company, PT Indeks Komoditas Indonesia (IKI) in its new report said that various government incentives have accelerated the development of nickel smelters in the country, with at least 40 smelters have been built so far this year, and more than 40 new projects are expected in the future.

The report said the government has provided various incentives such as tax allowance, tax holiday, zero import tax, bonded zone facility, and assistance in land acquisition and permitting process, in a bid to accelerate the development of domestic nickel downstream industry to generate greater value from the country’s huge nickel reserves.

From only five smelters operating in 2014, the number has grown to at least 40 smelters, consisting of 36 smelters producing ferronickel or NPI, two smelters producing nickel oxide (MHP), one smelter producing nickel hydroxide, and four smelters producing nickel matte, the report said.

Indonesia Nickel Mining Association (APNI) mentioned that Indonesia, as the world’s largest nickel producer, has been in the global spotlight due to the development of the nickel-based industry. However, the country also faces three long-term major risks, namely nickel resource conservation, waste disposal and carbon emission.

-

SteelMint analysis: An overview of Turkiye’s steel sector

Turkiye is one of the largest ferrous scrap importing countries in the world. Other key industries that contribute to the country’s economy include textiles, chemicals, cement, motor vehicles and construction. The country provides certain leverages for international trading and is a key destination for trade between Europe and Asia.

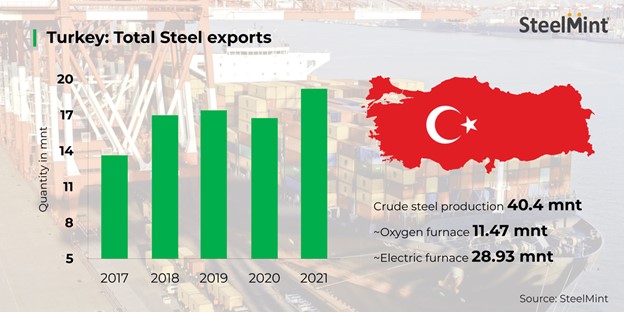

Turkiye produced 40.4 million tonnes (mnt) of crude steel in CY 2021 out of which 11.47 mnt i.e. 28.4% was churned out from oxygen furnace (BOF) and 28.93 mnt i.e. 71.6% was produced from electric arc furnace (EAF), as per World Steel Association (WSA) report. Higher crude steel output resulted in increased scrap consumption.

- Pig iron imports up: Turkiye’s pig iron imports stood at 1.2 mnt in 2021 vis-à-vis 1.14 mnt in the corresponding period last year (CPLY), up slightly by 5.3% y-o-y. The country’s entire consumption in 2021 was 11.6 mnt.

- Steel exports see 15% rise: Total finished steel exports from Turkiye jumped 15% to 19.2 mnt in 2021 compared to 16.75 mnt in 2020.

Also, according to the Turkish Automotive Manufacturers’ Association (OSD), total car production in CY21 stood at 1,276,140 units wherein exports amounted to 937,005 units, marking an increase of 2% as compared to 916,538 units in CY20.

Turkiye’s scrap market in 2021

- Ferrous scrap import shipments increase: Turkiye recorded ferrous scrap imports at 24.37 mnt in 2021, an increase of 10% against 22.18 mnt in 2020, as per SteelMint data. USA accounted for the largest share of 16% in total exports to Turkiye in CY21 followed by the Netherlands at 13% share and the UK at 10%.

If compared on m-o-m basis, the country’s imports rose by 22% to 2.49 mnt in December 2021 vis-a-vis 2.04 mnt in November. Notably, import volumes in December were the highest in 2021.

Reasons behind the rise in imports–

- Imported ferrous scrap demand in the Turkish market rebounded in CY21 as mills remained active in booking deep-sea scrap cargoes throughout the year as buying interest picked up slightly.

- There was an improvement in demand of billets and long steel products in the Turkish market. Market participants believe that strong demand for billets kept scrap bookings active.

- Freight rates from the US coast to Turkey fell which eased scrap prices, boosting buying interest.

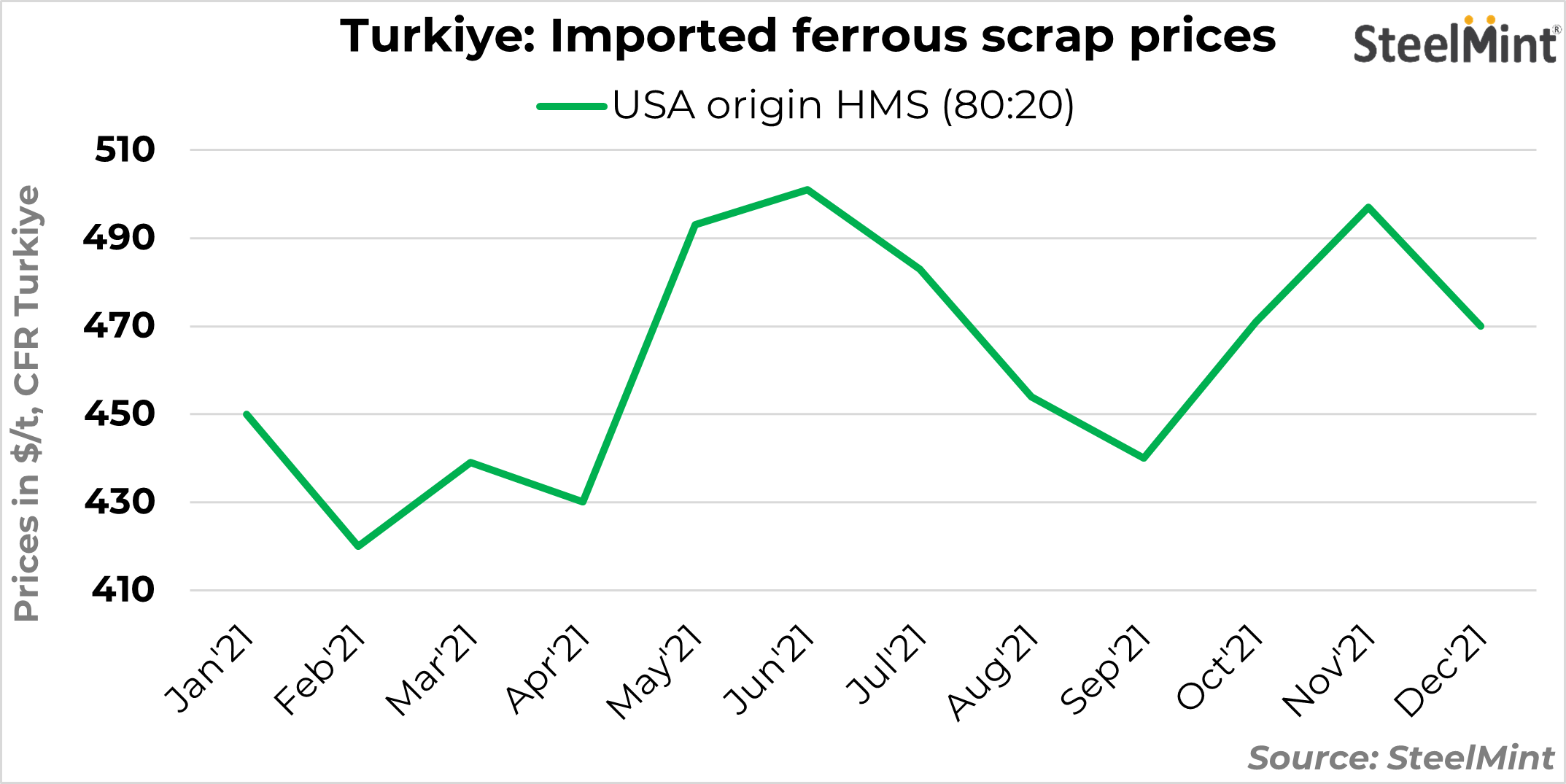

Imported scrap prices rise in CY21

SteelMint’s assessment of US-origin HMS 1&2 (80:20) stood at $459/t CFR Turkey in January-December 2021 against $291/t CFR in January-December 2020, up by around $168/t CFR Turkey y-o-y.

Prices surged as Lira eroded against the dollar to settle at TRY 13.31 in 2021 which was at 7.37 towards the end of 2020. The volatile market situation and a sharp fluctuation in the national currency put pressure on steel mills to lower their local scrap prices in 2021. Also, sluggish domestic and overseas demand, especially from China amid the winter months kept Turkish market under pressure.

Hassles in scrap market:

- Suspension of operations at mills on higher electricity costs: EAF steelmakers announced suspension of crude steel production in the first few months amid increased electricity costs. As a consequence, buying activities in the regional market decreased. The heavy snowfall also caused logistical problems in the market.

- Russia hikes scrap export duty: Russia approved an almost three-fold hike in the export duty on ferrous scrap, effective 1 May’22, to support domestic raw material availability and control the rise in steel prices. The minimum duty on exports of ferrous metals outside the Eurasian Economic Union was increased from EUR 100/t to EUR 290/t.

- Government declares surge in energy tariffs: The start of summer season was accompanied by a sharp rise in energy tariffs. Economic factors and the global hike in energy costs are among the reasons behind it. The Turkish Energy Market Regulatory Authority increased prices depending on the customer category.

- Rising billet imports: Also, the country’s billet imports in H1CY22 increased sharply as its prices were almost at par with those of imported scrap. Russia was the top exporter with 75% share followed by Ukraine with 5%.

Way forward:

The input costs of Turkish steel mills are anticipated to increase further after the country’s Energy Market Regulatory Authority elevated electricity prices for industrial use by 50% on 31 August 2022. State gas distributor Botas also raised natural gas prices for industrial use by 50.8% from September 2022. This may lead in Turkish steel mills opting for production cuts or lift prices despite the sluggish market as their margins are lower.

SteelMint Events will be hosting the 3rd Steel & Raw Material Conference, Emerging Bangladesh, on 20-21 September, 2022 at Hotel Radisson Blu, Chittagong, Bangladesh. The conference will explore key issues like the country’s steel production and demand outlook, global scrap trade flow changes, especially post-the Russia-Ukraine war, the ship recycling scenario, key emerging sectors, price trends and a lot more.